What Is Form 8586: Low-Income Housing Credit - TurboTax Tax Tips

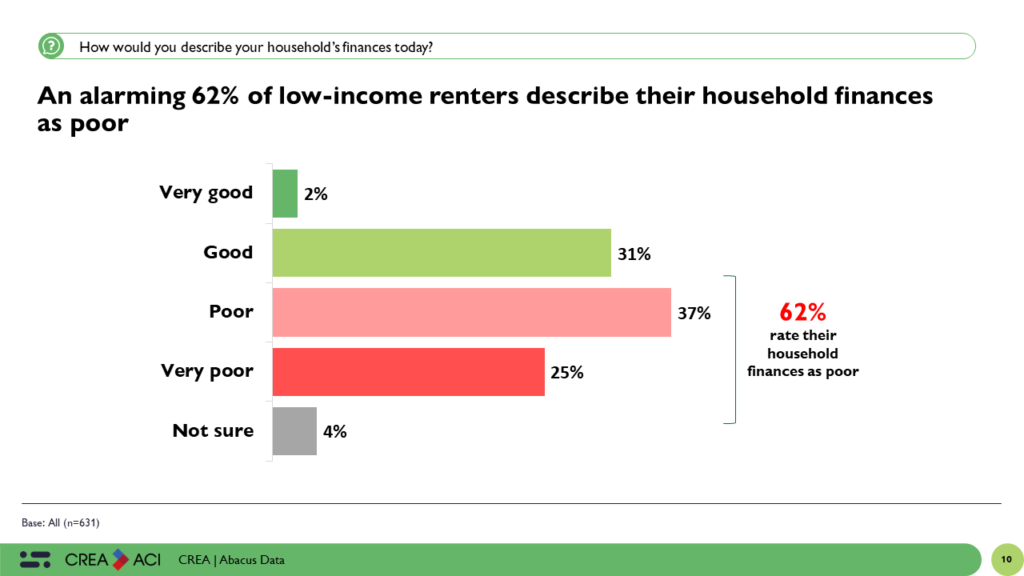

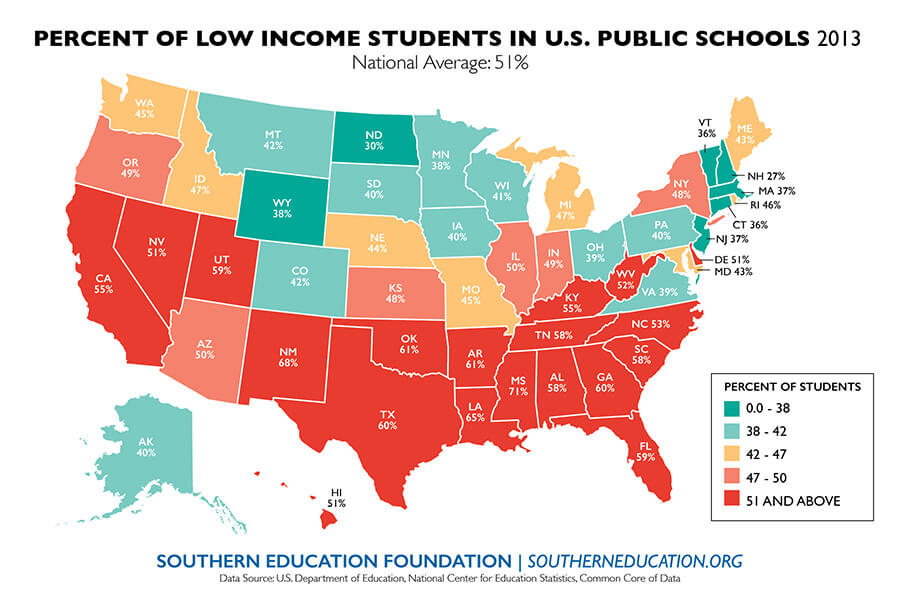

General business tax credits provide incentives for business activities beneficial to the American public or the economy in general. Owners of rental buildings in low-income housing projects may qualify for the low-income housing credit, which is part of the general business tax credit, using Form 8586 to calculate the amount of the credit.

