Credit Suisse: Too big to manage, too big to resolve, or simply too big?

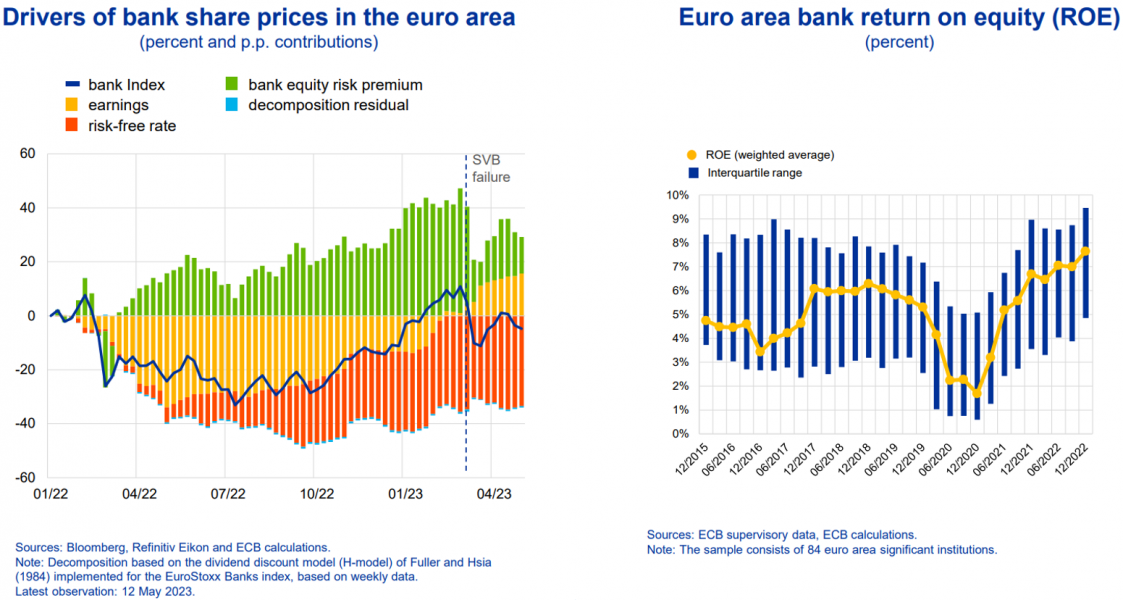

The runs on Silicon Valley Bank and Credit Suisse in March 2023 revived attention on banking regulation, resolution, and government intervention. This column analyses the details of the run on Credit Suisse and its eventual takeover by UBS. It highlights multiple discrepancies between official statements and implemented measures, both by Credit Suisse and Swiss authorities. Furthermore, it argues that the reforms adopted after the 2007-2009 crisis are still insufficient for resolving systemic institutions. Going forward, authorities must be able to act promptly and implement correction actions before risks of failure become too severe.

UBS Cuts Out Credit Suisse - Bloomberg

Too Small to Not Fail - by Danielle DiMartino Booth

Global lessons from the demise of Credit Suisse

Small Managers - BIG ALPHA Episode 14

Credit Suisse Could Be Too Big to Bail Out, Nouriel Roubini Says - Bloomberg

Real-Estate / Podcast

Karthik Balisagar on LinkedIn: After spending almost a decade to solve the problem of 'too big to fail'…

Credit Suisse: The Failure of Too Big to Fail

Federal Officials Testify at House Hearing on Silicon Valley Bank Collapse

SUERF - The European Money and Finance Forum

4 strategies for managing volatilitySignet Financial Management

Too Big to Fail: Definition, History, and Reforms

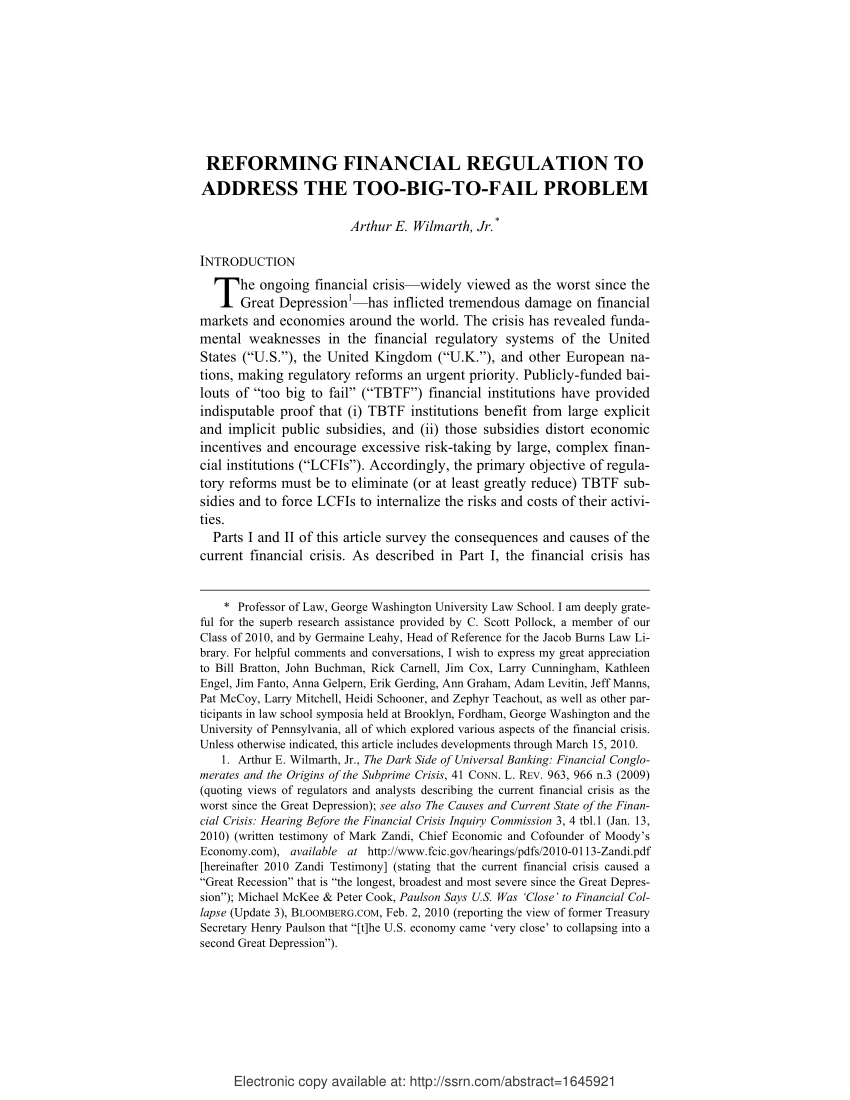

PDF) Reforming Financial Regulation to Address the Too-Big-To-Fail Problem