Section 44B: Income From Shipping Business For Non-Residents

Section 44B lays down rules for non-residents in shipping. Here’s all you need to know about presumptive income, tax rate and calculation.

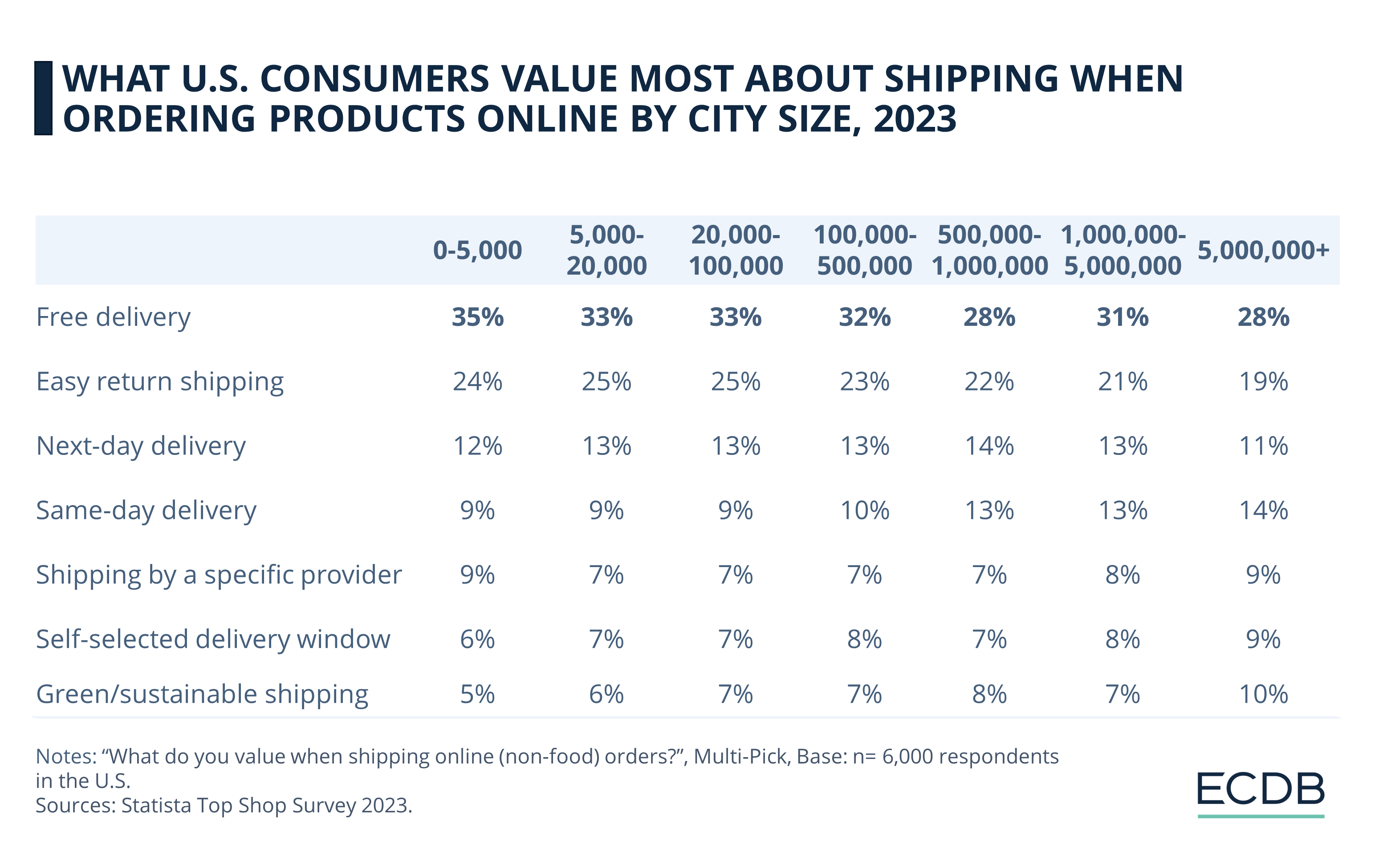

U.S. Shipping Preferences 2023: Online Shoppers Value Free Delivery

International Taxation: Taxation of Non-residents' Shipping Business-Section 44B of the Act – MTLiveCA

A Guide to Medicare Tax Rate for Small Business Owners (2023) - Shopify

How To Start Dropshipping: A 9 Step Guide (2024) - Shopify Nigeria

Trading Lives for Profit: How the Shipping Industry Circumvents Regulations to Scrap Toxic Ships on Bangladesh's Beaches

Taxability of non residents engaged in shipping business

Dollar Crisis Spurs Malawi to Devalue Its Currency by 44% - BNN Bloomberg

Tax presentation business income

Presumptive taxation

Shipping Business Operators: Types, Charters, Taxation and Benefits

Income is Taxed in the same Year in which it is earned

International Taxation: Taxation of Non-residents Shipping Business- Section 172 of the Act

My jaw dropped,' says Ontario woman of $12K air ambulance bill in Nova Scotia