Low-Income Housing Tax Credit Program

The Fund is responsible for administering the Low-Income Housing Tax Credit Program, which generates low-income residential rental units by encouraging private investment through federal tax credits. Since its inception, this program has produced more than 17,200 affordable rental units in West Virginia. If you are interested in receiving updates on the Fund’s Low-Income Housing Tax […]

PPT - INTRODUCTION TO LOW-INCOME HOUSING TAX CREDITS PowerPoint Presentation - ID:3258686

The Low-Income Housing Tax Credit Program at Year 30: Recent

A Guide to LIHTC by MHEGINC - Issuu

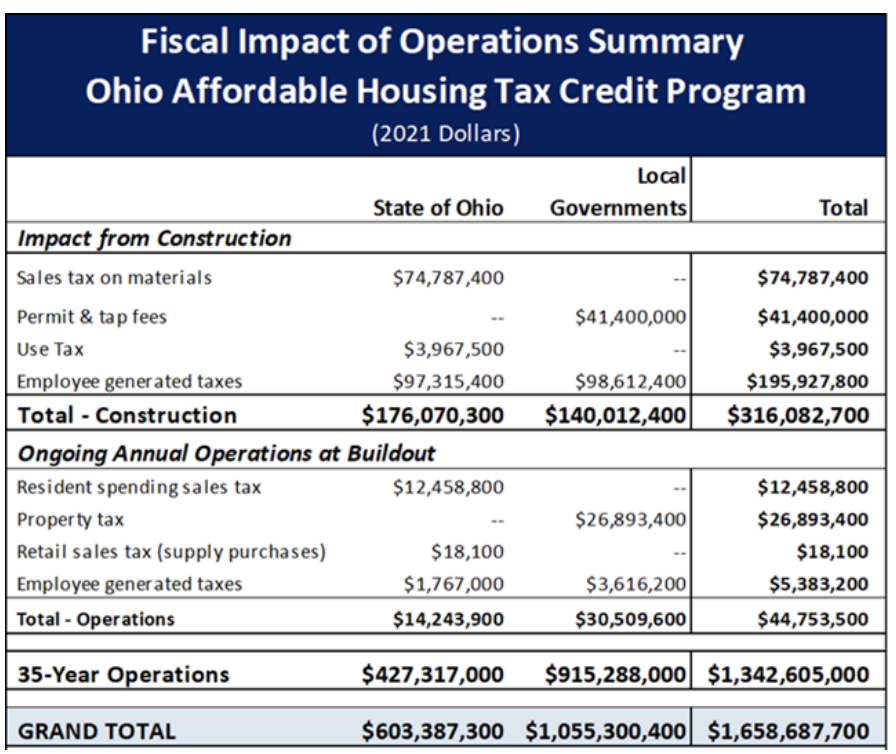

THE OHIO AFFORDABLE HOUSING TAX CREDIT PROGRAM: Creating Jobs While Solving Ohio's Affordable Housing Crisis

LIHTC, Low Income Housing Tax Credits, Energy Rating

Green Building in Low-Income Housing Tax Credit Developments

Series: Low Income Housing Tax Credit Spending Difficult To Track, Measure

State housing agency's $79.5 million tax credit allocation to

Low-Income Housing Tax Credit Program – JES Holdings, LLC

Housing Tax Credits Contributing To Chicago Segregation

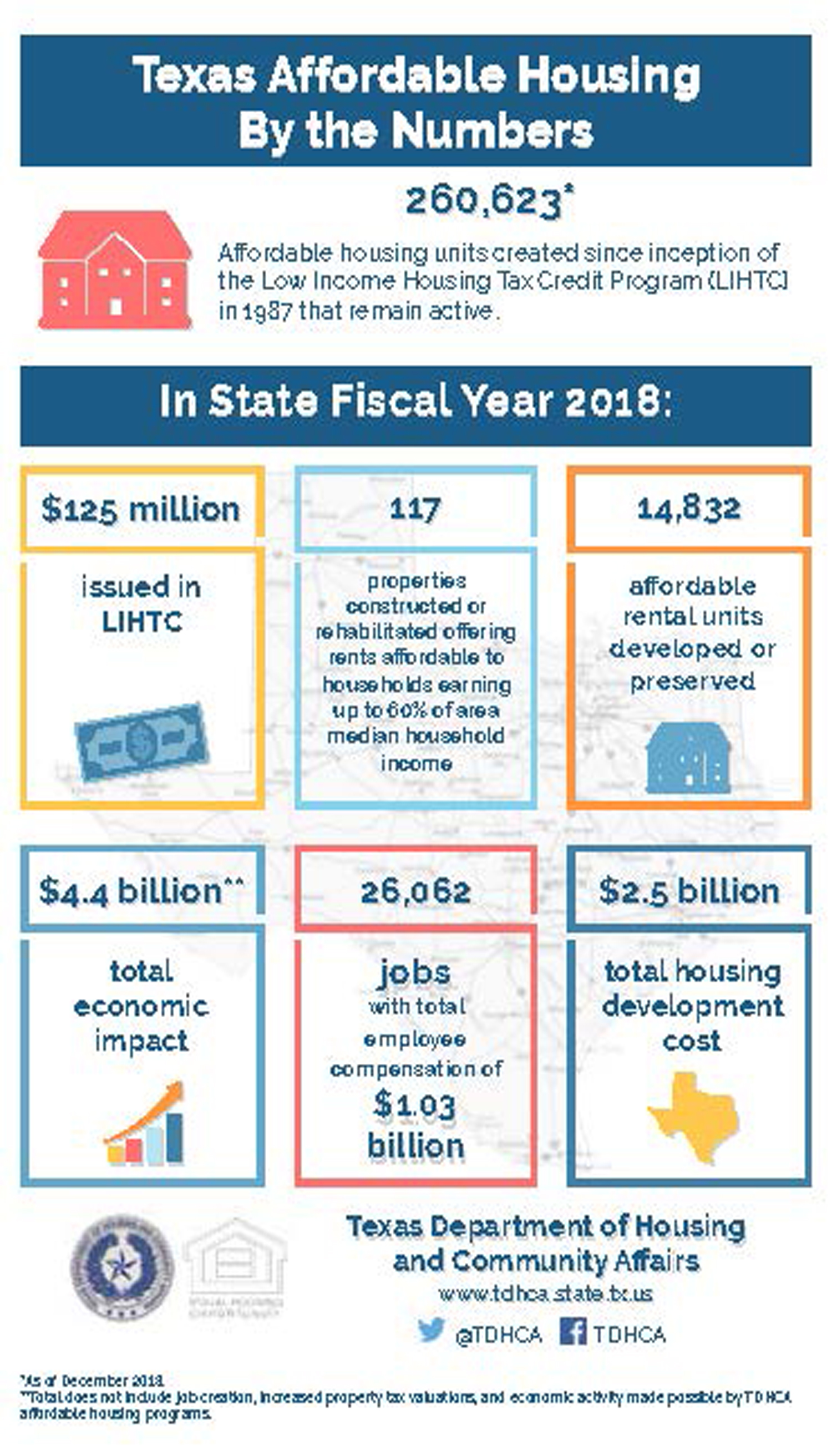

Revisiting the economic impact of low-income housing tax credits in Georgia