What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

Tax Audits and Notices

How Long Do You Really Have To Respond to an IRS Tax Due Notice? - The Wolf Group

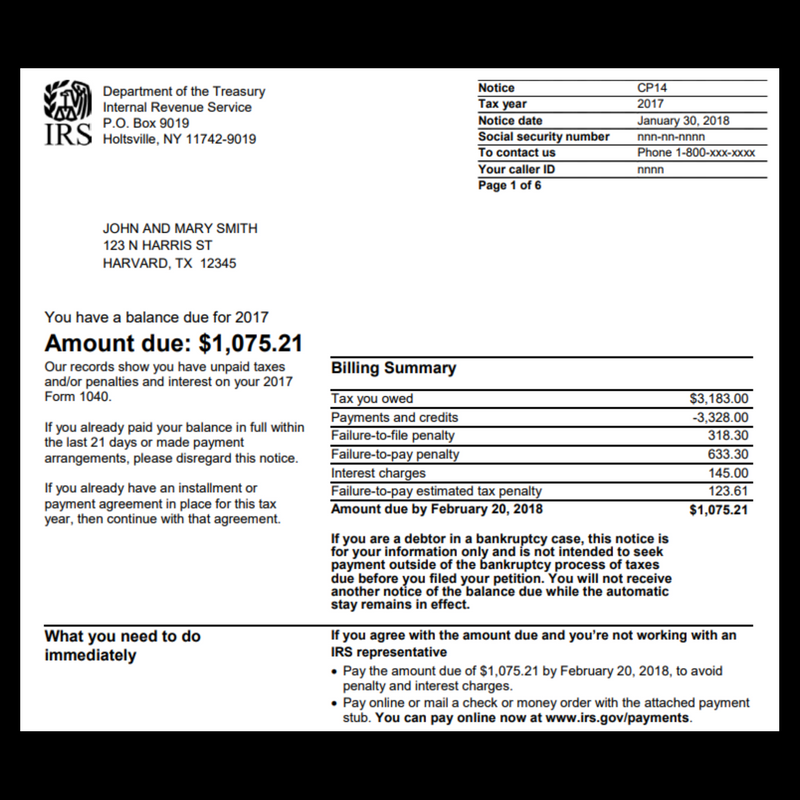

