:max_bytes(150000):strip_icc()/Option-fe0c0ee9204c4a50a281e728fb4c7cab-c571c7af929e4b8587c5a28ad9905f53.jpg)

What are Options? Types, Spreads, Example, and Risk Metrics

Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

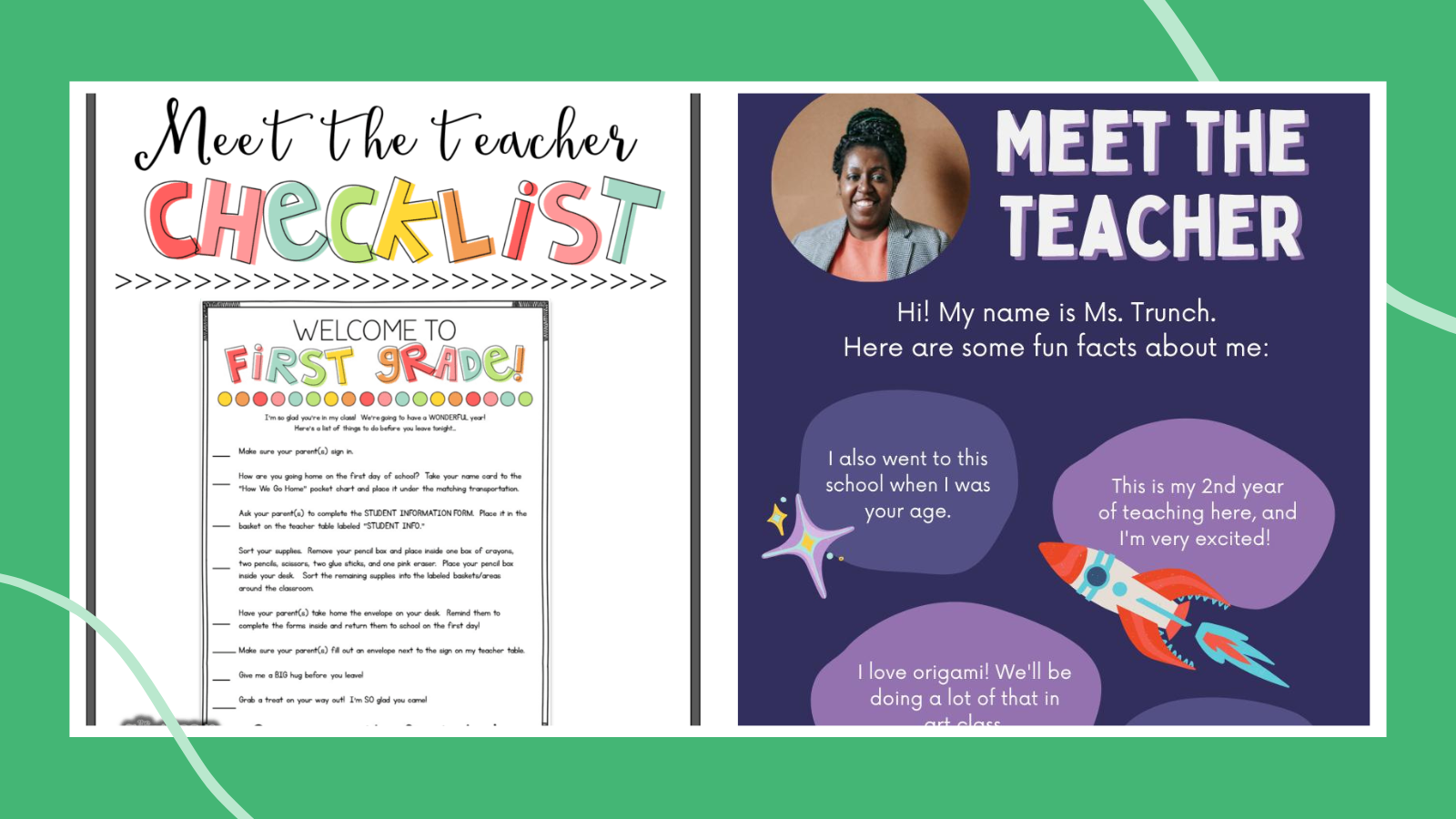

It's all about the Color! Our Cover options explained. - There's a, Color Palette Book

:max_bytes(150000):strip_icc()/bullcall-spread-4200210-1-blue-759c3882be664370823655c8d7ac9bb5.jpg)

Credit Spread vs. Debit Spread: What's the Difference?

Theta (THETA) Overview - Charts, Markets, News, Discussion and, rbx gum stock off

:max_bytes(150000):strip_icc()/Theta-a603b898c11243c0bde5da34f74fa83f.jpg)

Expiration Date Basics for Options (Derivatives)

:max_bytes(150000):strip_icc()/Cover-call-ADD-SOURCE-0926fedb5c054b2796cb5f345c173cc7.jpg)

How to Profit With Options

What are options contracts?. Options contracts are best described as…, by A Student

Understanding options - Wiki - Mustachian Post Community

What are Options? Types, Spreads, Example, and Risk Metrics

Liquidity Provider Strategies for Uniswap v3: Options, by Atis E

Comparative Analysis of Root Finding Algorithms for Implied Volatility Estimation of Ethereum Options

Is it better to use an ATM, ITM, or OTM stock option if you want to benefit more from the change in the stock market volatility? - Quora

What Are Options? Types, Spreads, Example, And Risk Metrics, 55% OFF

:max_bytes(150000):strip_icc()/call-option-4199998-ddd54a71fc9a479f9dda9e5b9943d9c4.jpg)

What Is a Call Option and How to Use It With Example

:max_bytes(150000):strip_icc()/Term-Definitions_IV-3e90aaab2e7a42b4a50211aaa927c078.jpg)

How Implied Volatility (IV) Works With Options and Examples

:max_bytes(150000):strip_icc()/Straddle-7993da3c0f9c4cc6aa008c96e6895385.jpg)

What Is a Straddle Options Strategy and How to Create It