Guide to Schedule R: Tax Credit for Elderly or Disabled - TurboTax

The Internal Revenue Service extends a special credit to older taxpayers called the Credit for the Elderly or the Disabled. This tax break allows individuals and couples to reduce the amount of their income tax by their allowable credit. While a taxpayer may qualify for a larger credit under this provision, the IRS limits the allowable credit to the amount of income tax due. If your credit exceeds your income tax, you will not be able to receive the excess credit as a refund.

IRS Schedule 3 walkthrough (Additional Credits & Payments)

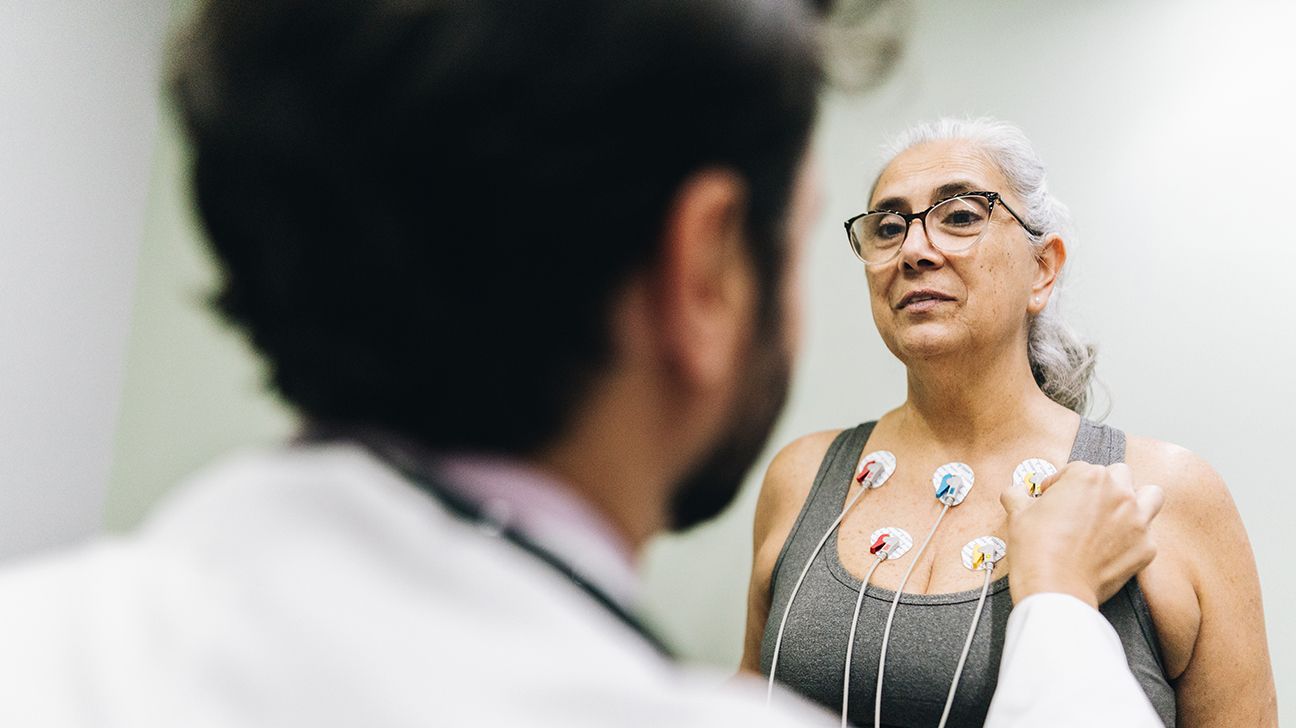

Free Tax Preparation & Help for Seniors: A Guide of Resources [2023]

Form 1040: U.S. Individual Tax Return

Schedule R (Form 1040 or or 1040-SR)