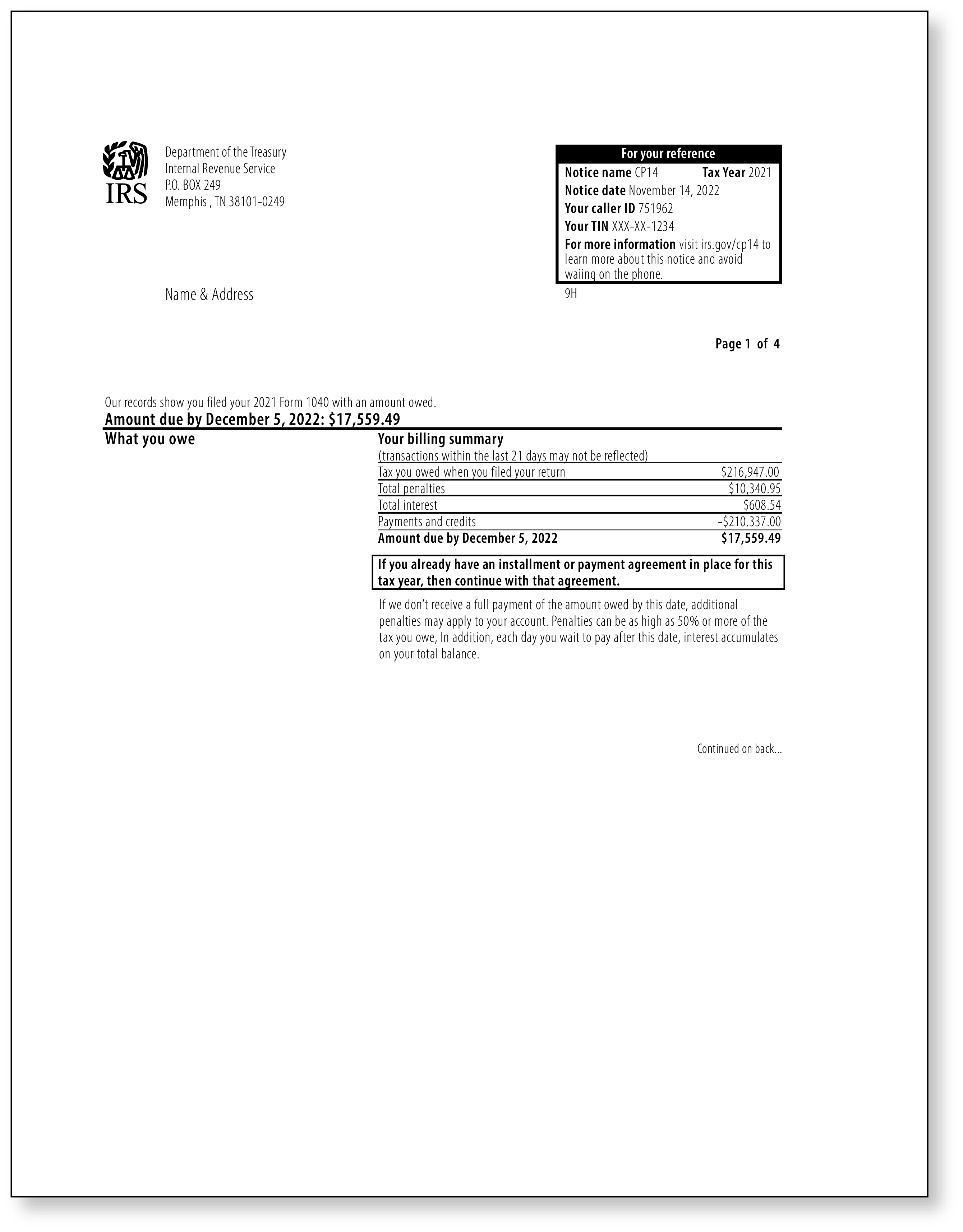

How to Handle IRS Notice CP14 - MoneySolver

IRS-Tax-Notices-Letters

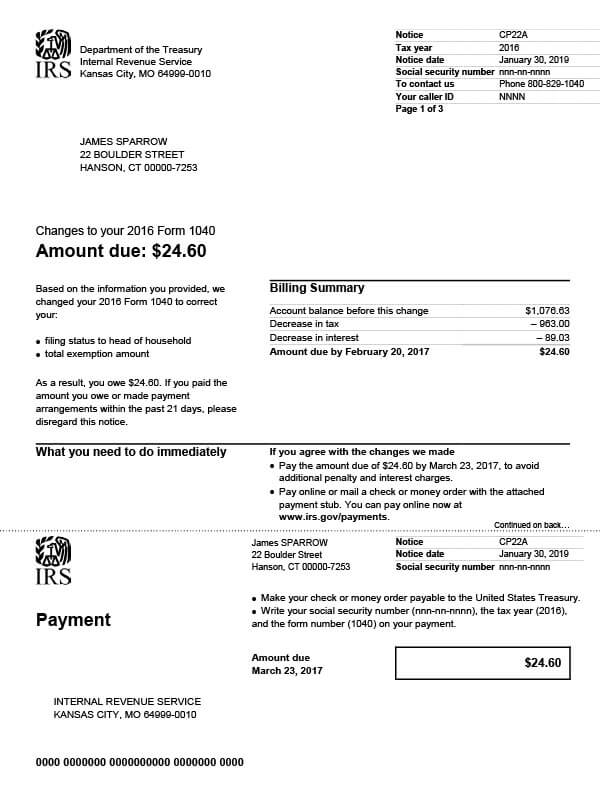

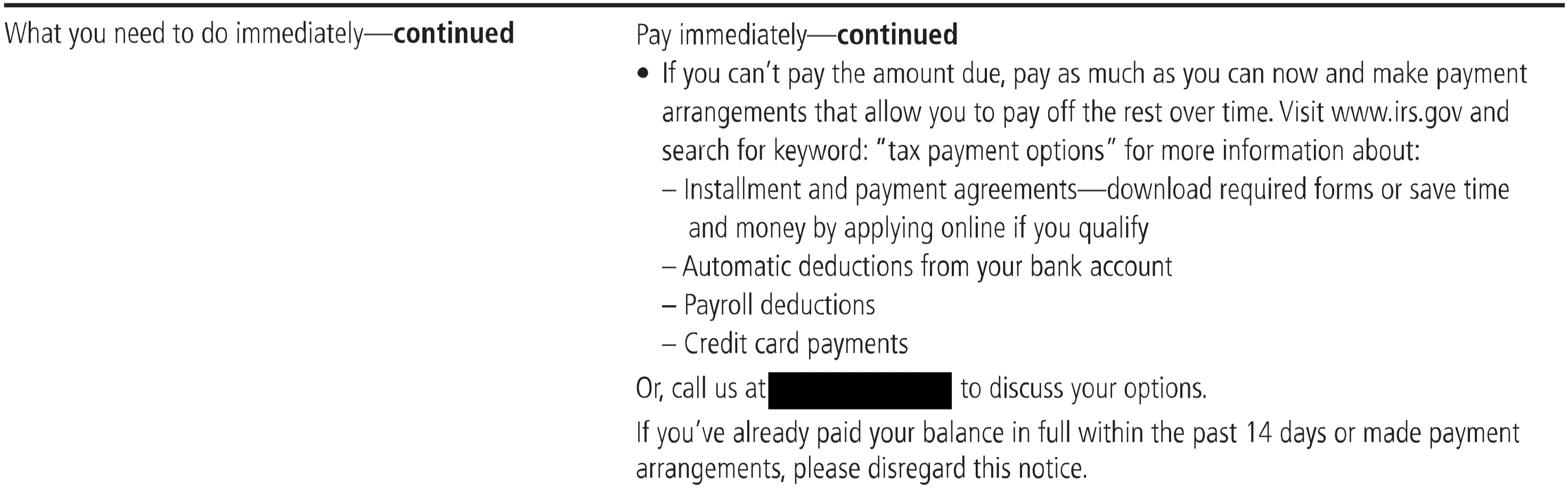

IRS Notice CP22A - Tax Defense Network

Instructions for Form 9465 (11/2023)

Got this today after filing in January : r/IRS

IRS Letter 3219: What To Do When the IRS Sends You a Notice of Deficiency - Choice Tax Relief

