Carry and Roll-Down on a Yield Curve using R code

lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

Keep Calm and “Carry and Roll” On

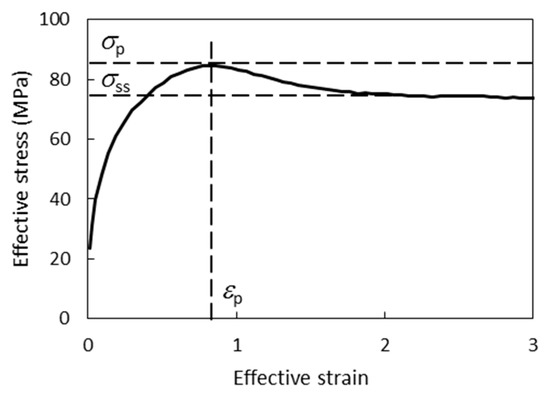

Materials, Free Full-Text

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

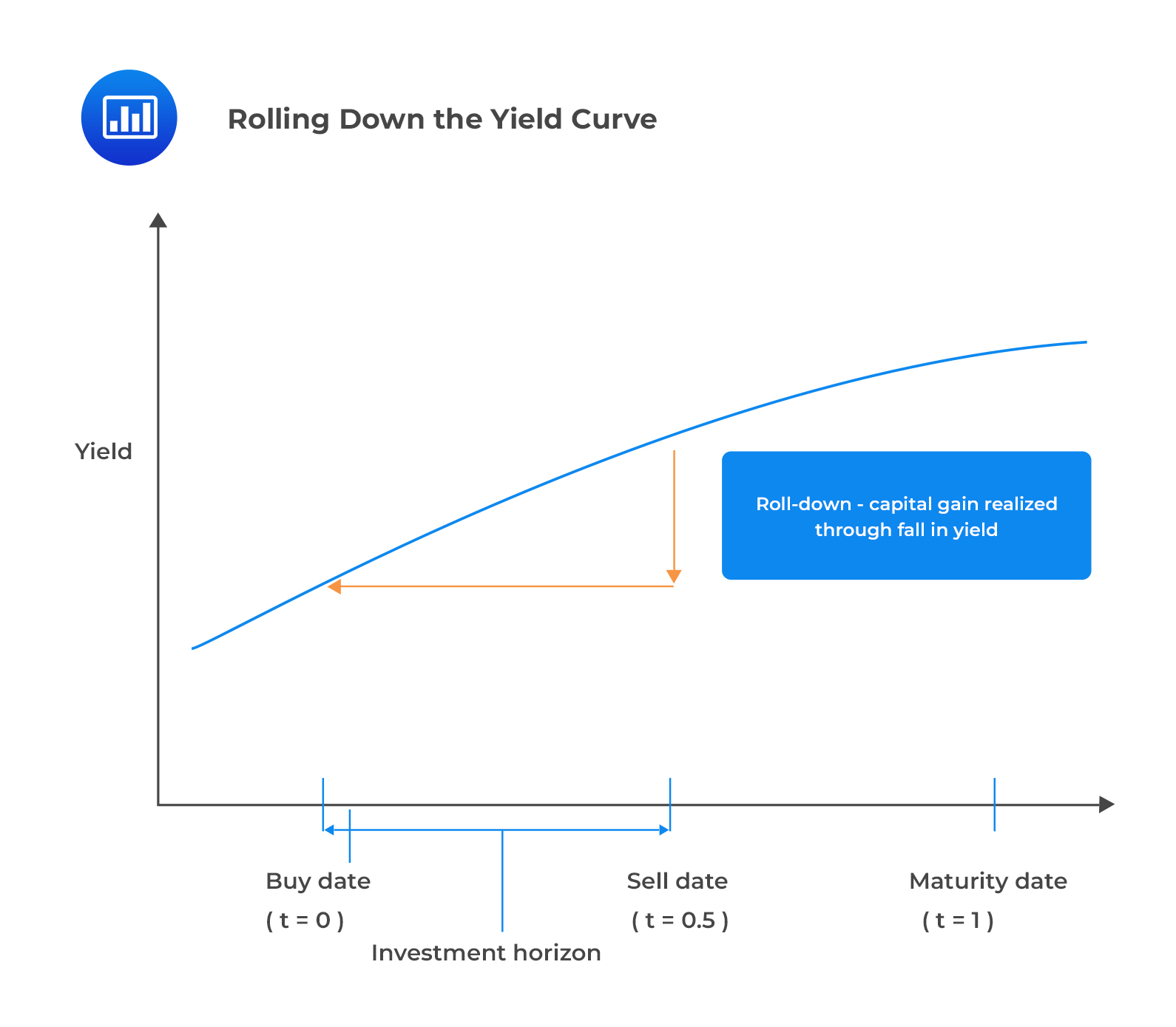

Riding the Yield Curve and Rolling Down the Yield Curve Explained

Riding the Yield Curve and Rolling Down the Yield Curve Explained

Corporate bonds: Unraveling Roll Down Returns in Corporate Bond Portfolios - FasterCapital

Fixed income: Carry roll down (FRM T4-31)

:max_bytes(150000):strip_icc()/convexity-4198782-a4e62f51917a4d07a4d03fe386e87c95.jpg)

Convexity in Bonds: Definition, Meaning, and Examples

Fixed income: Carry roll down (FRM T4-31)

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

Carry and Roll-Down on a Yield Curve using R code

Riding the Yield Curve - CFA, FRM, and Actuarial Exams Study Notes

Rolling down the yield curve – Fixed Income Strategy

Interest Rate Carry

:max_bytes(150000):strip_icc()/Verywell-19-2704717-WallRollDown03-2029-ea9a46394d0145a08ffc470be2dfa083.jpg)