Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

THE Foundation #1 NIL for Ohio State

THE Foundation #1 NIL for Ohio State

How to Start a Nonprofit in Ohio

Free Cash Donation Receipt - PDF

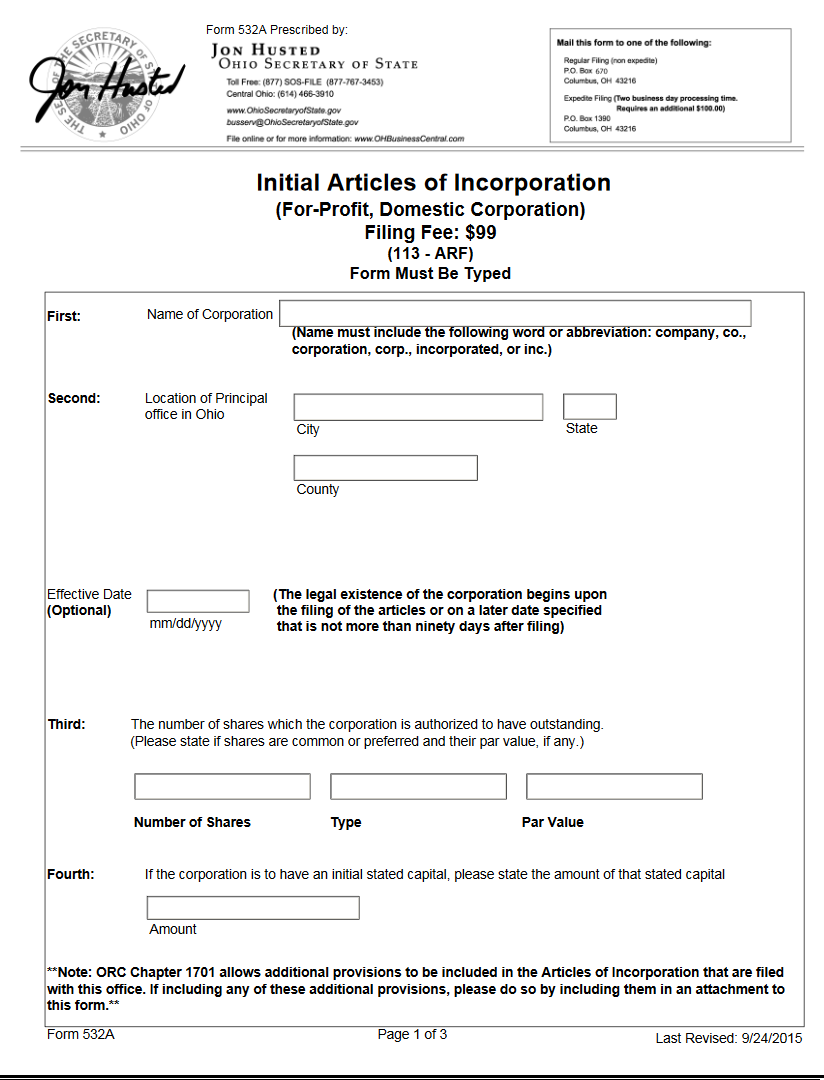

Free Ohio Articles of Incorporation For Profit Domestic Corporation

6 Differences Between For-Profit and Nonprofit Organizations

Federal implications of passthrough entity tax elections

Free Nonprofit Bylaws Free to Print, Save & Download

Income - General Information

Soft money group raises $1 million to advance Frank LaRose's Ohio U.S. Senate bid • Ohio Capital Journal

2024 State Income Tax Rates and Brackets

In Sheep's Clothing: United States' Poorly Regulated Nonprofit Hospitals Undermine Health Care Access

How to fill out a W-9 for a nonprofit corporation