Form 990: Five Common Mistakes and How to Avoid Them, Marcum LLP

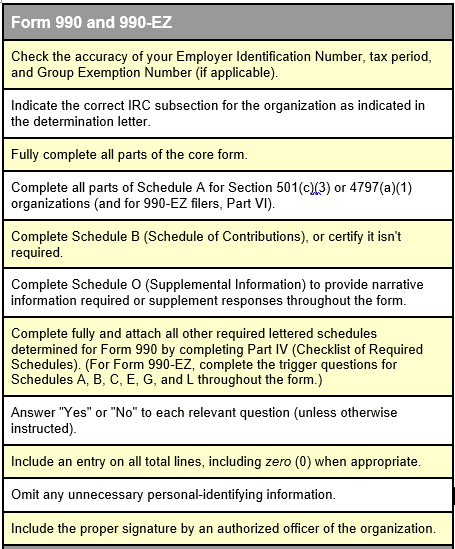

Organizations should take the time to prepare for and carefully review their Form 990, seeking assistance from a tax professional as needed.

Organizations should take the time to prepare for and carefully review their Form 990, seeking assistance from a tax professional as needed.

Common Form 990 Mistakes

2021 Form 990 for Rebuilding Together Valley of the Sun

IRS Form 990-PF ≡ Fill Out Printable PDF Forms Online

Managed Accounting Services, Marcum LLP

John Bonk, CPA on LinkedIn: Form 990: Five Common Mistakes and How to Avoid Them

Erin Crowley on LinkedIn: Form 990: Five Common Mistakes and How to Avoid Them

What Are the Most Common Form 990 Mistakes Nonprofits Make? - GRF CPAs & Advisors

Erin Crowley on LinkedIn: Form 990: Five Common Mistakes and How to Avoid Them

Know where the money goes: How to read a non-profit's I-990 form

Justin Van Fleet, CPA on LinkedIn: Nonprofit and Social Sector Update and Best Practices

Friedman LLP on LinkedIn: Form 990: Five Common Mistakes and How to Avoid Them

Streamline Employee Expense Reimbursement with Expensify and QBO, Marcum LLP

Form 990-PF: Return of Private Foundation

Managed Accounting Services, Marcum LLP

Friedman LLP on LinkedIn: Form 990: Five Common Mistakes and How to Avoid Them