Understanding gifts in consideration of marriage or civil

Whether you are gifting cash or possessions, there are some limited inheritance tax reliefs available, that you may want to consider.

Intention - A Third Way to Transform Gifts and Inheritances into Matrimonial Assets - The Singapore Law Gazette

Marriage in modern China - Wikipedia

2024 Wedding Planning Checklist + Printable Timeline & To-Do List

Transferring Home Ownership - Gibson & Associates LLP

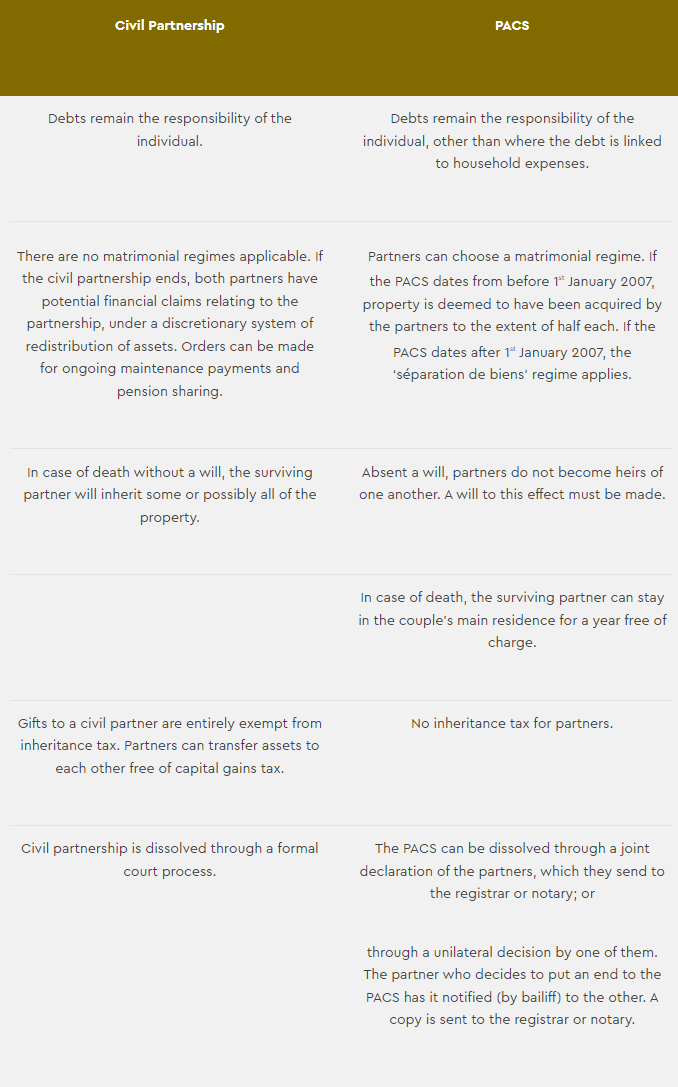

The unintended consequences of the French PACS - mind the trap - Lexology

Potentially Exempt Transfers: Everything you need to know about gifts - Balance: Wealth Planning

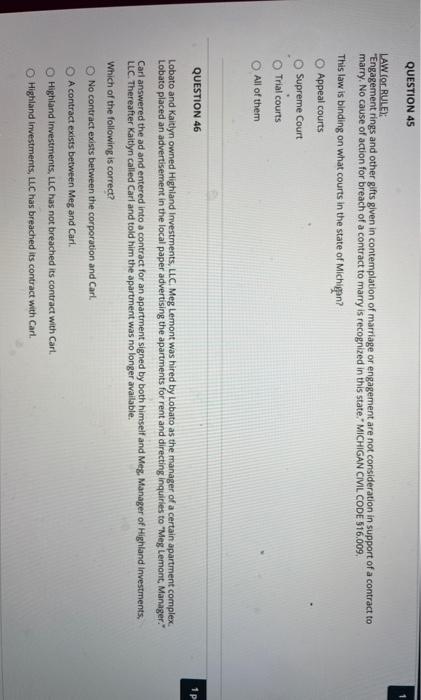

Solved QUESTION 45 LAW (or RULE; Engagement rings and other

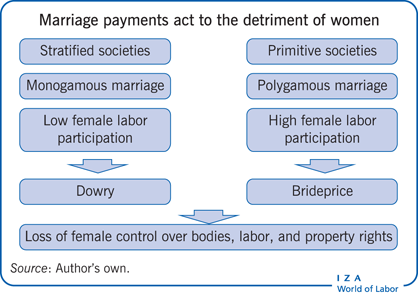

IZA World of Labor - Human capital effects of marriage payments

The Limits on Conditional Gifts in Wills - Mann Lawyers

Energy efficiency is a win-win - Winckworth Sherwood LLP

A criitical analysis of Gifts under the transfer of property act.

Property Law, Marriage, and Divorce in Texas