How Does a Wraparound Mortgage Work?

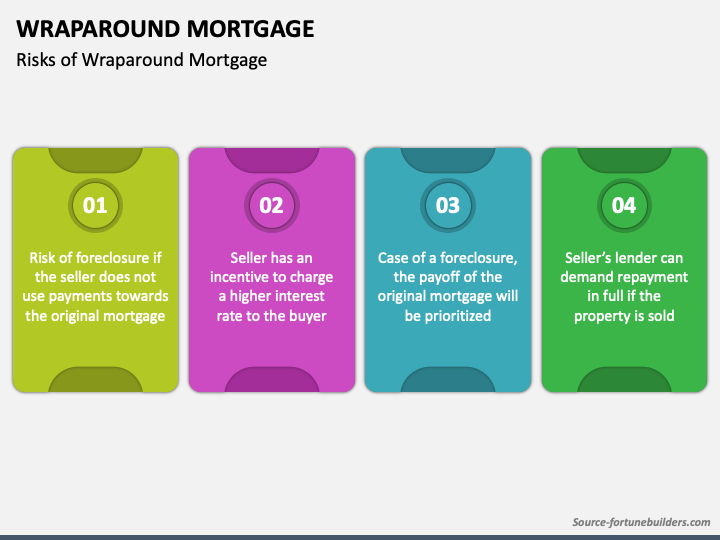

A wraparound mortgage allows a property seller to keep their original mortgage loan in place while they agree to finance the bulk of the purchase for a new buyer. The seller is effectively financing a subordinate mortgage for their buyer while keeping the original mortgage in place. It works much like a “subject to” purchase with a few key differences.

Understanding Wraparound Mortgages: Managing Interest Rates with Ease - FasterCapital

What Is a Wraparound Mortgage? Investor's Guide

What is a Wrap-Around Mortgage? A Quick Overview

A Guide to Wraparound Mortgages and Risks Associated With The Due-on-Sale Clause?

Carmen Bondoc

What Is a Wraparound Mortgage and How Does It Work?

Wraparound Mortgage PowerPoint Template and Google Slides Theme

Realty411 Featuring Gene Guarino - Build a Legacy Vol 8. No. 4

Mary Walker Miller on LinkedIn: How Does a Wraparound Mortgage Work?