:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

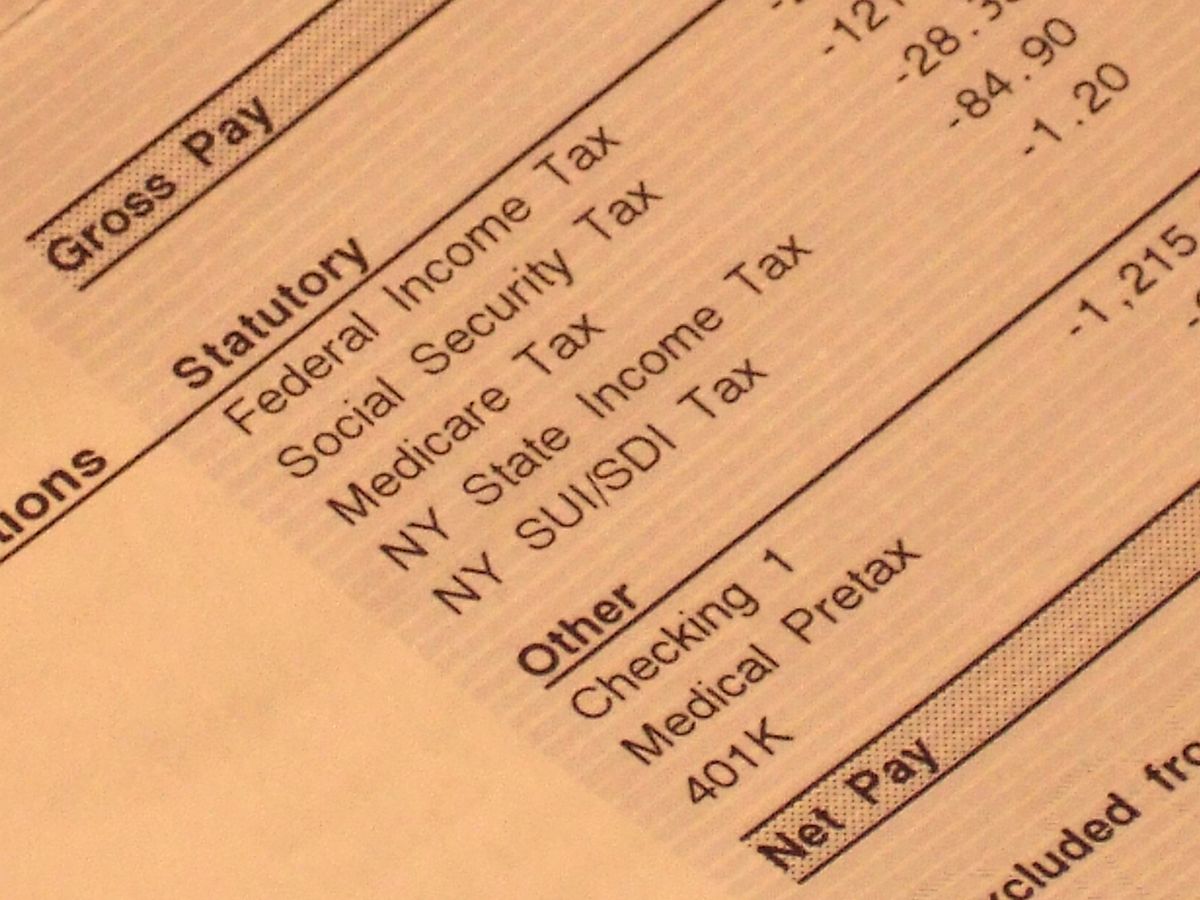

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

100e7 FM - A Rádio do Seu Coração, caiobá fm 100.7

UAE Corporate Tax Registration Exemptions – Tax, 46% OFF

Requesting FICA Tax Refunds For W2 Employees With Multiple

What Eliminating FICA Tax Means for Your Retirement, fica tax

What Is Social Security Tax? Definition, Exemptions, and Example

What Is Social Security Tax? Definition, Exemptions, and Example

FICA Tax Refund Timeline - About 6 Months with Employer Letter and

:max_bytes(150000):strip_icc()/mail-4b3c29eeac4d46118893c2bc1577459a.jpg)

FICA Tax Refund Timeline - About 6 Months with Employer Letter and

Overview of FICA Tax- Medicare & Social Security, fica tax

What Is Social Security Tax? Definition, Exemptions, and Example