Labour Mobility Tax Deduction for Tradespeople • Canada's Building

5

(782)

Write Review

More

$ 17.50

In stock

Description

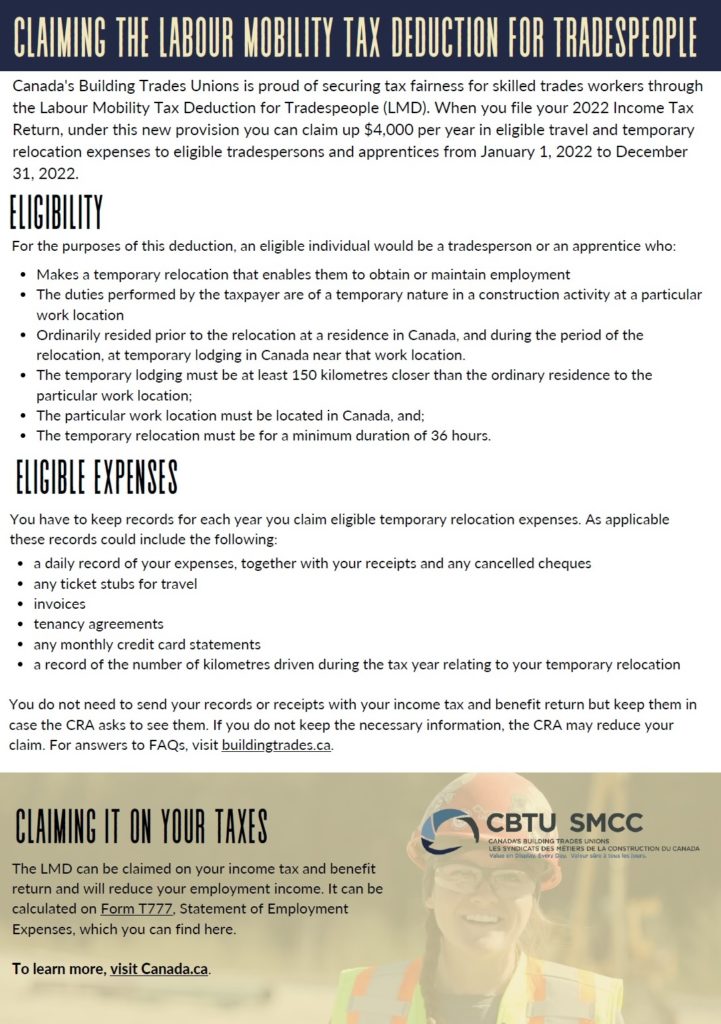

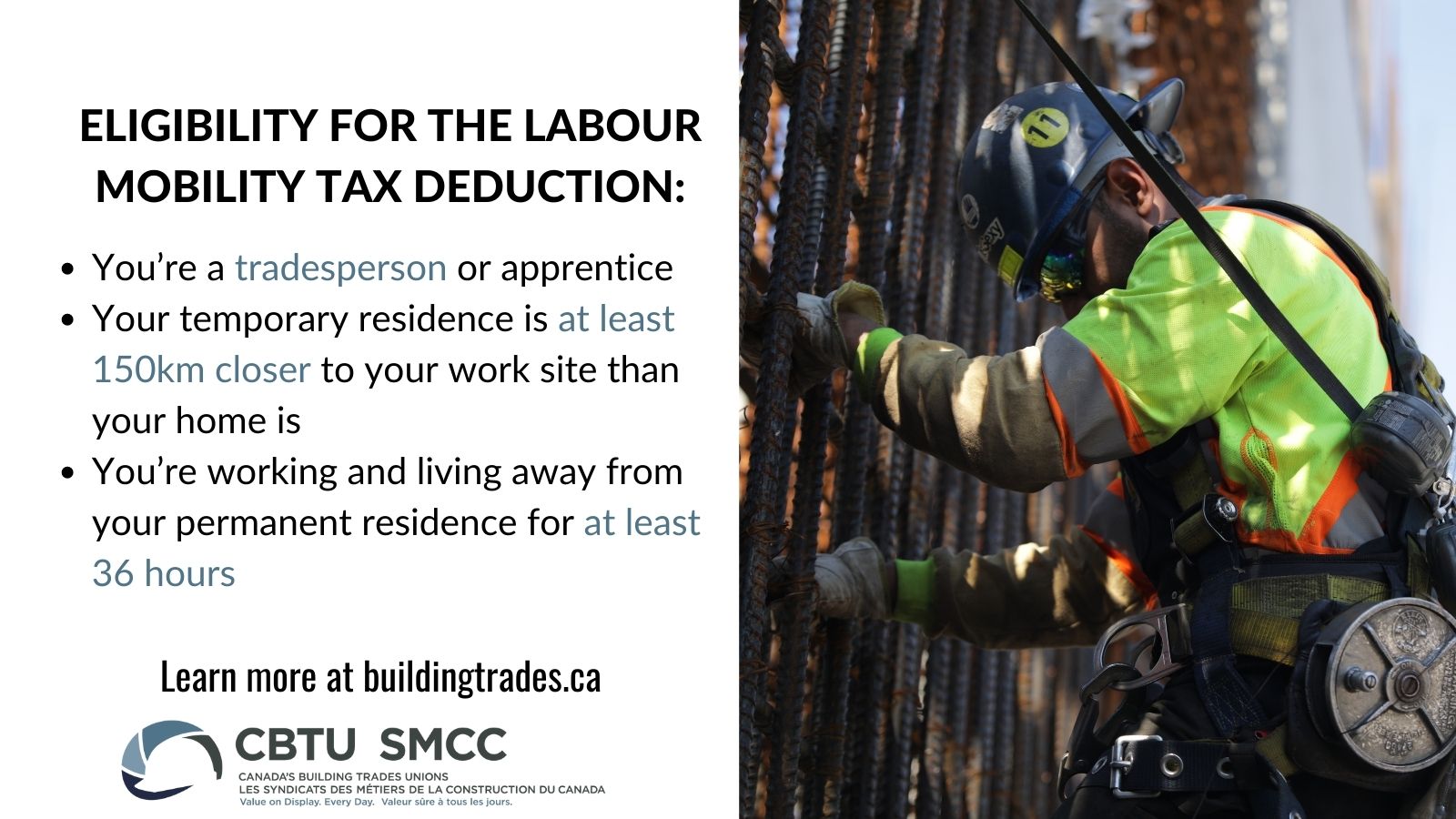

After over two decades of advocacy, tax fairness is now a reality for tradespeople across Canada.

Canada Adds 21,000 Jobs in September, Unemployment Rate Falls

Tax Changes For 2023 (2022 Tax Year)

