Tax Credits for Individuals and Families

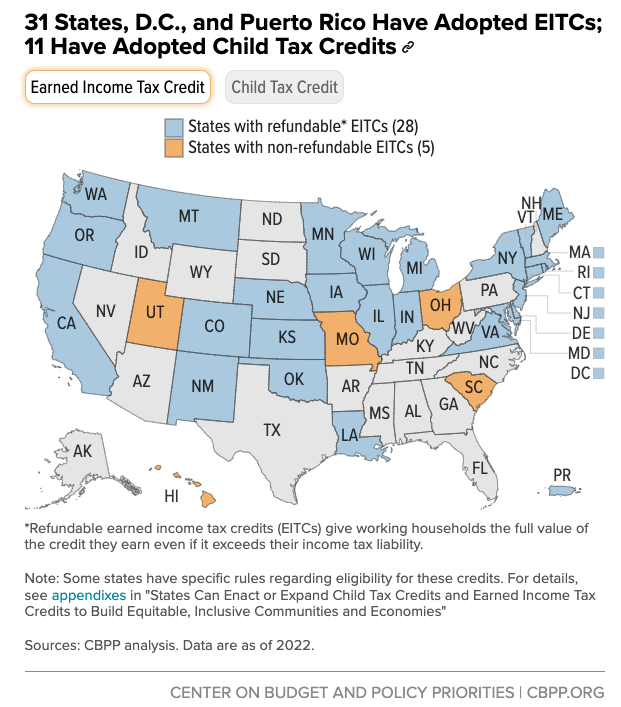

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

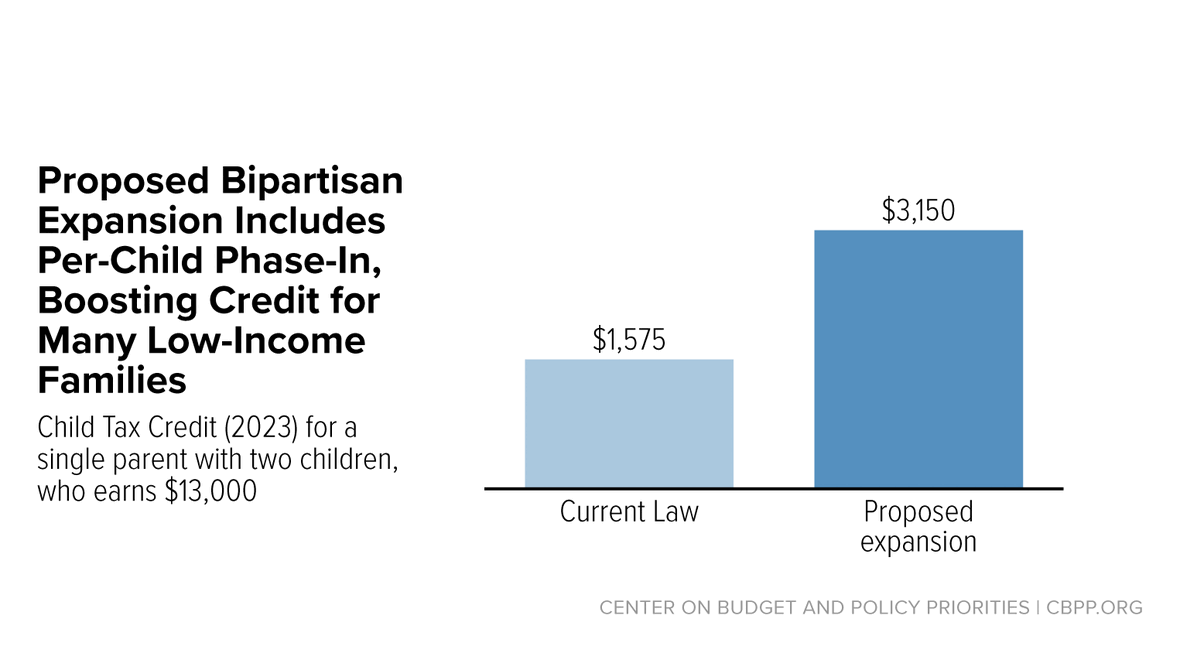

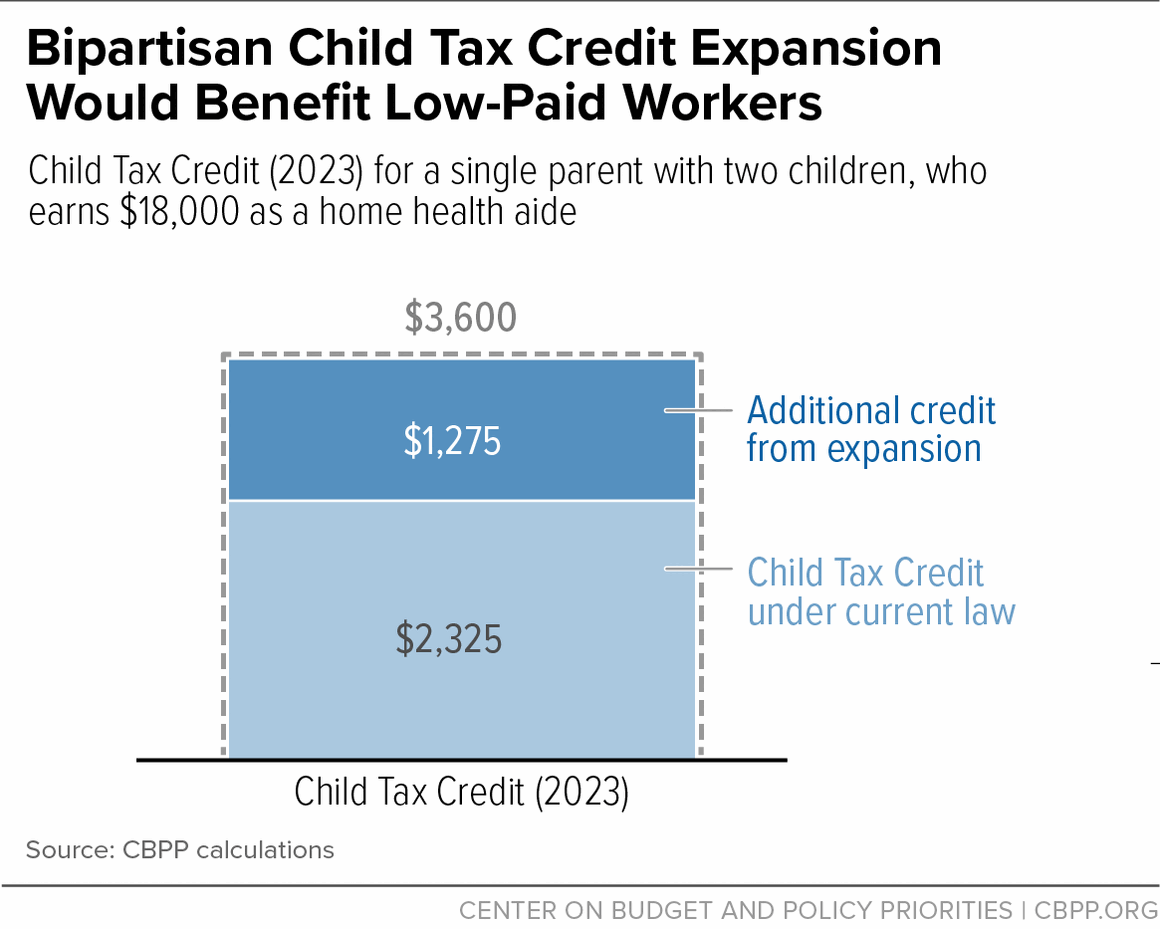

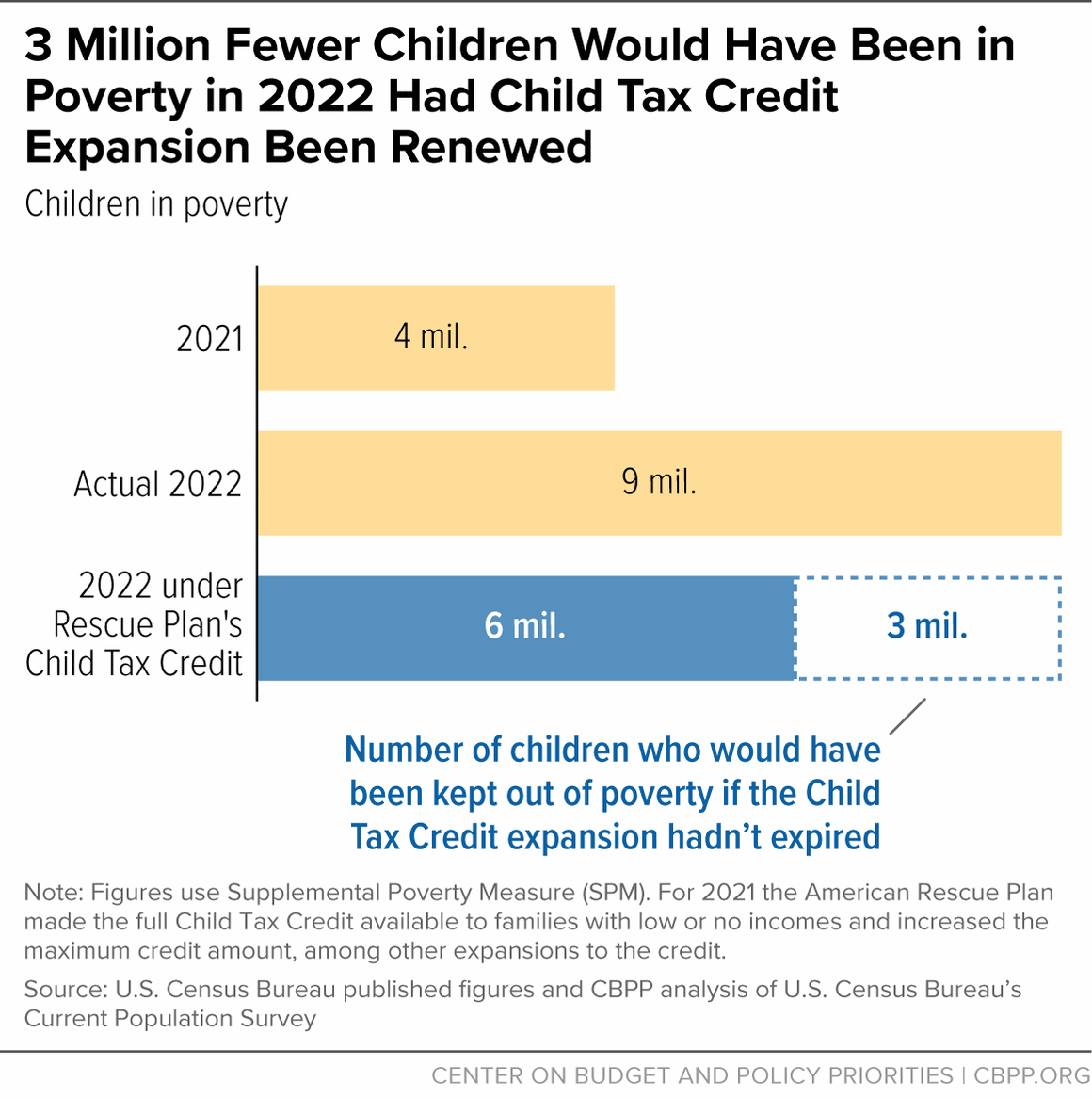

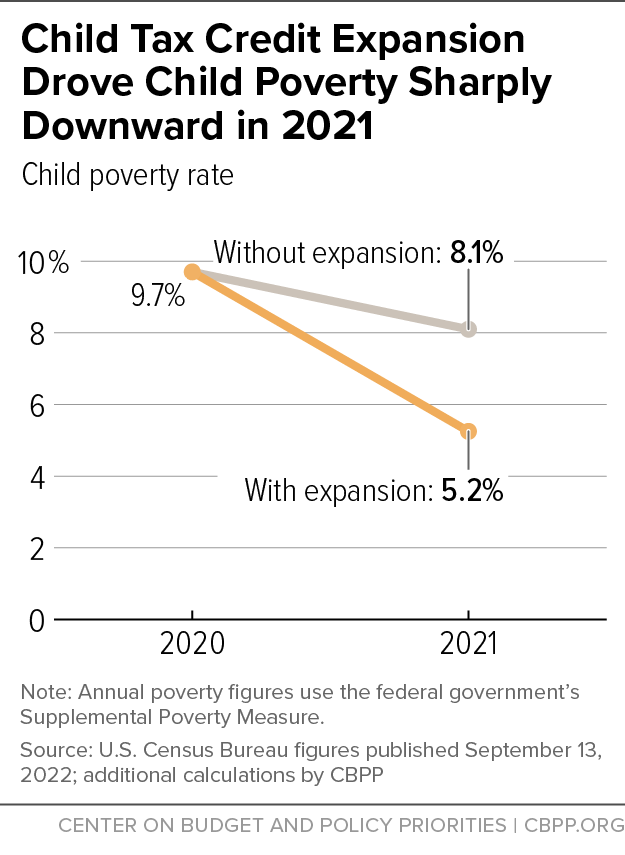

Bipartisan Child Tax Credit Expansion Would Benefit Millions of

How to Build on the Affordable Care Act

State Specific Information

Federal Tax Credit - FasterCapital

How Do You Make the Most Tax Benefits by Investing in Insurance

State Fact Sheets: The Earned Income and Child Tax Credits

Benefits of Expanding Child Tax Credit Outweigh Small Employment

Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

Year-End Tax Policy Priority: Expand the Child Tax Credit for the

Chart Book: The Earned Income Tax Credit and Child Tax Credit

The speech from the throne

Republican Tax Credit Proposal Would Provide New Breaks to Tax

Family Health Insurance: Buy Affordable Mediclaim for Family

Best Income Tax Saving Investment Options in India

Policy Basics: The Child Tax Credit