1099-G tax form: Why it's important

If you received unemployment compensation during the year, you should receive the 1099-G tax form. If you got the form and didn't receive jobless benefits, you could be the victim of identity theft.

What Is a 1099-G Tax Form? - TheStreet

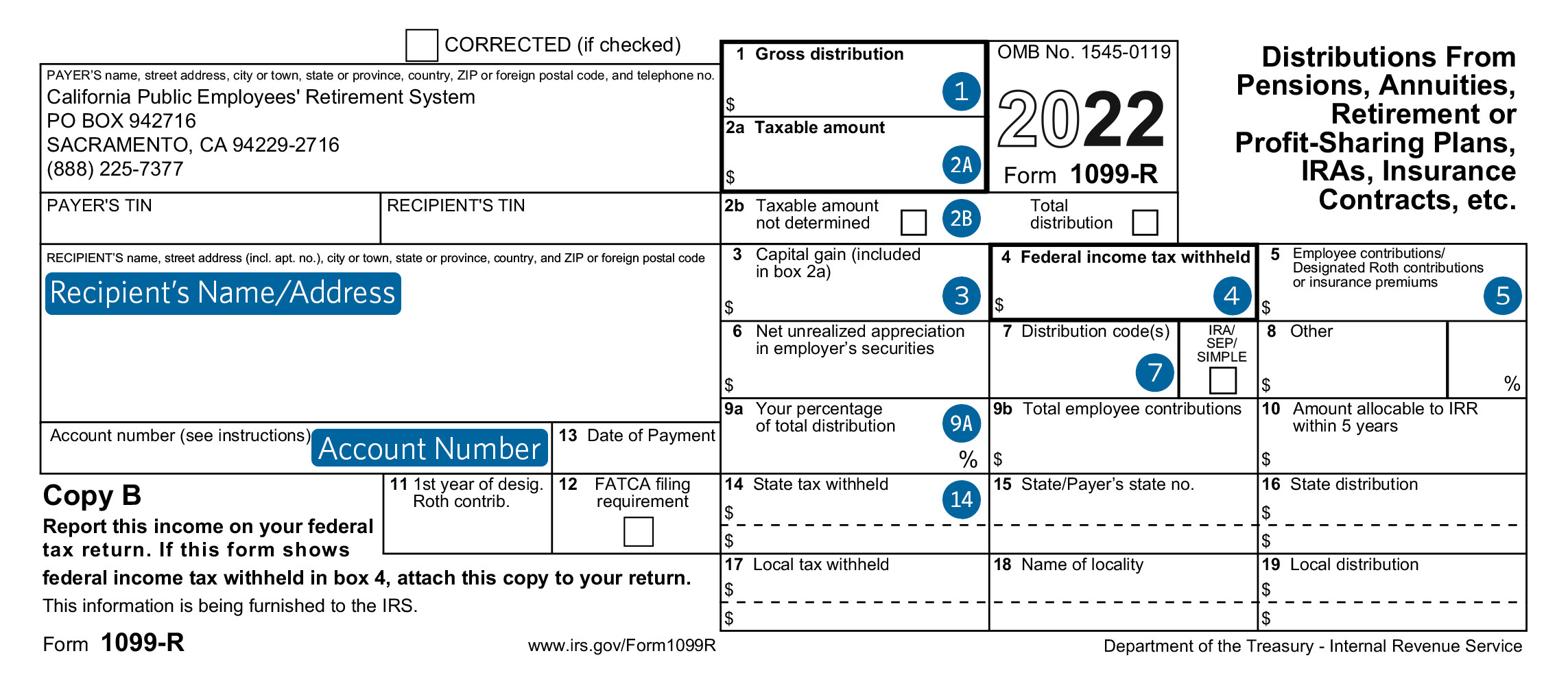

Understanding Your 1099-R Tax Form - CalPERS

Missing An IRS Form 1099 For Your Taxes? Keep Quiet, Don't Ask!

