IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

Have you received a 1099-K, 1099-B or 1099-MISC form about your crypto? Here’s what you need to know about 1099 forms and what it means for your crypto taxes.

Free 1099-K Online Filing on FreeTaxUSA®

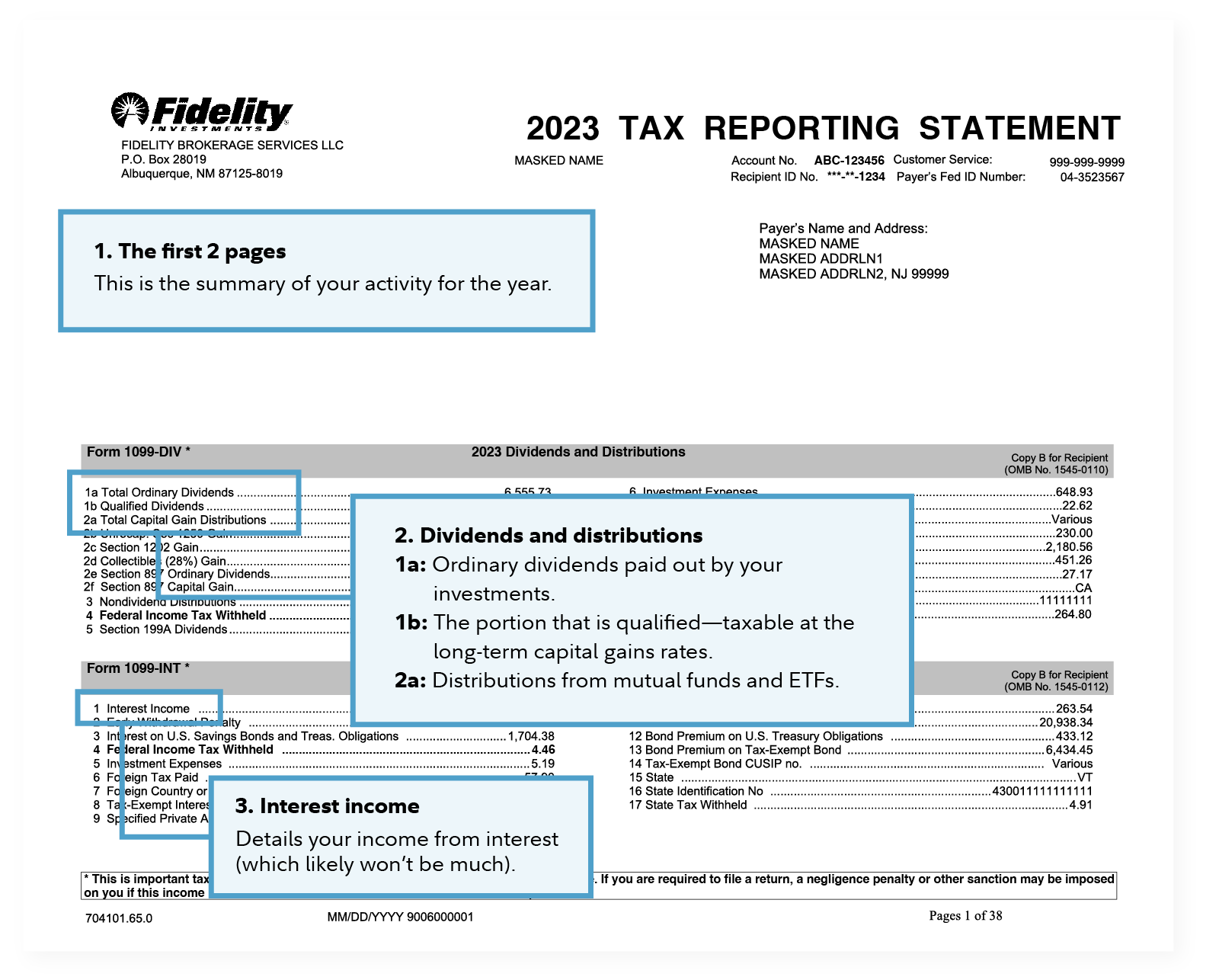

Tax-Filing Myth Buster: 1099 Deadlines for Brokerage - Ticker Tape

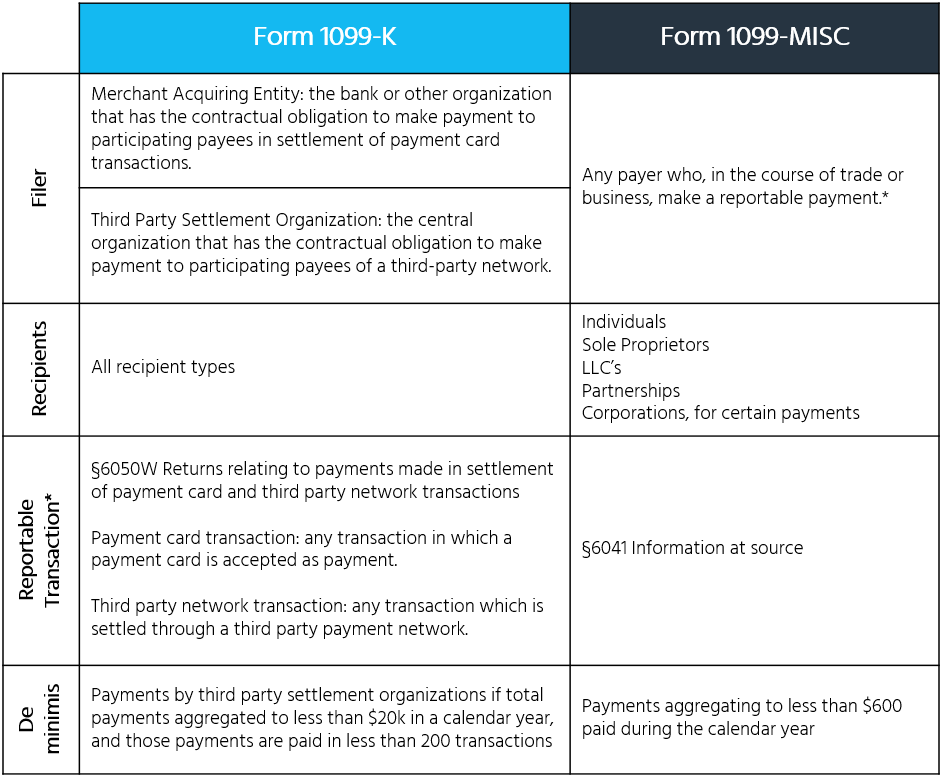

Form 1099-K vs Form 1099-MISC - What is The Difference

1099-MISC vs. 1099-NEC vs. 1099-K: Understanding the Differences- Intuit TurboTax Blog

