Deducting Business Travel Expenses - A Self-Employed Guide

Being self-employed lets you deduct business travel expenses. Follow this self-employed tax guide to learn how to claim travel expense deductions.

15 Popular Deductions to Reduce Your Self-Employment Taxes – Forbes Advisor

Entrepreneur's Guide: Self Employment Tax Deductions Demystified - FasterCapital

Deducting Business Travel Expenses - A Self-Employed Guide

The business travel tax deduction: What it is and how to take advantage of it - TravelDailyNews International

What Travel Expenses You Can (and Can't) Write Off

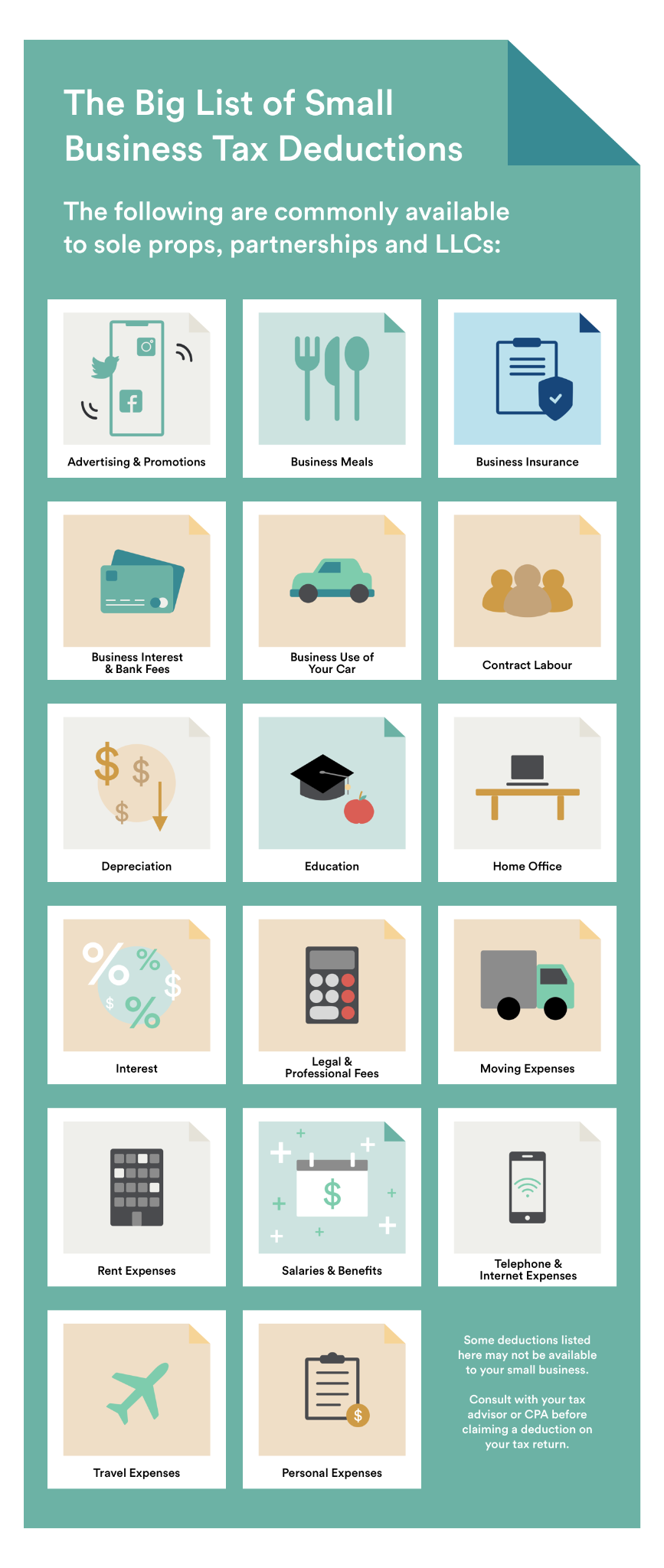

Business expenses - 36 small business expenses you can claim, this is a handy list to remind you and to reduce your tax payment - RKB Accounting & Tax Services

Business Expense Categories Cheat Sheet: Top 35 Tax-Deductible Categories

The Beginner's Guide to Self-Employed Taxes

How to Prepare the T2125 if you are a Small or Self Employed Business Owner