Mobility tax deduction for tradespersons and indentured apprentices

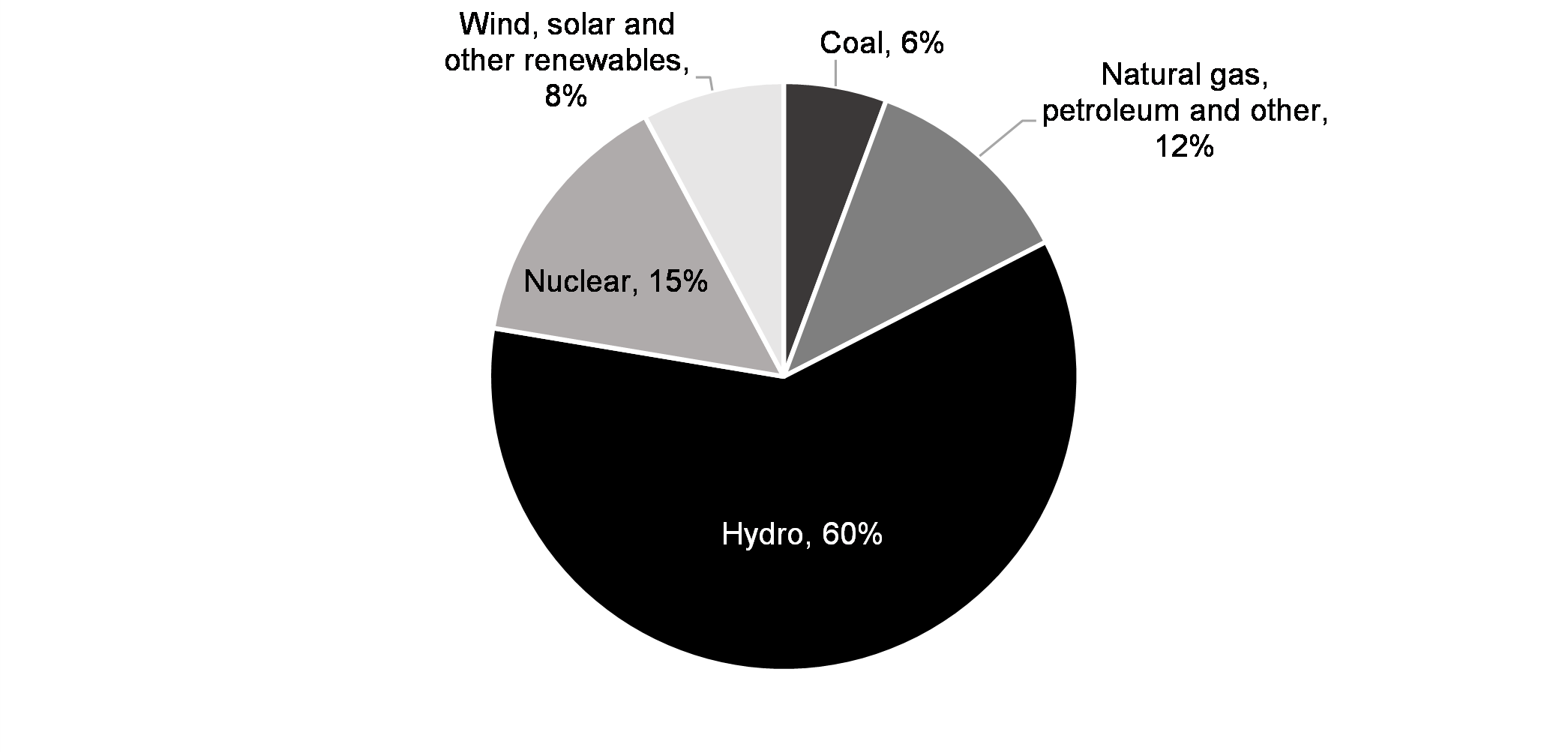

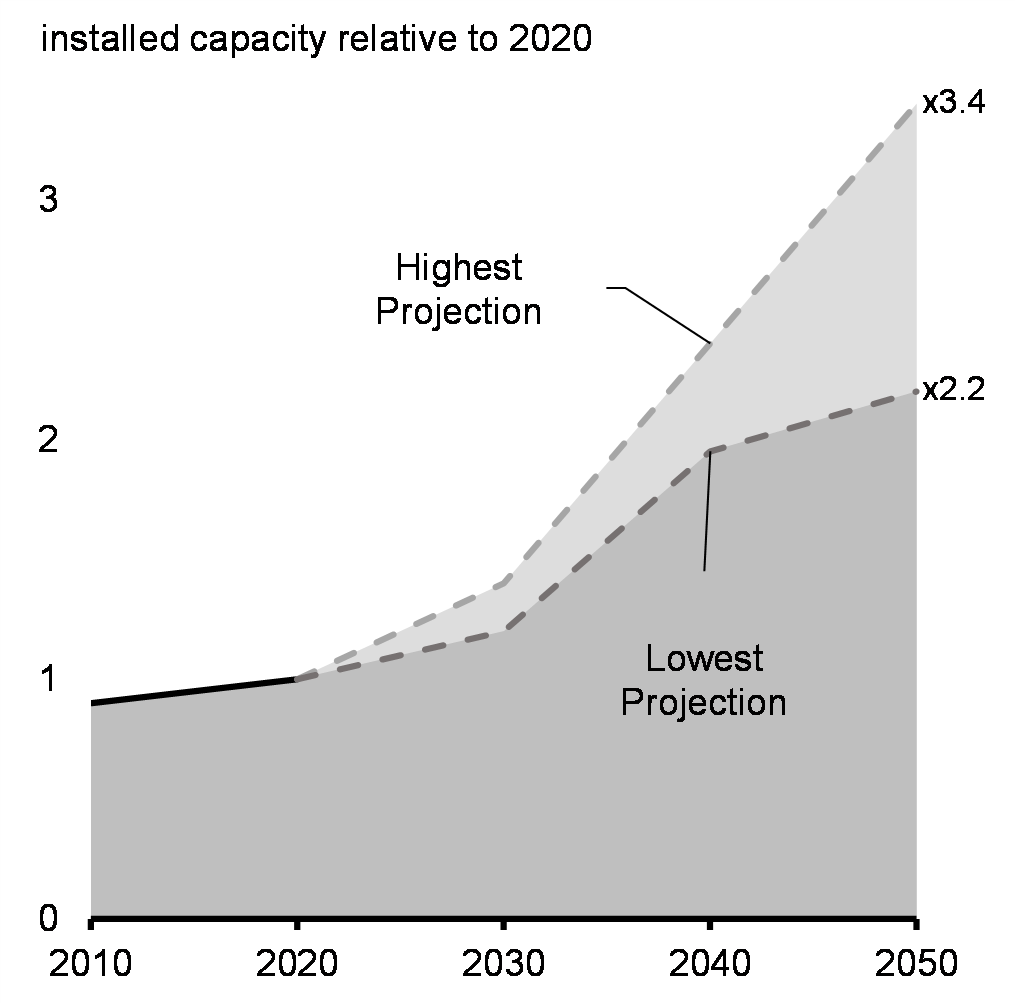

Chapter 3: A Made-In-Canada Plan: Affordable Energy, Good Jobs

2022 Canadian Federal Budget: Personal Tax

This election, skilled trades construction workers need mobility

2022 Federal Budget Review - BMO Private Wealth

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

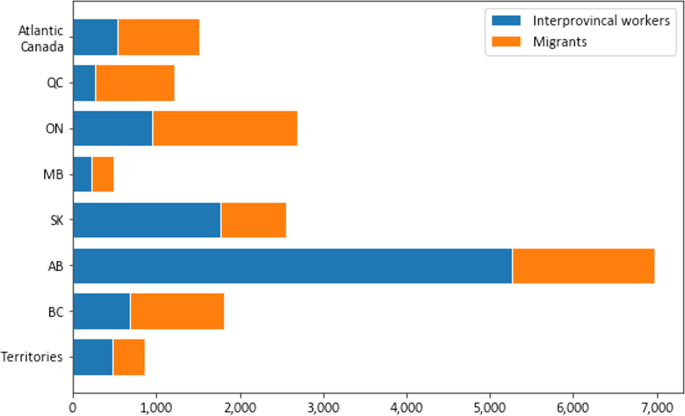

The Mobility of Construction Workers in Canada: Insights from

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

Chapter 3: A Made-In-Canada Plan: Affordable Energy, Good Jobs

You may also like