Will Your Crypto Transactions Be Reported on a Form 1099?

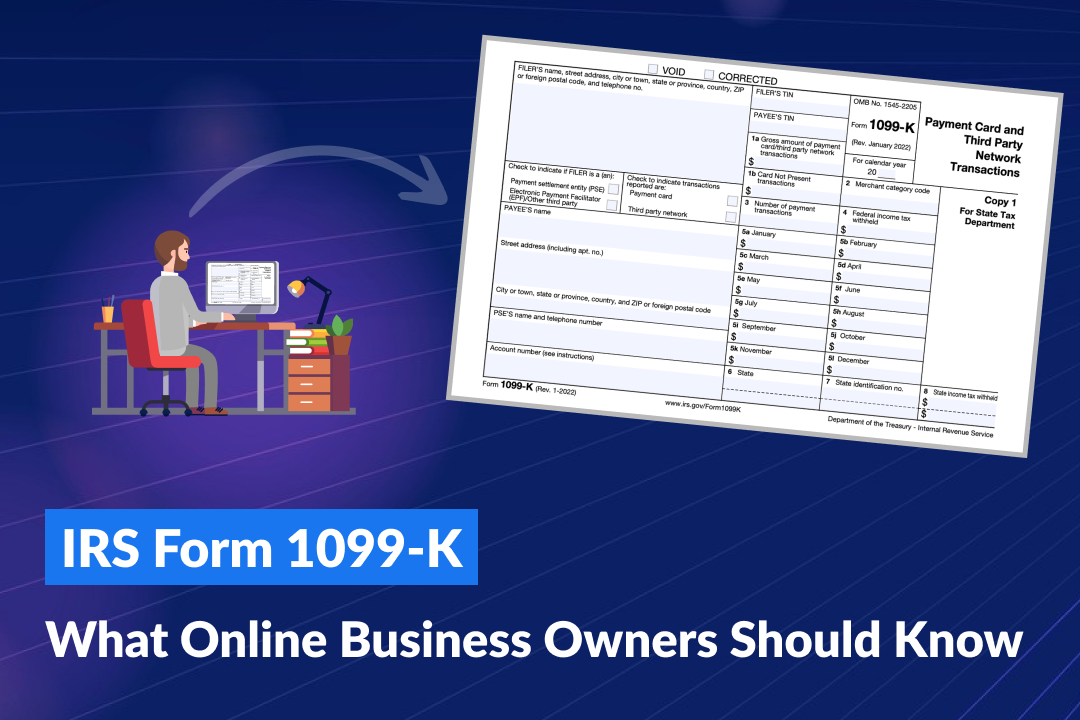

IRS Form 1099-K: What Online Business Owners Should Know

:max_bytes(150000):strip_icc()/form-1099-c-understanding-your-1099-c-form-4782275_final-9a33850e37ad4d54839284865d5b507b.png)

Form 1099-C: Cancellation of Debt: Definition and How to File

Will Binance.US send a 1099? - Quora

1099 tax form, 1099

A Crypto Guide to Form 1099-B

Understanding Changes in Form 1099-K Reporting for 2023 Tax Season

IRS Forms 1099-MISC vs. 1099-K: States Close Tax Reporting Gap