Can you claim tax benefit for tax paid on insurance premium?, ET RISE MSME DAY

Section 80C and 80D of Income-tax Act entitles specified taxpayers to claim deductions for the entire amount paid to the insurance company for specified insurance schemes.

ITR Filing AY2023-24: Don't forget to claim these 5 deductions under old tax regime - ITR filing: Section 80C deductions

Income tax deduction: Salaried can claim up to Rs 75,000 tax deduction for paying health insurance premiums, how - Pay health insurance premiums, claim tax deductions

Health Insurance on EMI: Benefits Explained

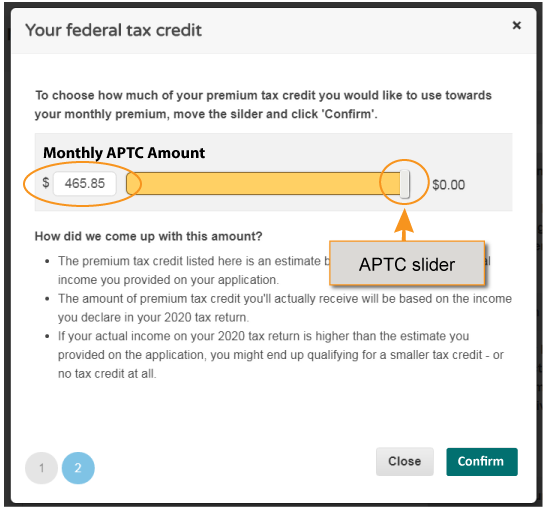

Adjust APTC / MNsure

Tax Harvesting: What is Tax Loss Harvesting & How does It Works

What To Do With Your Tax Refund in Canada [2024]

