Negative Return - Definition, Tax Treatment, Examples

4.9

(270)

Write Review

More

$ 26.00

In stock

Description

A negative return represents an economic loss incurred by an investment in a project, a business, a stock, or other financial instruments.

What is Negative Income Tax and How Does It Work

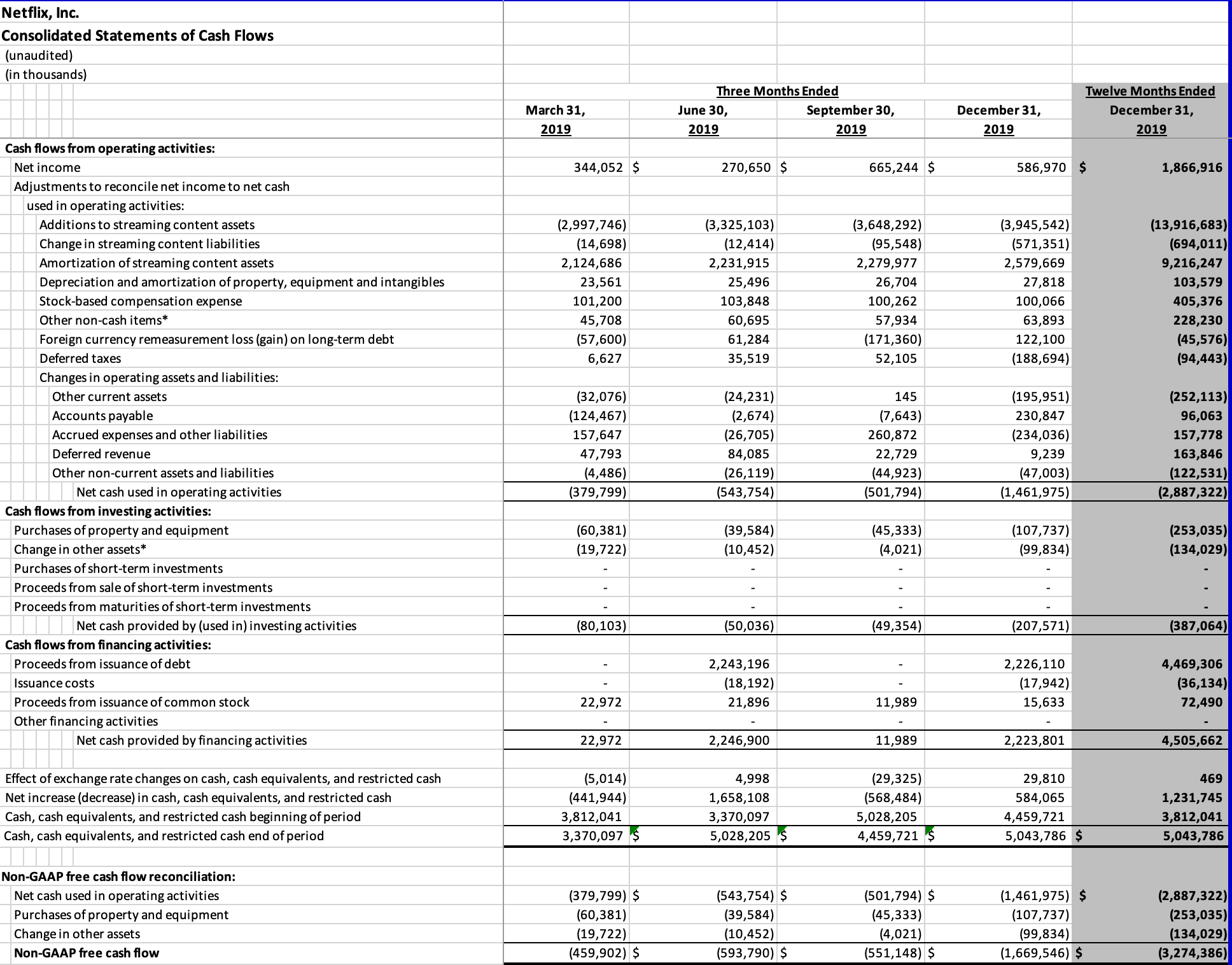

Negative Cash Flow Explained - Why Is It Not Always Bad?

Constructing the effective tax rate reconciliation and income tax provision disclosure

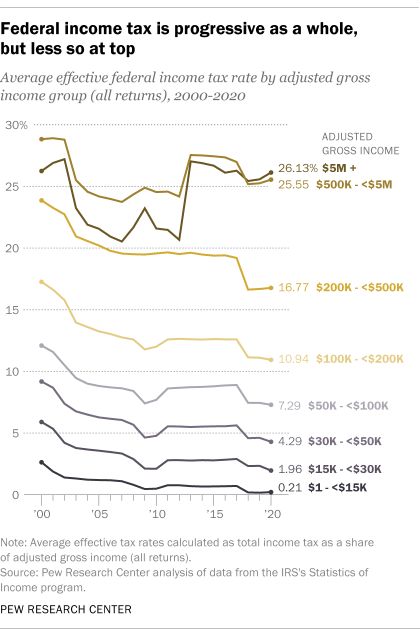

Who does and doesn't pay federal income tax in the U.S.

Negative income tax - Wikipedia

How to Calculate ROI to Justify a Project

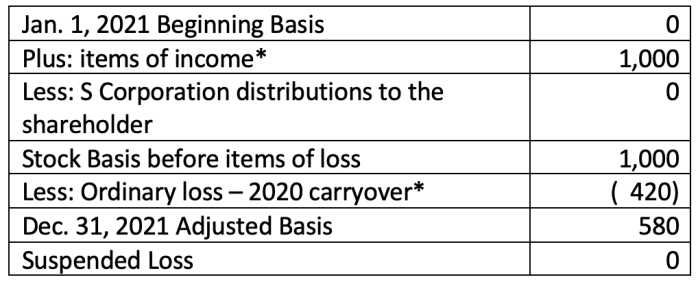

Basics of shareholder basis in an S Corporation - Tax Pro Center

Introduction to Total Return Swaps

15 Negative Reciprocity Examples (2024)

Relief for small business tax accounting methods - Journal of

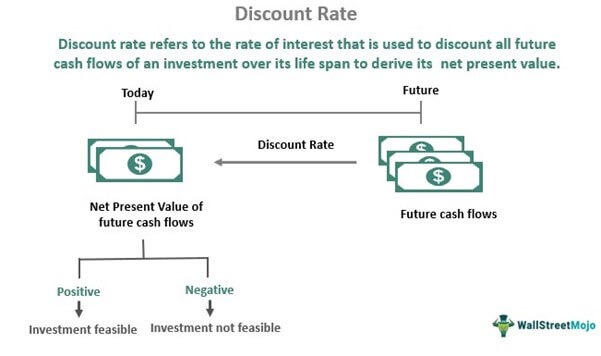

Discount Rate - Definition, Formula, Calculation, NPV Examples

Related products

You may also like