Should You Refinance To A 15-Year Mortgage?

Refinancing from a 30-year mortgage to a 15-year loan can help you pay down your mortgage faster and save money on interest.

You can cut your total mortgage interest in half, but there’s one big catch.

Refinance into a 15-year mortgage and save, Resale News

Top Residential Realty Today Mortgages Loan contingency Content

Brian Colvert, CFP® on LinkedIn: Make Smarter Personal Finance

:max_bytes(150000):strip_icc()/dotdash-111214-buying-home-cash-vs-mortgage-v2-325bbfe3ca7343ca904ecaa9d2cb6c67.jpg)

Buying a House With Cash vs. Getting a Mortgage

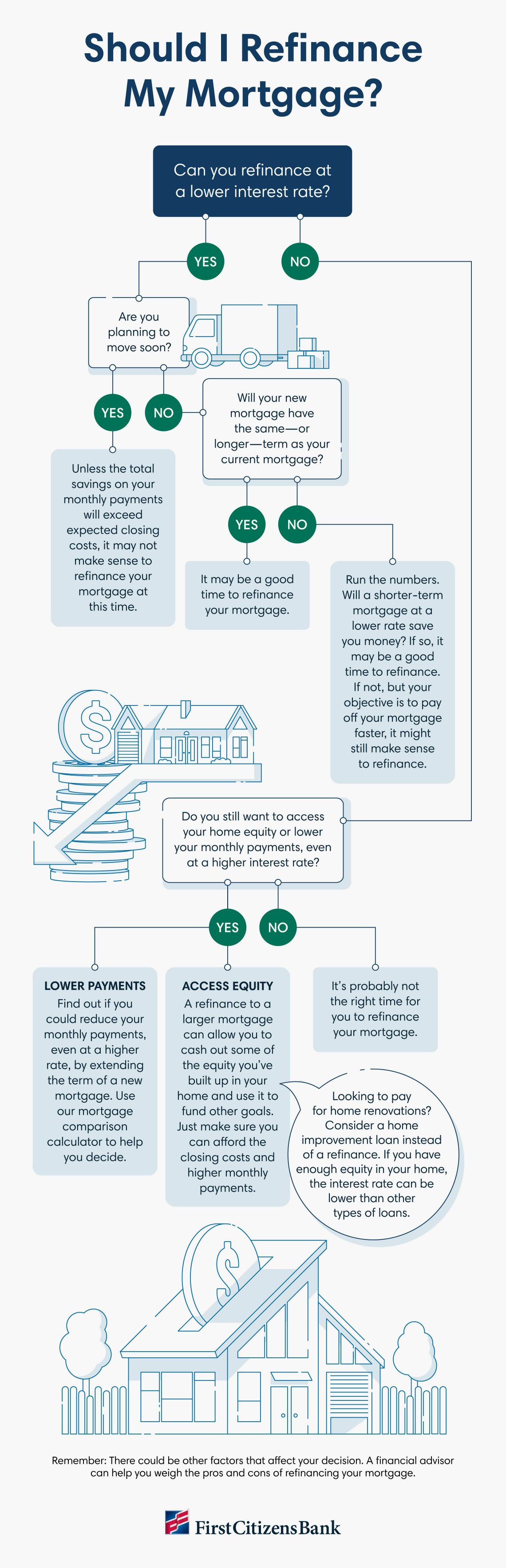

Pros And Cons Of Refinancing

Mortgage Refinance Guide

Top Residential Realty Today Mortgages Loan contingency Content

Today's 30-Year Refinance Rates – Forbes Advisor

Victor Brinkmeier, Loan Officer, NMLS # 328821

Articles on Home and Family Finances - Learning Hub

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash-Out Refinance vs. Home Equity Loan: What's the Difference?

Should You Refinance to a 15 Year Mortgage?

Brian Colvert, CFP® on LinkedIn: Where do you want to go in 2019?

Bonfire Financial Has Been Featured In

15 Year vs 30 Year Mortgage Calculator: Calculate Current 15yr FRM or 30yr Monthly Fixed Rate Mortgage Refinance Payments

:max_bytes(150000):strip_icc()/Simply-Recipes-Marcella-Hazen-LEAD-01-4-b0d19d55e46f41c89c625139149aafb6.jpg)