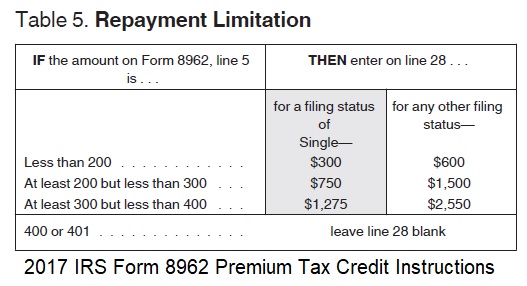

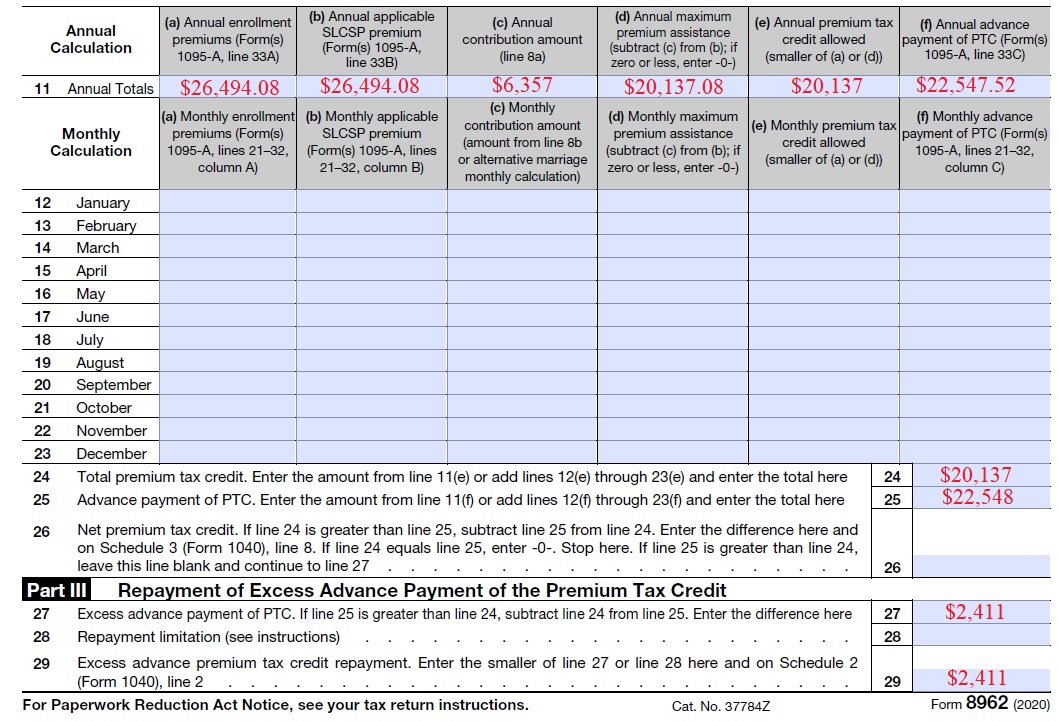

IRS limits on ACA Advance Premium Tax Credit repayment

Tax Credit or Repayment? Health Insurance Subsidies for 2022

Fortune India: Business News, Strategy, Finance and Corporate Insight

Are Your Insurance Premiums Tax Deductible? - Merit Insurance Brokers

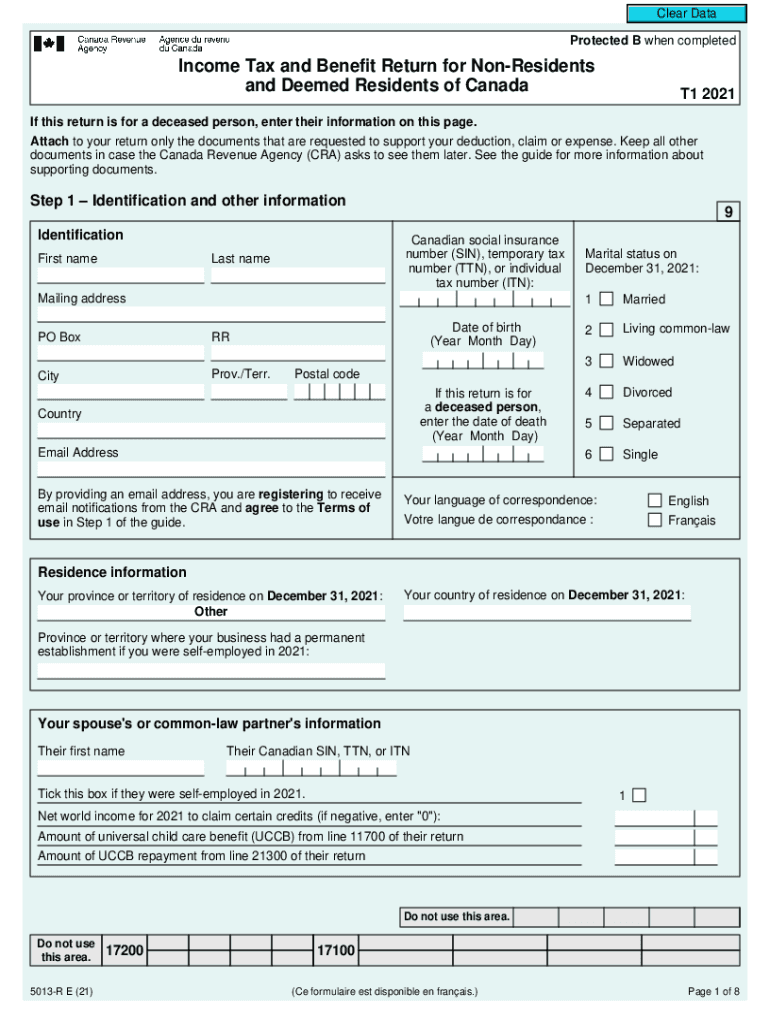

2021 Form Canada 5013-R Fill Online, Printable, Fillable, Blank - pdfFiller

MSME Registration Benefits - Tax and Others

IRS To Refund Excess Health Insurance Subsidy, Confirms 2020 Suspension