:max_bytes(150000):strip_icc()/StraightLineBasis-27e5ac7651b24572a05ef272c2475554.jpg)

Straight Line Basis Calculation Explained, With Example

4.8

(82)

Write Review

More

$ 19.99

In stock

Description

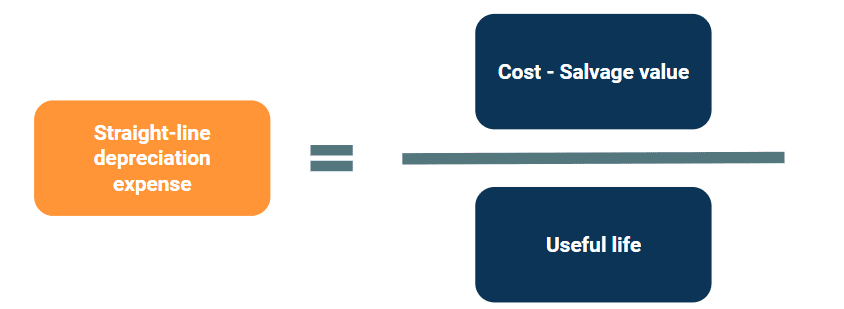

Straight line basis is the simplest method of calculating depreciation and amortization, the process of expensing an asset over a specific period.

Line Method - FasterCapital

:max_bytes(150000):strip_icc()/Investopedia_UnitofProductionMethod_3-2-605ae41c4eef428baab0f3e152c7afda.jpg)

What Is the Unit of Production Method & Formula for Depreciation?

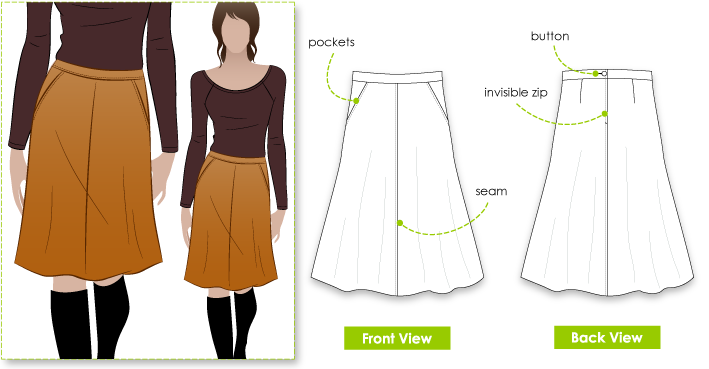

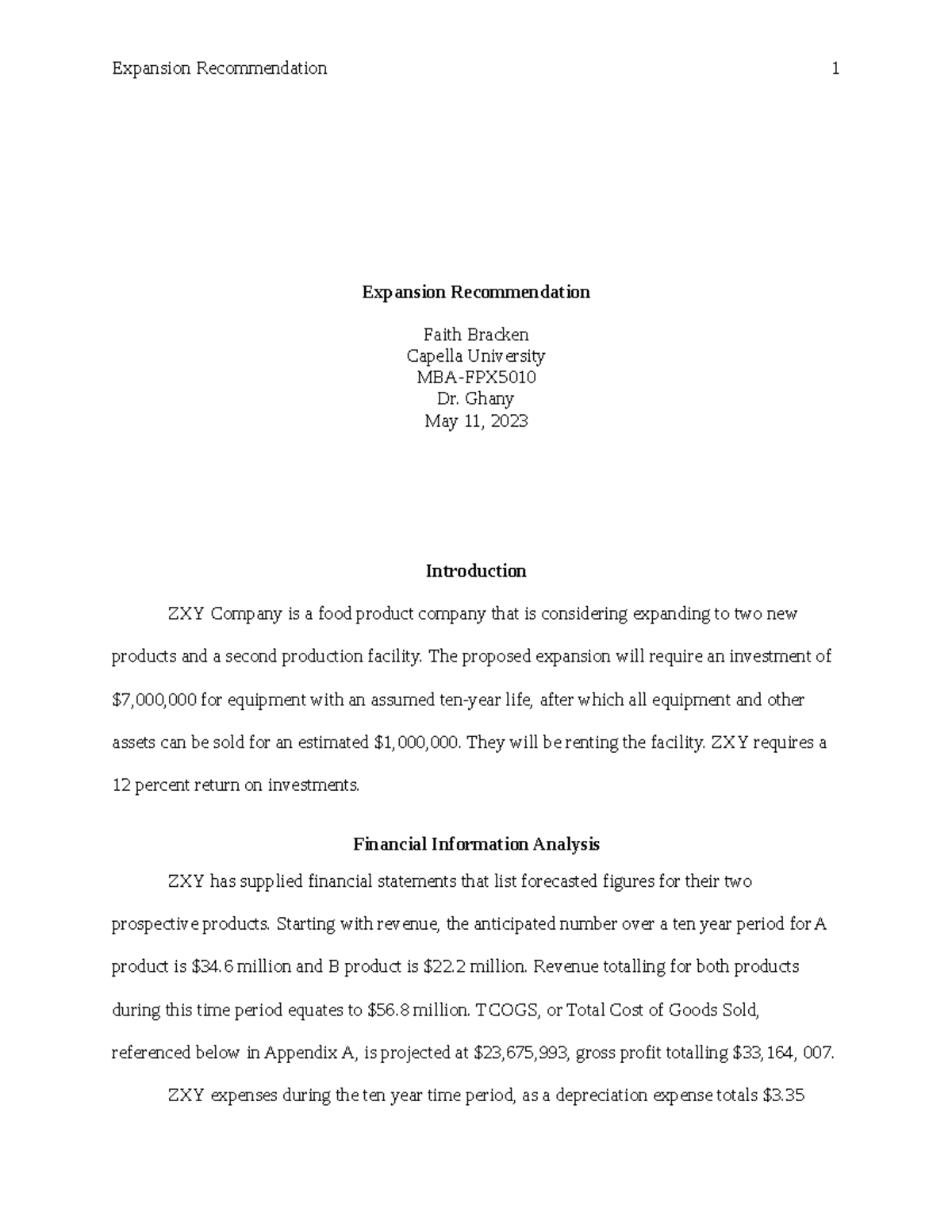

FPX5010 Bracken Faith Assessment 4-1 - Expansion Recommendation

Straight Line Depreciation

Straight Line Amortization - [ Definition, Formula Calculation

How to calculate depreciation under the straight-line method using

Straight Line vs Reducing Balance Depreciation

Depreciation Expense Double Entry Bookkeeping

Depreciation Expense: Straight-Line Method Explained with a

:max_bytes(150000):strip_icc()/GettyImages-1086691530-e29ad0c666e64044bd440a79fe577816.jpg)

Straight Line Basis Calculation Explained, With Example

Related products

You may also like