Is Lululemon Athletica Inc (LULU) a Good Buy in the Apparel Retail Industry?

Lululemon Athletica Inc (LULU) is near the top in its industry group according to InvestorsObserver. LULU gets an overall rating of 75. That means it scores higher than 75 percent of

Lululemon: An Overvalued Growing Apparel Retailer (NASDAQ:LULU)

Lululemon's yoga pants keep selling, even for at-home workouts

Lululemon: LULU Stock One of the Best in Apparel, Says Argus

Lululemon Stock Falls on Margin Disappointment - Barron's

Lululemon's bleak holiday-quarter targets overshadow strong Q3

Lululemon (LULU) announces new 5-year targets at analyst day 2022

Lululemon Athletica Sales Jump; Forecast Misses Wall Street Target

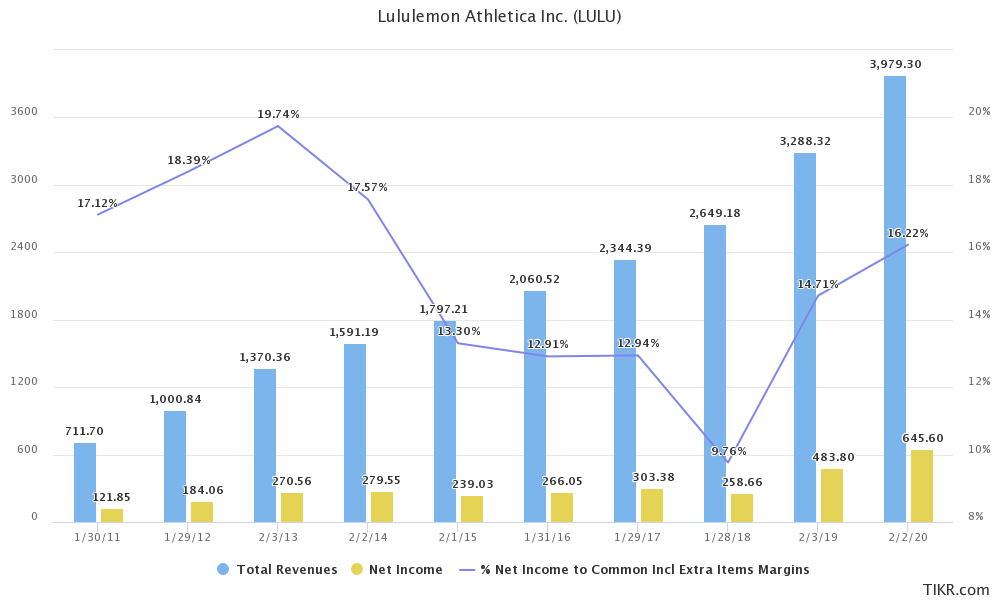

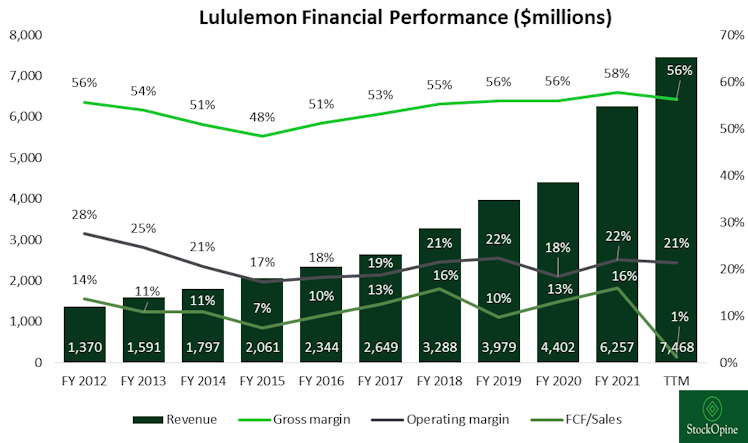

Post by StockOpine, Commonstock

Lululemon's positioned to be a menswear disrupter - MarketWatch

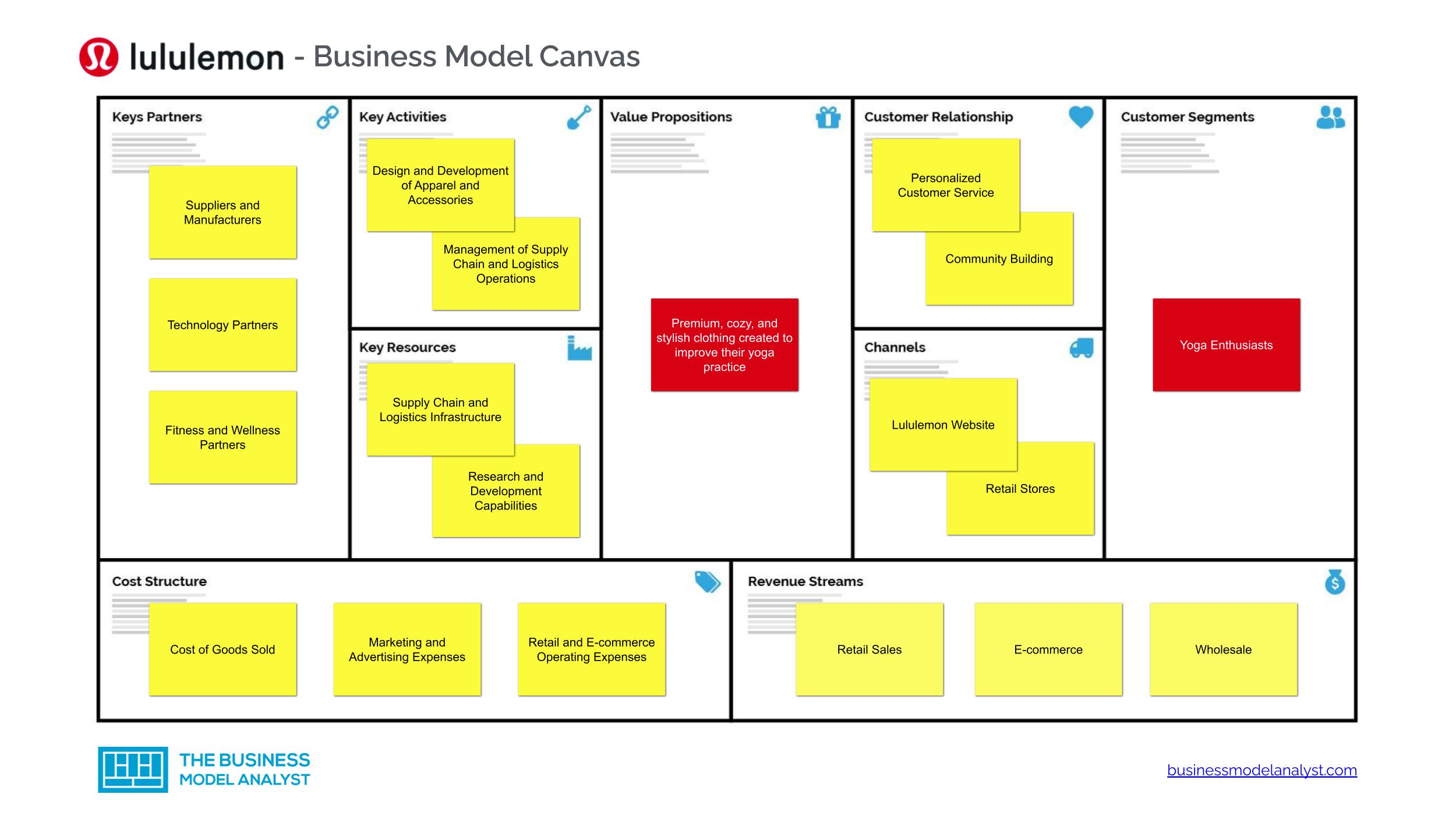

Lululemon Business Model - How Lululemon Makes Money?

How much a $1,000 investment in Lululemon 10 years ago would be worth

Lululemon Share Price Newsday International Society of Precision Agriculture

Why Investors Should Keep lululemon (LULU) Stock for Now

Lululemon Says Sales Soar but Supply Chain Remains a Concern - The New York Times