How Venture Capital Works

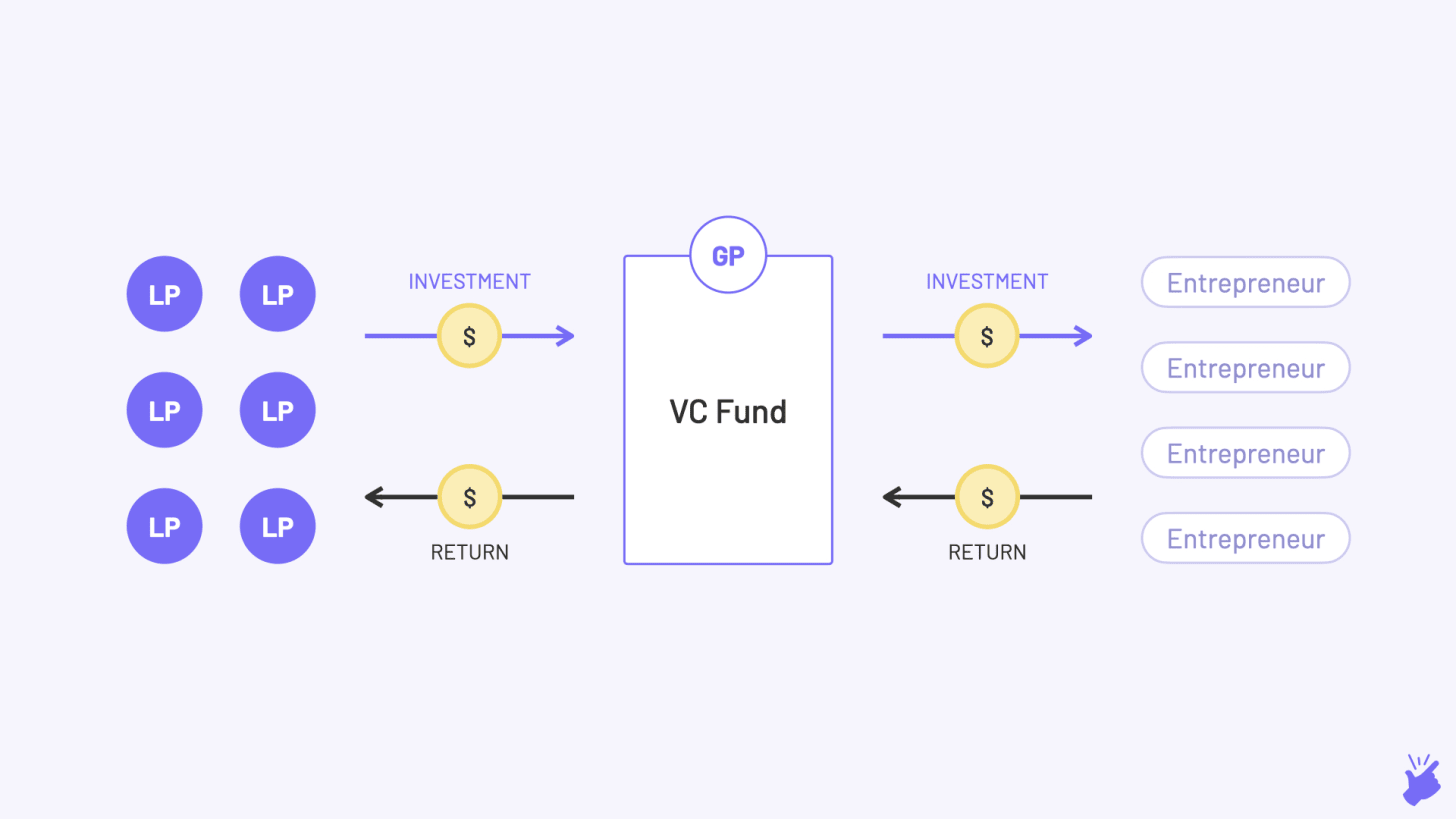

The popular mythology surrounding the U.S. venture-capital industry derives from a previous era. Venture capitalists who nurtured the computer industry in its infancy were legendary both for their risk-taking and for their hands-on operating experience. But today things are different, and separating the myths from the realities is crucial to understanding this important piece of the U.S. economy. Today’s venture capitalists are more like conservative bankers than the risk-takers of days past. They have carved out a specialized niche in the capital markets, filling a void that other institutions cannot serve. They are the linchpins in an efficient system for meeting the needs of institutional investors looking for high returns, of entrepreneurs seeking funding, and of investment bankers looking for companies to sell. Venture capitalists must earn a consistently superior return on investments in inherently risky businesses. The myth is that they do so by investing in good ideas and good plans. In reality, they invest in good industries—that is, industries that are more competitively forgiving than the market as a whole. And they structure their deals in a way that minimizes their risk and maximizes their returns. Although many entrepreneurs expect venture capitalists to provide them with sage guidance as well as capital, that expectation is unrealistic. Given a typical portfolio of 10 companies and a 2,000-hour work year, a venture capital partner spends on average less than two hours per week on any given company. In addition to analyzing the current venture-capital system, the author offers practical advice to entrepreneurs thinking about venture funding.

Venture capital - Wikipedia

HOW VENTURE CAPITAL FIRM WORKS

What Exactly Is Venture Capital? - by Jason Leonard

How venture capital works Zider, R How venture capital works, Harvard Business Review, November-December, ppt download

fdev

Venture Capital: What is it and How it works? - Velocity

Venture Capital Investment Venture - FasterCapital

How Venture Capital Firm Works

A Quick Overview on VC Fund Structure

How Venture Capital Works - A Beginner's Guide To Investing

How Venture Capital works

Valuer Download Top Venture Capitalists in the USA

The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits (Wiley Finance): 9781119639688: Ramsinghani, Mahendra: Books

How Venture Capital Works. Part 4: Anatomy of a VC, by Erik Hormein

:max_bytes(150000):strip_icc()/capital-investment.asp-final-f3ff599ea410488aa1f99fd0e5f81f55.png)