Low-Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

It's time to build more public housing in the U.S. to solve the affordability crisis.

Housing Mobility Strategies and Resources

/cdn.vox-cdn.com/uploads/chorus_asset/file/24937557/GettyImages_1358862098.jpg)

Child poverty's historic drop and rebound, explained in one chart

A D.C. Suburb Finds a Creative Answer to America's Housing

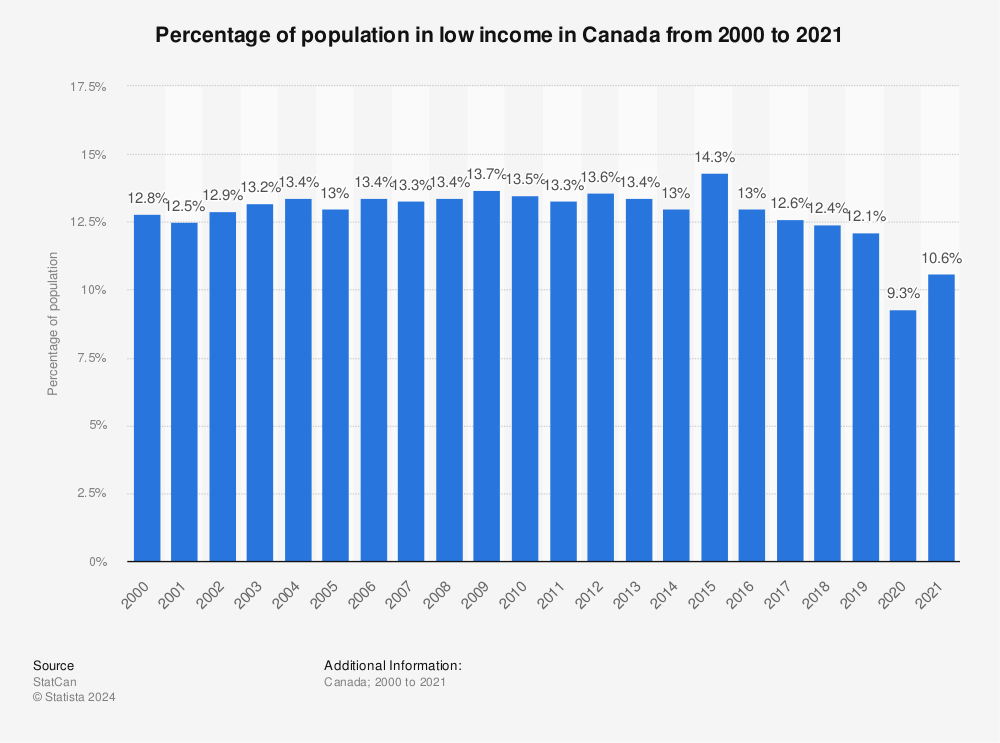

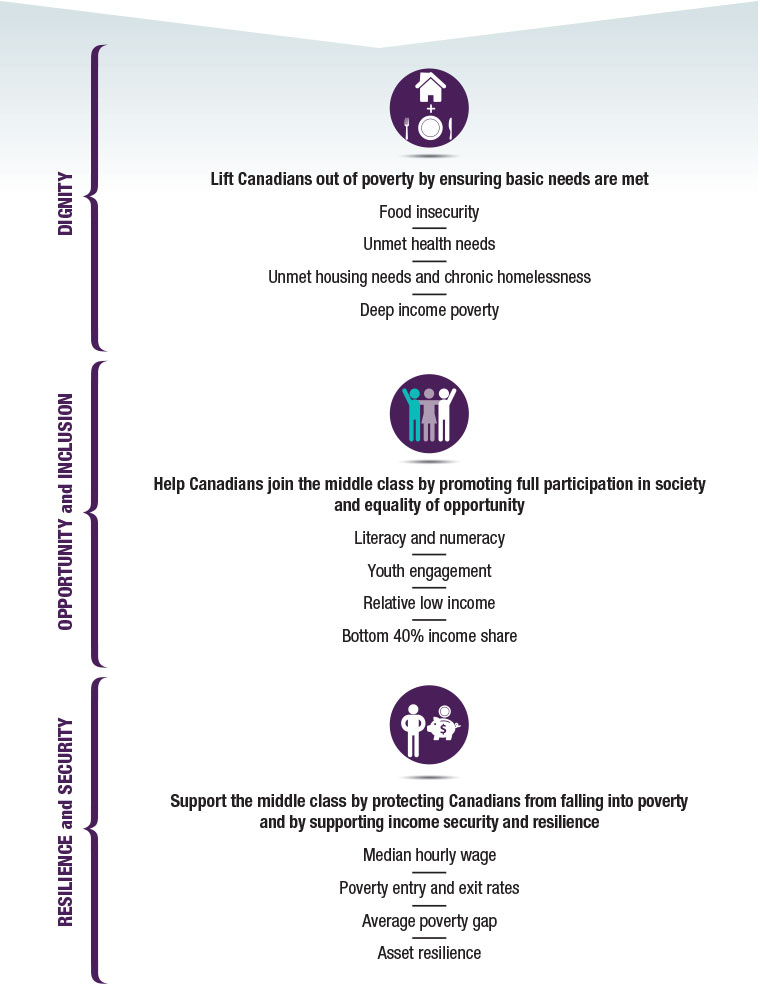

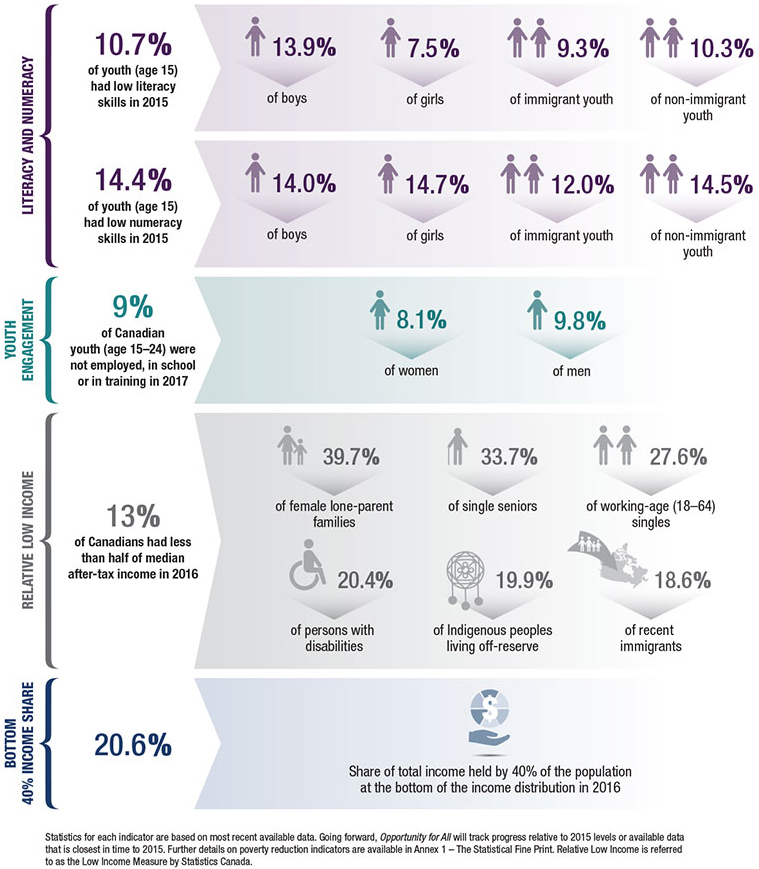

Canada's First Poverty Reduction Strategy