Your Federal Income Tax For Individuals, IRS Publication 17, 40% OFF

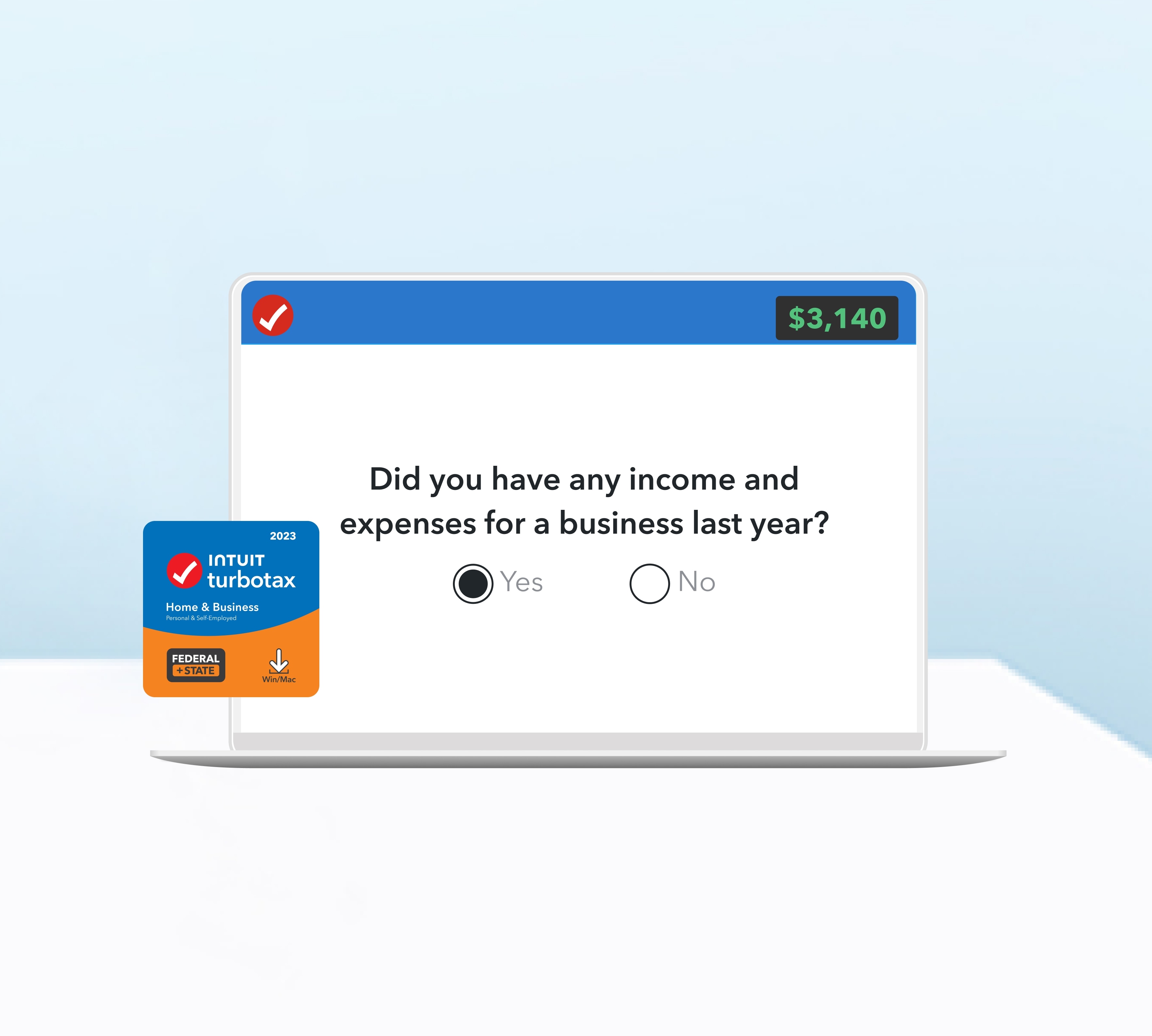

TurboTax® Home & Business Desktop 2023-2024

Apple With Medical Pulse Logo Health Apple Creative Logo, 40% OFF

TurboTax® Home & Business Desktop 2023-2024

Low-Income Housing Tax Credit (LIHTC)

3725 N Sherman Dr, Indianapolis, IN 46218 Trulia, 43% OFF

IRS Form 8586 Walkthrough (Low-Income Housing Credit)

Insulation Tax Credit: What You Need To Know in 2024

Banker & Tradesman June 11, 2018 by The Warren Group - Issuu

Rules For Claiming A Dependent On Your Tax Return TurboTax, 53% OFF

Housing Benefit Self Employed Factory Wholesale

Your Federal Income Tax For Individuals, IRS Publication 17, 40% OFF