Maximizing Your Tax Benefits with HSA, HRA, and FSA for

In the world of financial planning and healthcare, Health Savings Accounts (HSA), Health Reimbursement Arrangements (HRA), and Flexible Spending Accounts (FSA) play a pivotal role in helping individuals and families manage their medical expenses. If you're a breastfeeding parent, you may not be aware how they can be ut

Did you know? InsideTracker plans are HSA/HRA/FSA eligible

HSA Planning When Both Spouses Have High-Deductible Health Plans

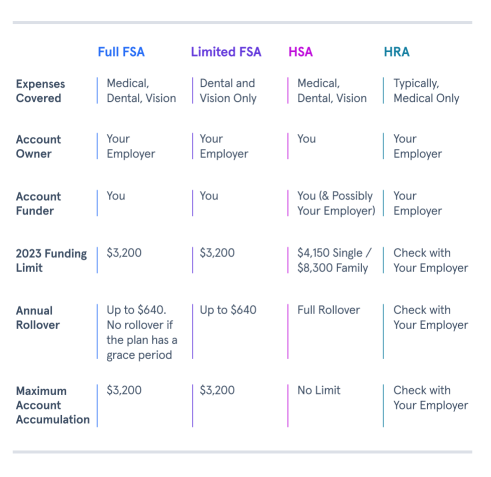

FSA vs HSA vs HRA: What's the Difference? - Bennie

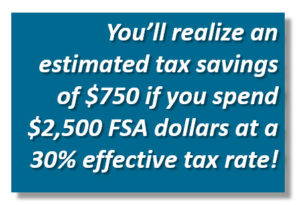

Realize the potential of HSA tax benefits

Jenn M Gives Self-Care Tips for All the Moms

SuperMom Spotlight: Charity Solberg

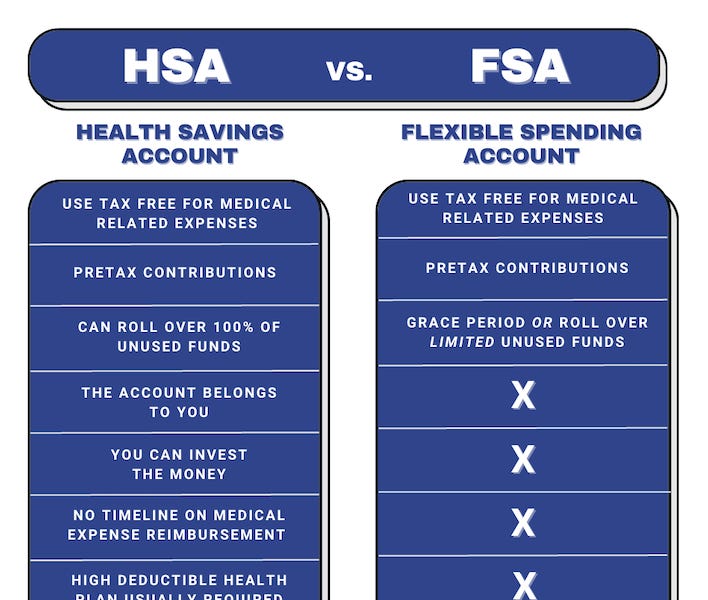

HSA or FSA: Which is Better for Married Couples?

Did you know? InsideTracker plans are HSA/HRA/FSA eligible

Plan Comparison with Shareable Reference Chart: FSA, HSA, and HRA

Anatomy of an HSA by BRI, Benefit Resource, BRI

HSAs vs. FSAs: What's the Difference?

A Few Of Our Favorite Affirmations - Simple Wishes