Tie breaker Rule for an individual in International Taxation

5

(641)

Write Review

More

$ 6.00

In stock

Description

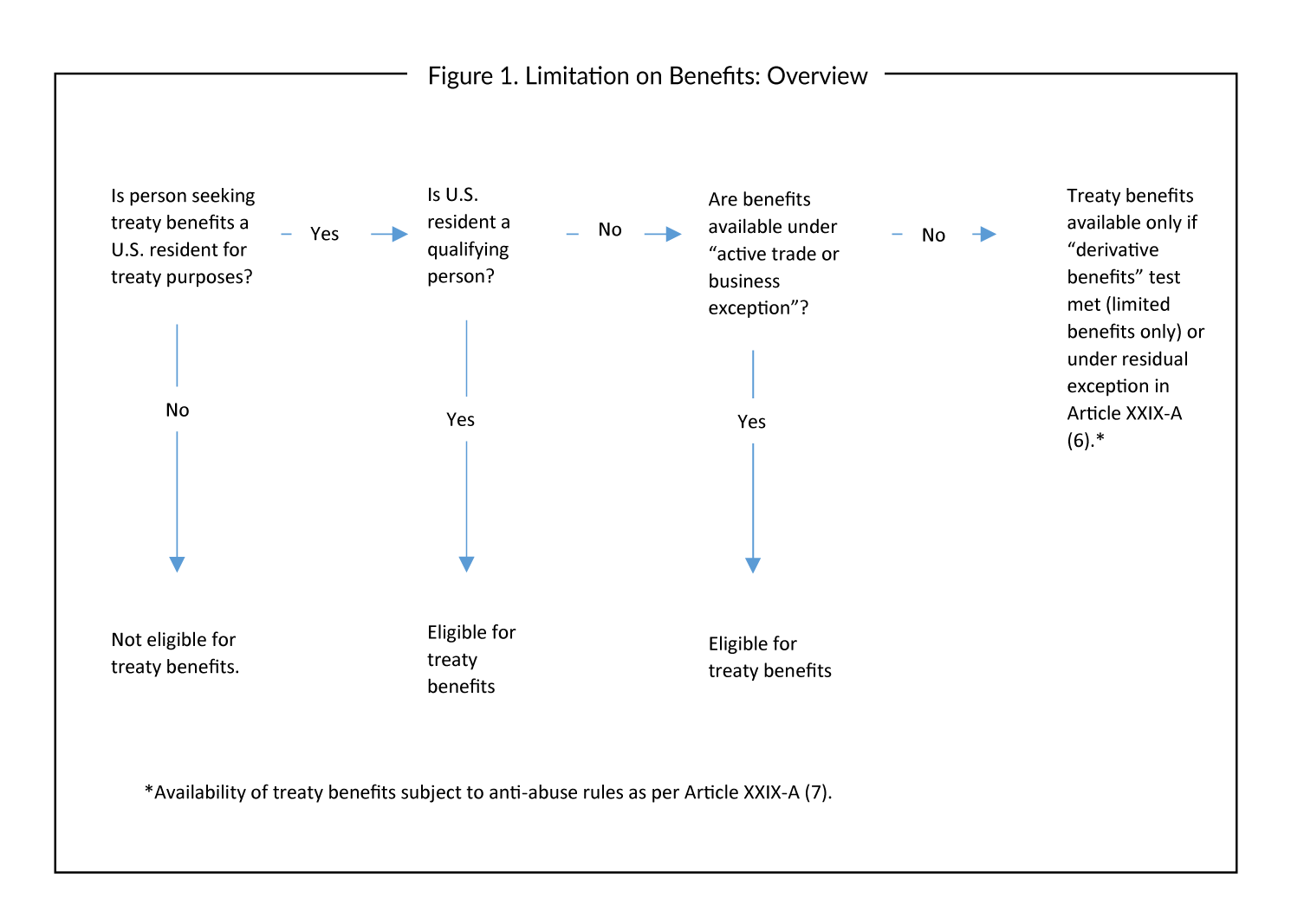

Article 4 deals with the provision, where an individual becomes a tax resident of the Country of Source as well as Country of Residence . I.

Americans Working in Canada and Taxes

International Taxation

VAT Applicability on UAE's Oil & Gas Sector

Tie breaker Rule for an individual under International Tax #dtaa #tiebreaker #residentialstatus

Tax Treaties Business Tax Canada

CA Arinjay Jain on LinkedIn: TDS on Sale of Property by NRI - CA

Residency Tie Breaker Rules & Relevance

India - The Dilemma Of Dual Residence – Can Vital Interests Fluctuate Overnight? - Conventus Law

Royalty and Fees for Technical Services - Article 12

Key Points on TCS on Foreign Remittances

Related products

You may also like