1095 Forms: 1095-a vs. 1095-b vs. 1095-c

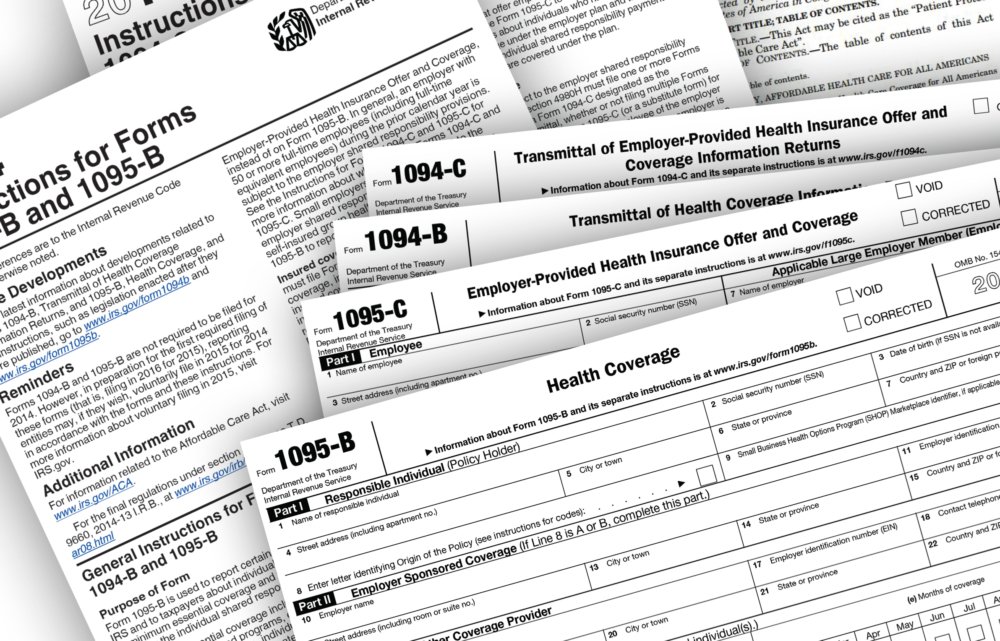

Employers may become overwhelmed by health insurance paperwork and reporting responsibilities. Under the Affordable Care Act (ACA), the IRS requires all applicable employers and qualified health plan providers to report information about their health plans and health coverage enrollment using tax Forms 1095 A, B, and C. However, there are different requirements for each of these documents.

The Differences Between 1095-A, 1095-B, and 1095-C

Form 1095-C Instructions - Office of the Comptroller

Short-Term vs. Long-Term Disability Insurance

What Is Form 1120-S vs. Form 1120?

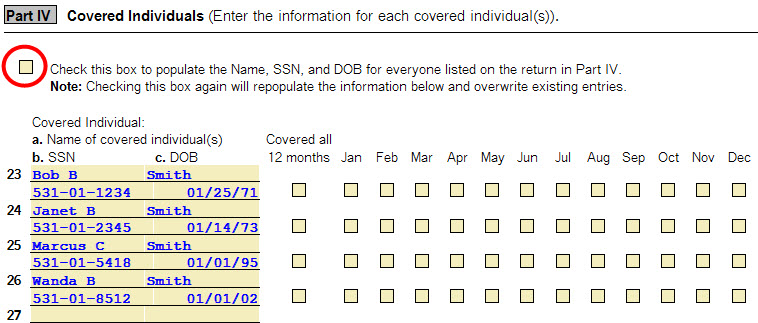

Entering Form 1095-A, 1095-B or 1095-C health coverage in ProSeries

Understand How HSAs, HRAs, and FSAs Compare

IRS Form 941: Complete Guide & Filing Instructions

29 1095 B Images, Stock Photos, 3D objects, & Vectors

Preventing Workplace Harassment: 5 Proactive Steps

What does a 1095-C delay mean for 1040 filings? - Integrity Data

Guide to Form 1095

Posts · Department of Human Resources & Strategic Talent Management · myUMBC

IRS e-Filing Deadline March 31 2022

What is Employment Practices Liability Insurance (EPLI)?

Short-Term vs. Long-Term Disability Insurance

:max_bytes(150000):strip_icc()/day-1-roundup-travel-gear-and-accessories-deals-tout-bdafc59503a94120803418cbb3c8cc7a.jpg)