CRA Travel Expenses For Employees - Travel Expenses Rules For 2024

Need to know how to receive travelling expenses reimbursement from your employer? Learn about CRA travel expenses and if they are taxable as part of your income.

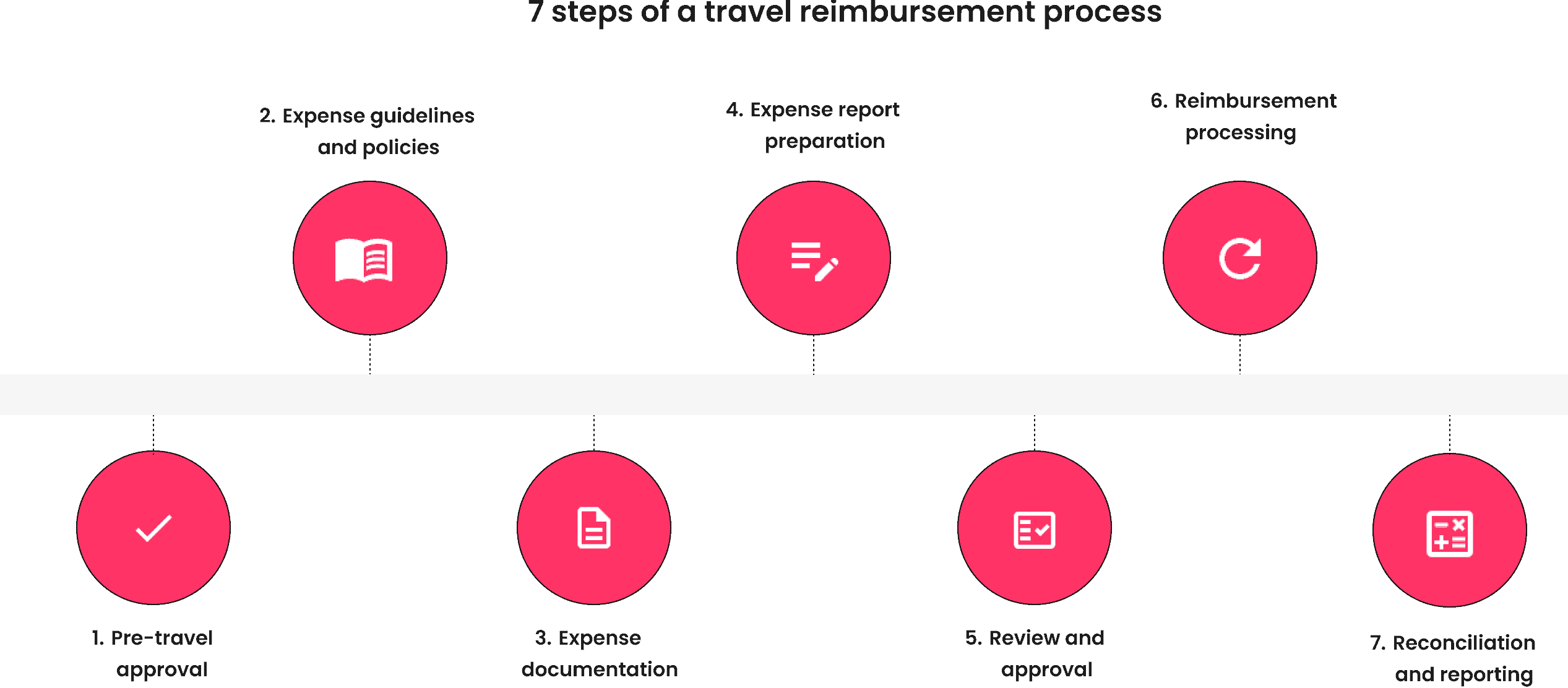

Travel Expenses Reimbursement Process – Questetra Support

Leave Travel Allowance (LTA) - Exemption Limit, Rules, How to Claim, Eligibility and Latest Updates

Falguni Kulkarni - Clinical Research Associate - COD Research

NPS partial withdrawal rule changes from February 2024: How does it work, when should you go for it? - The Economic Times

Employee Travel Expenses & Reimbursement: Thing You Need To Know - ABC of Money

Travel and Expense Policy, PDF, Credit Card

Employees working from home by choice can claim expenses, CRA says

Detailed Guide on Travel Expense Reimbursement

Sample Corporate Travel Policy for Employees and procedure

Travel Policy - 25+ Examples, Format, Word, Pages, Pdf

GoA-Travel-Meal-and-Hospitality-Expense-Policy

Timeero - CRA Mileage Rate: A 2024 Guide - Timeero