Australia Corporate Bonds: BBB-rated: 10 Years: Yield, Economic Indicators

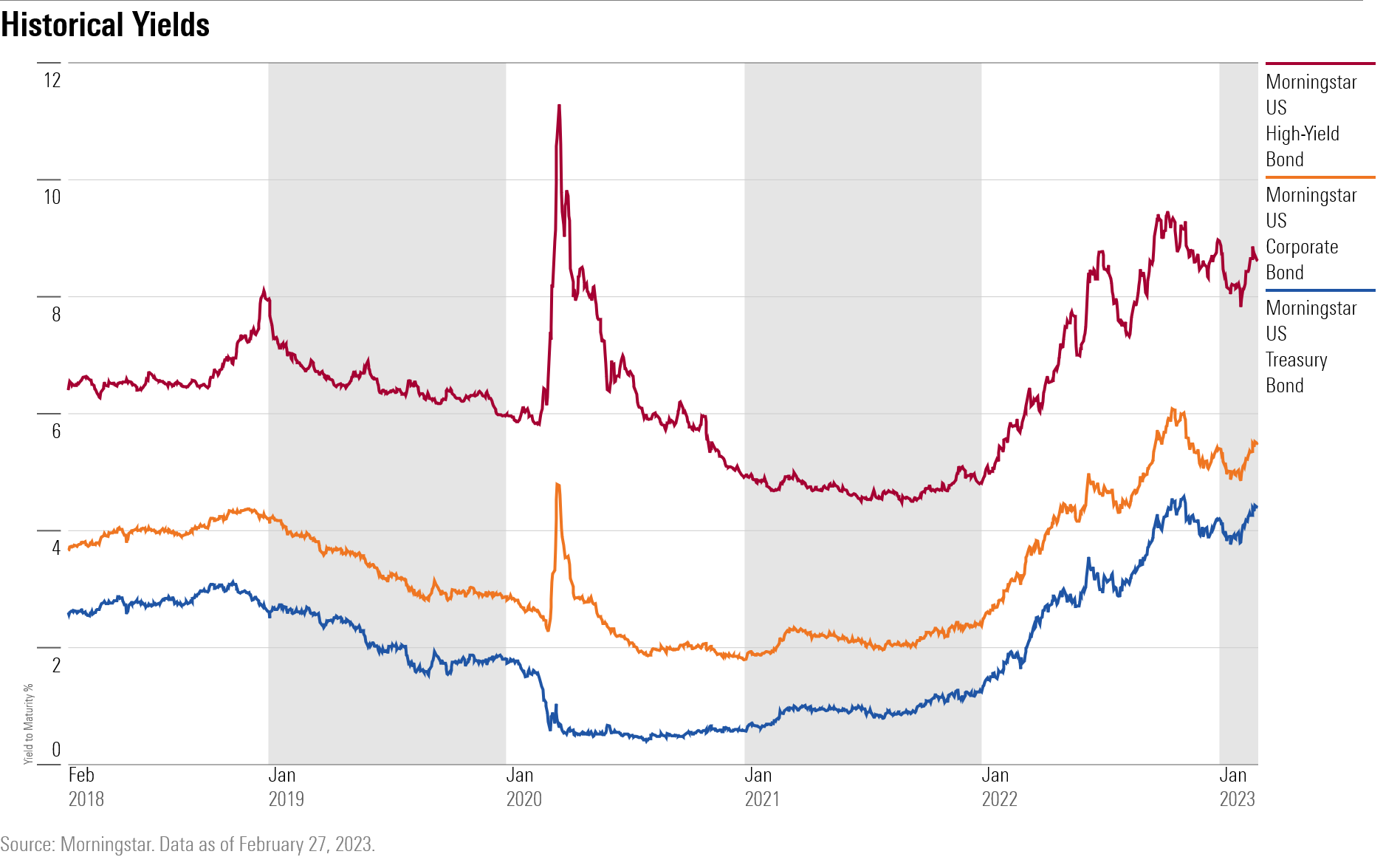

Australia Corporate Bonds: BBB-rated: 10 Years: Yield data was reported at 4.510 % in Apr 2018. This records an increase from the previous number of 4.390 % for Mar 2018. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data is updated monthly, averaging 6.810 % from Jan 2005 to Apr 2018, with 149 observations. The data reached an all-time high of 13.410 % in Dec 2008 and a record low of 4.090 % in Nov 2017. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data remains active status in CEIC and is reported by Reserve Bank of Australia. The data is categorized under Global Database’s Australia – Table AU.M008: Corporate Bond Yield and Spread.

