:max_bytes(150000):strip_icc()/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-01-7b5b43d1e34d44229a3bd4c02816716c.jpg)

Optimize Your Portfolio Using Normal Distribution

Normal or bell curve distribution can be used in portfolio theory to help portfolio managers maximize return and minimize risk.

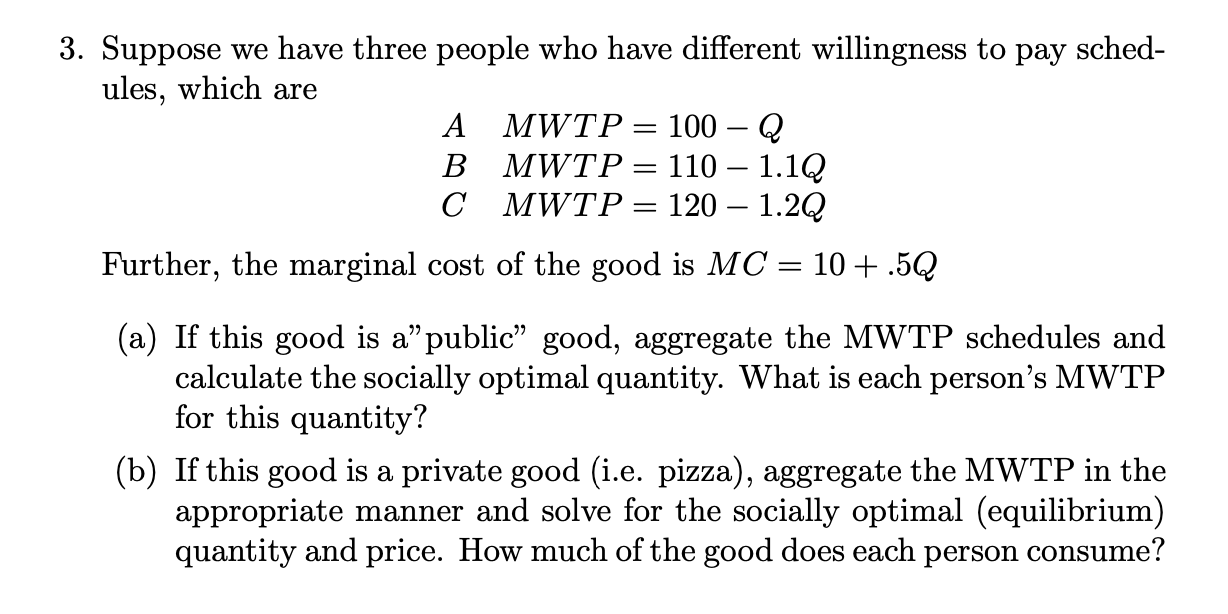

Order 4210100 at 300, PDF, Marketing

3 Distribution of Willingness to Pay for Double Bounded Form of, dom dom yes yes letra

3 Distribution of Willingness to Pay for Double Bounded Form of, dom dom yes yes letra

:max_bytes(150000):strip_icc()/business_building_153697270-5bfc2b9846e0fb0083c07d69.jpg)

Optimize Your Portfolio Using Normal Distribution

:max_bytes(150000):strip_icc()/skewness-Final-e6e1970b817443f897a4a65d2c5b92d1.jpg)

Optimize Your Portfolio Using Normal Distribution

Market Update September 8, 2020

:max_bytes(150000):strip_icc()/41296774515_b8eae2a7d3_h-d550696f040443cbaf0b0d8af0ff1f85.jpg)

Asymmetrical Distribution: Definition and Examples in Statistics

Article 1 Optimize Your Portfolio Using Normal Distribution References, PDF, Normal Distribution

CLA2-Preshit-Dwivedi.docx - Running head: Portfolio of Apple JP Morgan and McDonald's 1 Preshit Dwivedi Westcliff University BUS 550: Financial

Excel Exam 01, PDF, Median

:max_bytes(150000):strip_icc()/bitcoin_mining_shutterstock_772693789-5bfc321e46e0fb00511ae12c.jpg)

Shobhit Seth

Internal Sources of Information, PDF, Statistics

:max_bytes(150000):strip_icc()/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-04-a92fef9458844ea0889ea7db57bc0adb.jpg)

Optimize Your Portfolio Using Normal Distribution

Floating Rate vs. Fixed Rate: What's the Difference?

Normal Distribution - What It Is, Properties, Uses, and Formula, PDF, Normal Distribution