Solved: CA Unemployment AND Paid Family Leave Exclusion - Intuit Accountants Community

AG Nessel, UIA Alert Residents Of Tax Form For Victims Of, 49% OFF

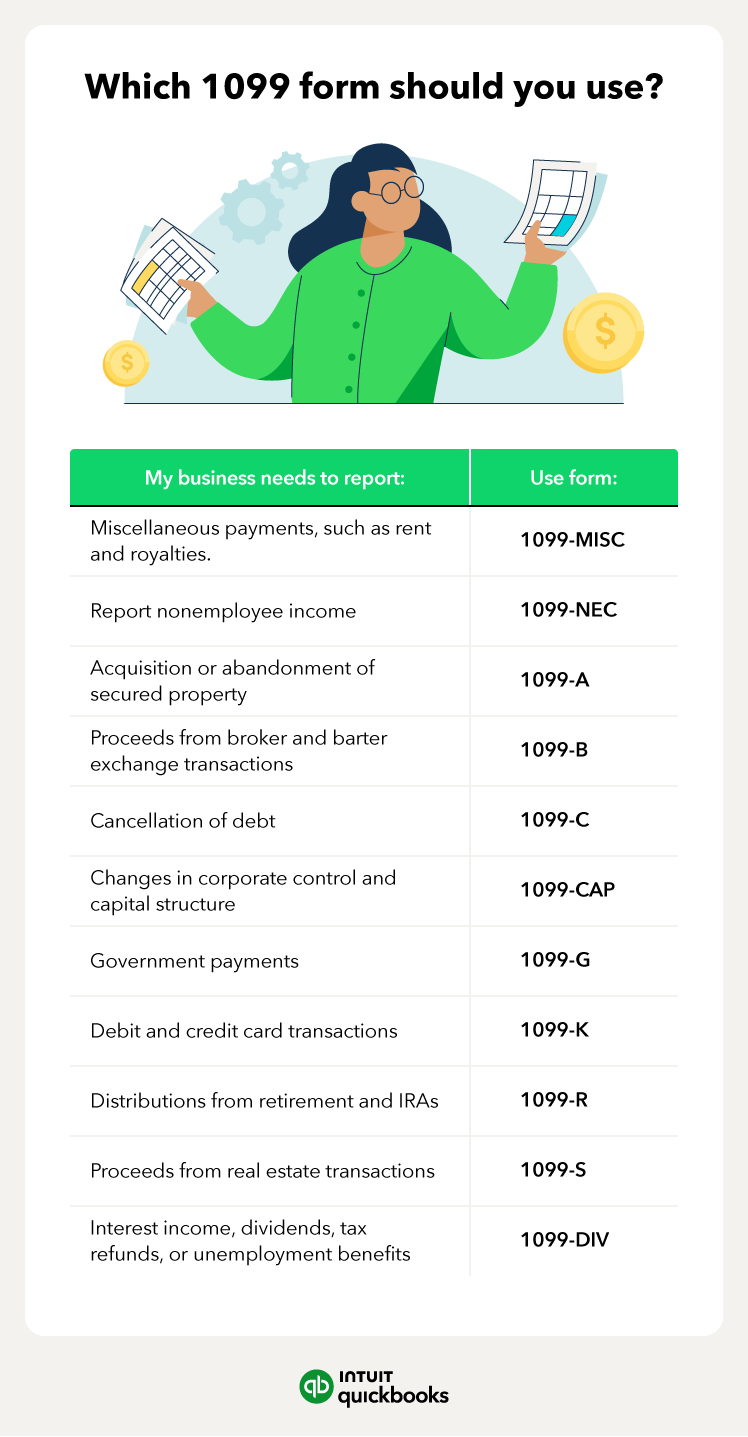

What is a 1099? Types, details, and how to use it

1040 Form vs 1099 Form: Everything You Need To Know - Tax1099 Blog

Tax Form 1099-G Available Online for Individuals Who Received Unemployment Benefits from Missouri in 2022

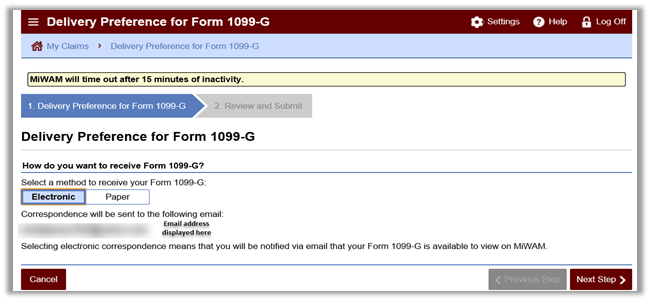

LEO - Your 1099-G Tax Form

1099-G Tax Information