Australia Corporate Bonds: BBB-rated: 10 Years: Yield data was reported at 4.510 % in Apr 2018. This records an increase from the previous number of 4.390 % for Mar 2018. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data is updated monthly, averaging 6.810 % from Jan 2005 to Apr 2018, with 149 observations. The data reached an all-time high of 13.410 % in Dec 2008 and a record low of 4.090 % in Nov 2017. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data remains active status in CEIC and is reported by Reserve Bank of Australia. The data is categorized under Global Database’s Australia – Table AU.M008: Corporate Bond Yield and Spread.

Adapting Allocations to a New Regime

Bring On Bonds

Sector Rotation: The Cornerstone of Our Investment Grade Strategy

Understanding Green Bond Performance in Market Setbacks

Why Some Say Investors Should Be Wary of Corporate Bonds

Credit Trends: Global Financing Conditions: Bond Issuance Set To Remain Weak Through Year-End, Expand Modestly In 2023

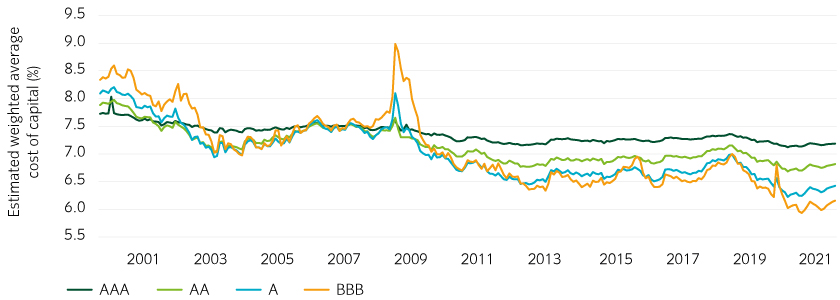

Credit Insights: Embracing the great BBB convergence

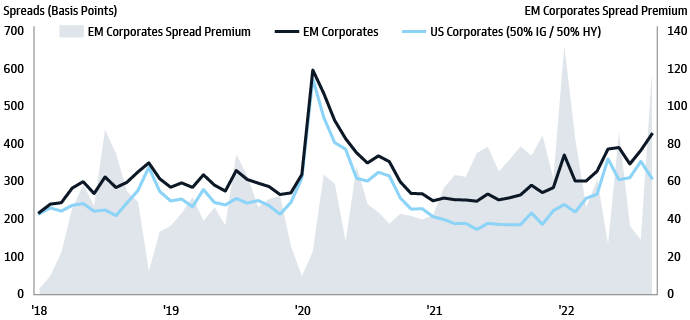

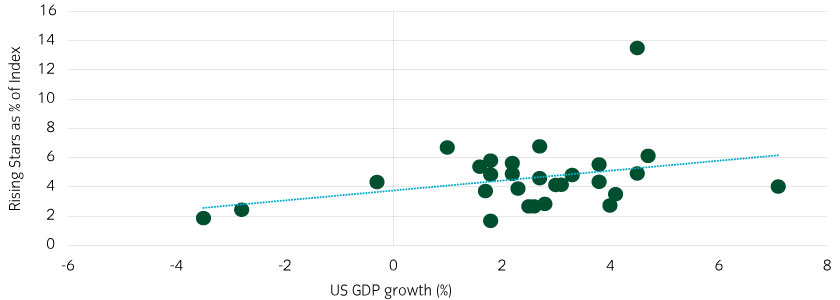

Navigating The EM Corporate Bond Market

Credit Insights: Embracing the great BBB convergence

Corporate Bonds

Municipals: Outperforming corporate fixed income with lower default risk

Low risk, investment grade corporate bonds 2% - 3% over cash rate