Why Lululemon's 2019 Profits Should Have Grown Nearly 30% Despite A Sharp Increase In Expenses

Lululemon Athletica Inc. (NASDAQ: LULU) has achieved robust growth over 2015-18, with the company’s revenue increasing a whopping 59%. But the apparel company’s expenses following a similar trend over this period – resulting in profits remaining broadly level.

Lululemon Athletica Inc. (NASDAQ: LULU) has achieved robust growth over 2015-18, with the company’s revenue increasing a whopping 59%. But the apparel company’s expenses following a similar trend over this period – resulting in profits remaining broadly level.

Lululemon Raises Outlook, Sidesteps Broader Retail Weakness - Bloomberg

3 Reasons Lululemon's Growth Is Accelerating

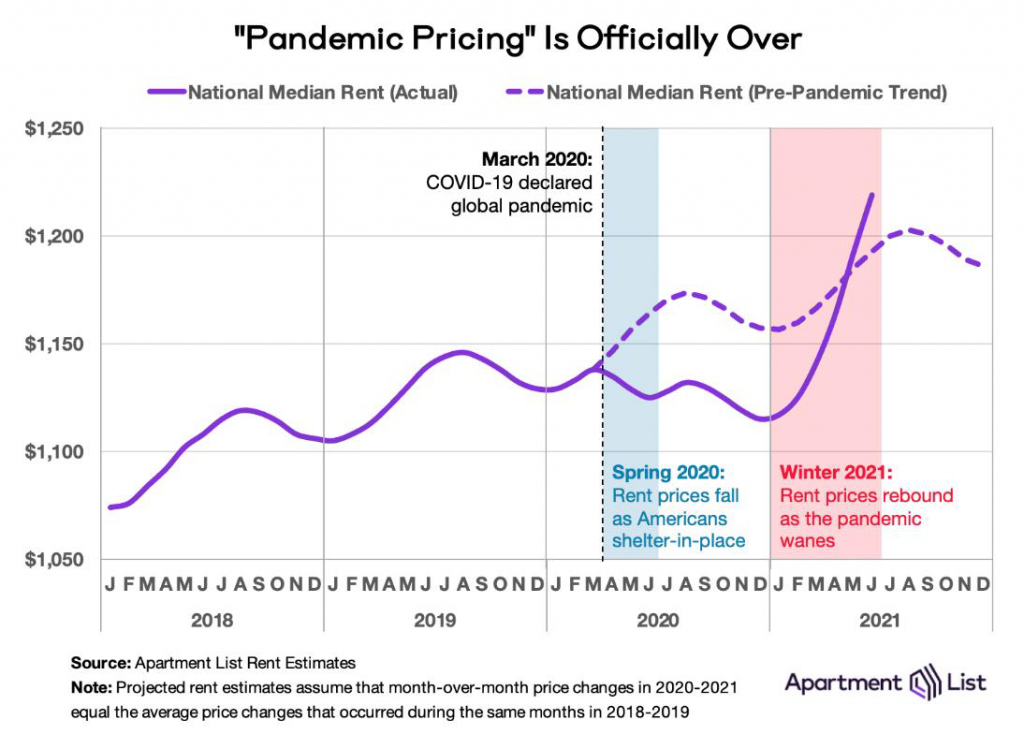

The Covid Economy Carves Deep Divide Between Haves and Have-Nots - WSJ

CSA - July 2019 by ensembleiq - Issuu

Lululemon Expenses International Society of Precision Agriculture

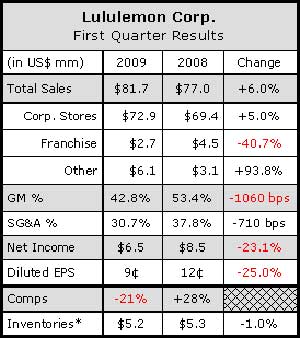

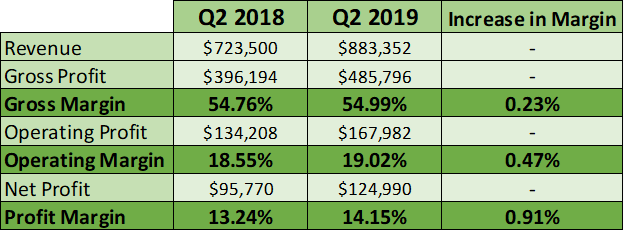

Lululemon Profits - FourWeekMBA

2022 Remake Fashion Accountability Report — Remake

Lululemon Expenses International Society of Precision Agriculture

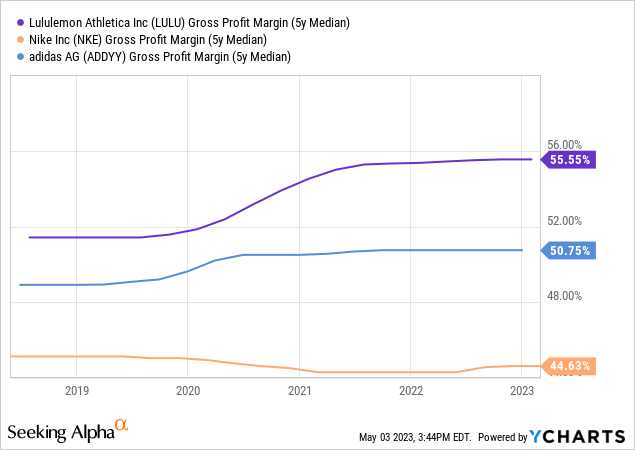

lululemon: gross profit worldwide 2010-2022

Clear Capital Clear Capital Admin

Lululemon Sales Revenue Online International Society of Precision Agriculture

Lululemon: A Closer Look At Financials, Growth Prospects, And Market Trends (LULU)

Lululemon: Growth Is Back To Pre-COVID Rates; However, Share Price Is Now 40% More Expensive (NASDAQ:LULU)

Morgan Stanley's Wilson Says Stock Risks Have Rarely Been Higher - BNN Bloomberg