Schedule R Walkthrough (Credit for the Elderly or the Disabled

Do I Pay Taxes On A Personal Injury Settlement? Morris, 59% OFF

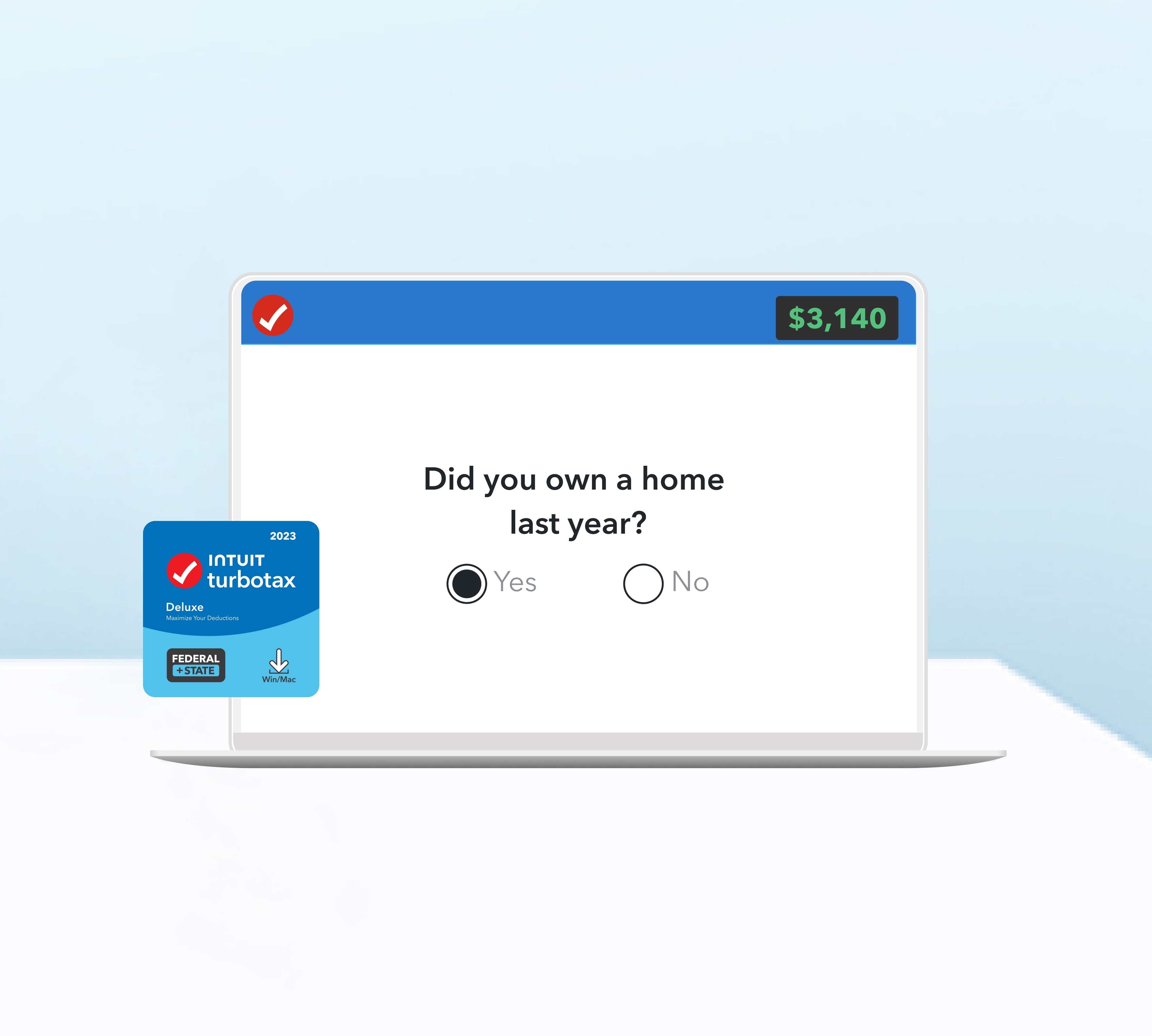

TurboTax® Deluxe Desktop 2023-2024

Credit for the Elderly or the Disabled - Schedule R (Form 1040) 2023 - Fill Online, Printable, Fillable, Blank

Top Tax Breaks for Disabled Veterans - TurboTax Tax Tips & Videos

Schedule R Walkthrough (Credit for the Elderly or the Disabled