Low Income Housing Tax Credit: Invest in Communities and Reduce Your Taxes - FasterCapital

Congress May Expand The Low-Income Housing Tax Credit. But Why?

House passes child tax credit expansion : NPR

Canada's poor urged to earn more by filing their taxes

Canada's First Poverty Reduction Strategy

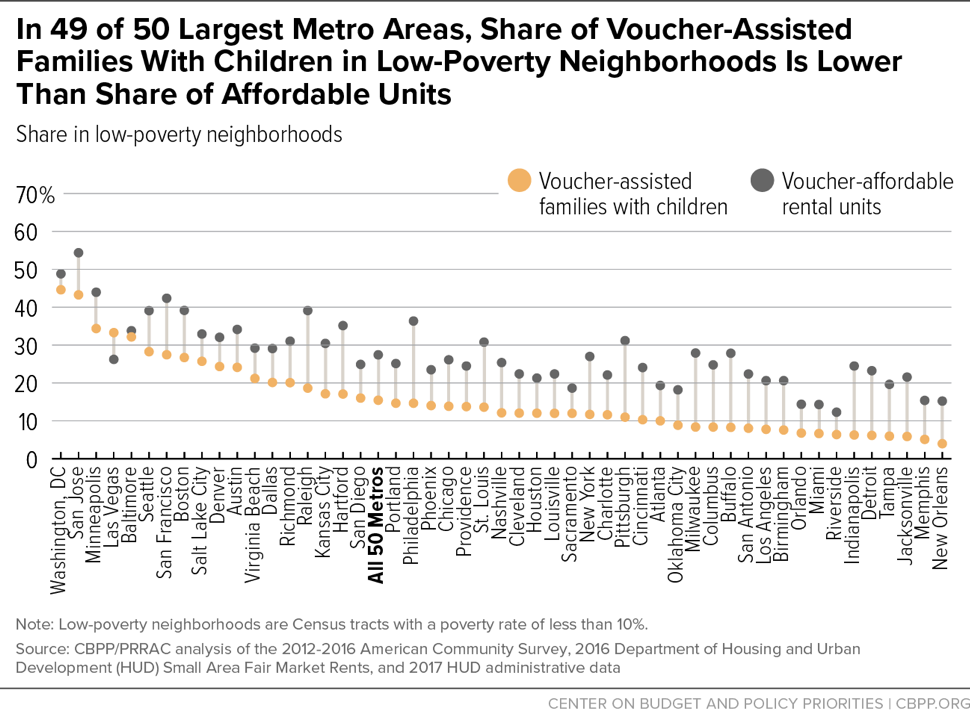

Few Low-Income Housing Tax Credit Units Are in Low-Poverty

Where Families With Children Use Housing Vouchers

/cdn.vox-cdn.com/uploads/chorus_image/image/72025056/1244775498.0.jpg)

It's time for Biden to prioritize the affordable housing shortage