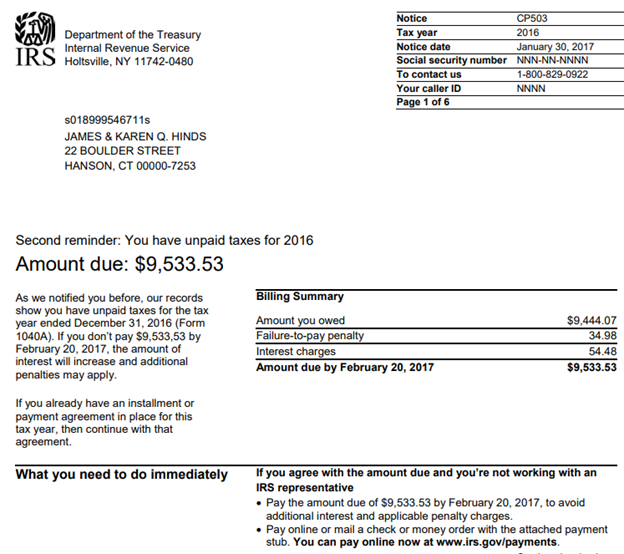

IRS Notice CP501: What It Is and How to Respond - Choice Tax Relief

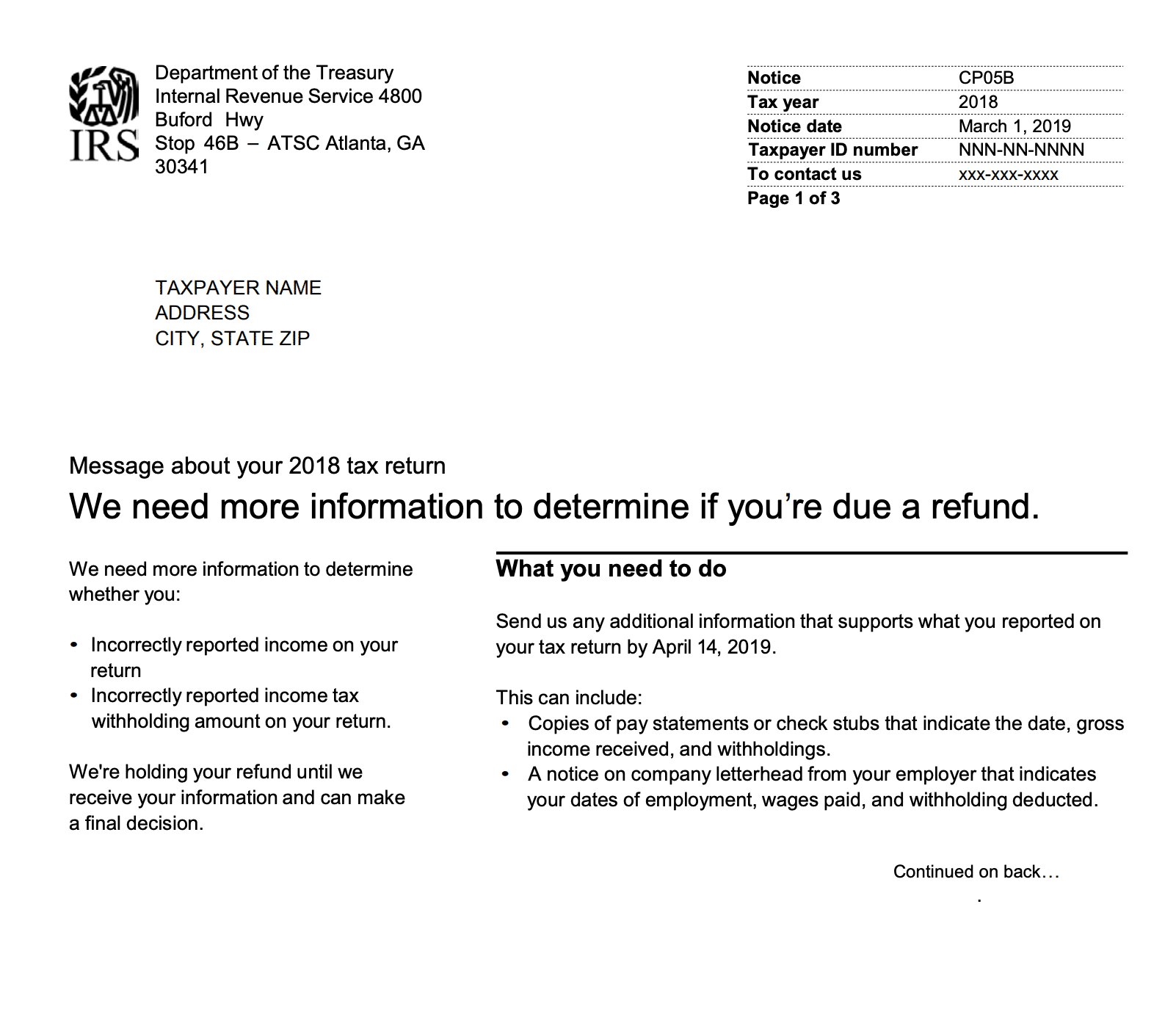

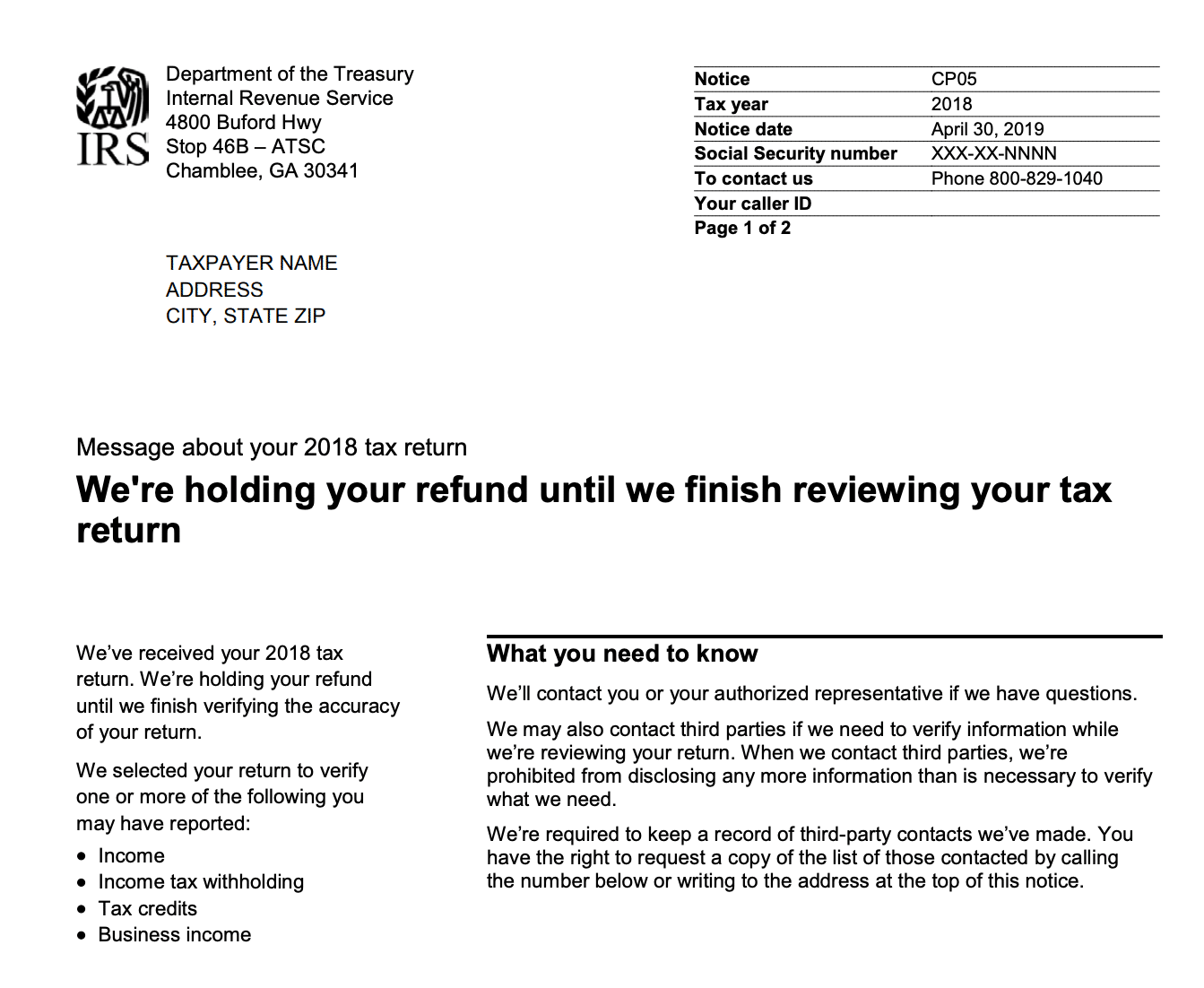

What Is a CP05 Letter from the IRS and What Should I Do?

What Is a CP05 Letter from the IRS and What Should I Do?

TaxAudit Blog, IRS CP14 Notice

How the IRS Taxpayer Advocate Service (TAS) Can Help You - Landmark

IRS Threatens Coloradans Who Already Paid Taxes: 'They're Frightened And They Don't Understand' - CBS Colorado

February 2023, Tax and IRS Scams