Dependent Life Insurance – What is it, and Should You Have it?

Dependent Life insurance provides employees with a lump sum of money in the tragic event that one of their covered dependents passes away.

Dependent Life insurance provides employees with a lump sum of money in the tragic event that one of their covered dependents passes away, providing peace of mind for employees.

We help working Canadians obtain, understand, and access benefits.

The difference between income protection and life insurance by kpartners - Issuu

How to Read and Understand Your Schedule of Benefits

What Is Dependent Life Insurance Coverage? Explained Simply

Guaranteed Issue Life Insurance Policies

Decoding the Puzzle: 4 Factors That Determine Your Life Insurance Coverage Needs

Voluntary Life Insurance And Voluntary Spouse Life Insurance

Dependent Life Insurance – What is it, and Should You Have it?

Michelle Singletary quote: Remember life insurance is intended as income replacement to help

Common Life Insurance Questions Department of Insurance, SC - Official Website

Associate Membership or Dependent Coverage: Determining What's Best For You — FEDmanager

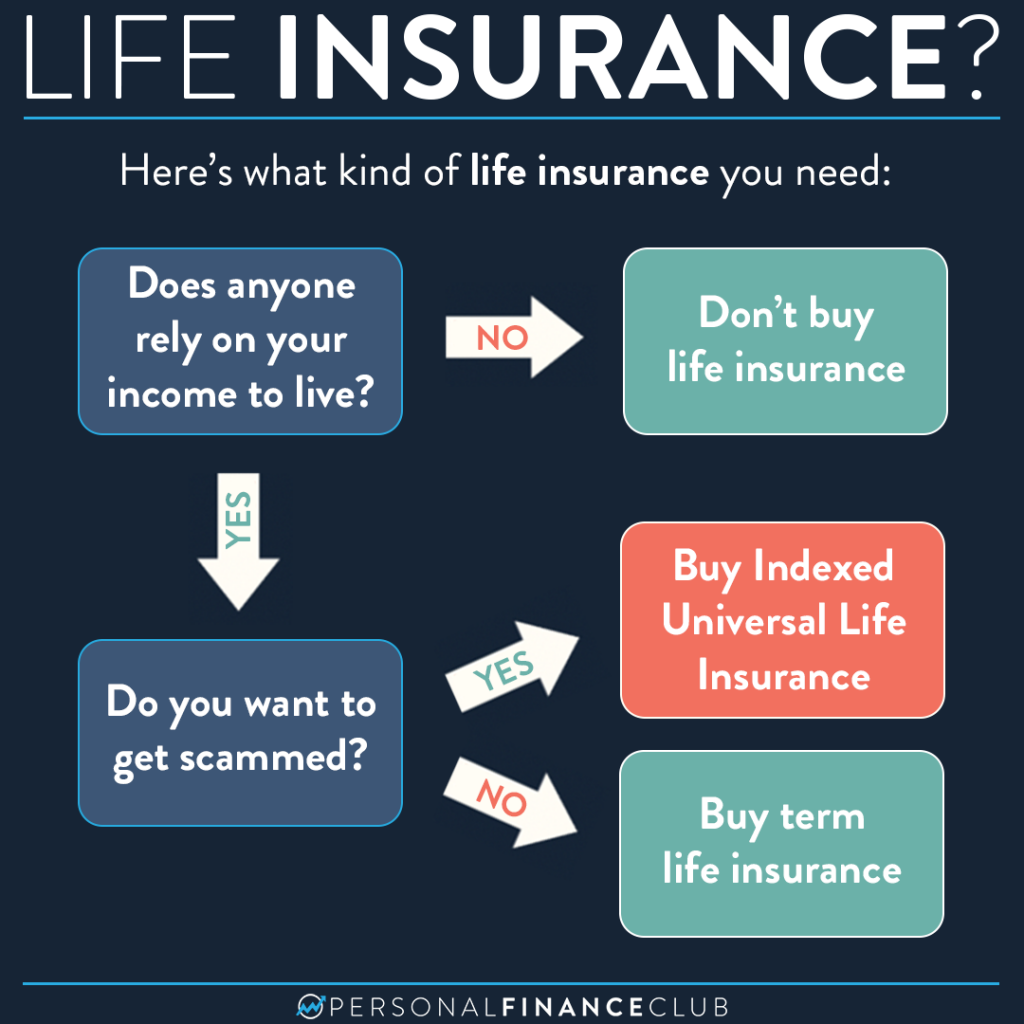

Here's what kind of life insurance you need – Personal Finance Club

Dependent Life Insurance - AutoNation