Calculate how much you would get from the expanded child tax credit - Washington Post

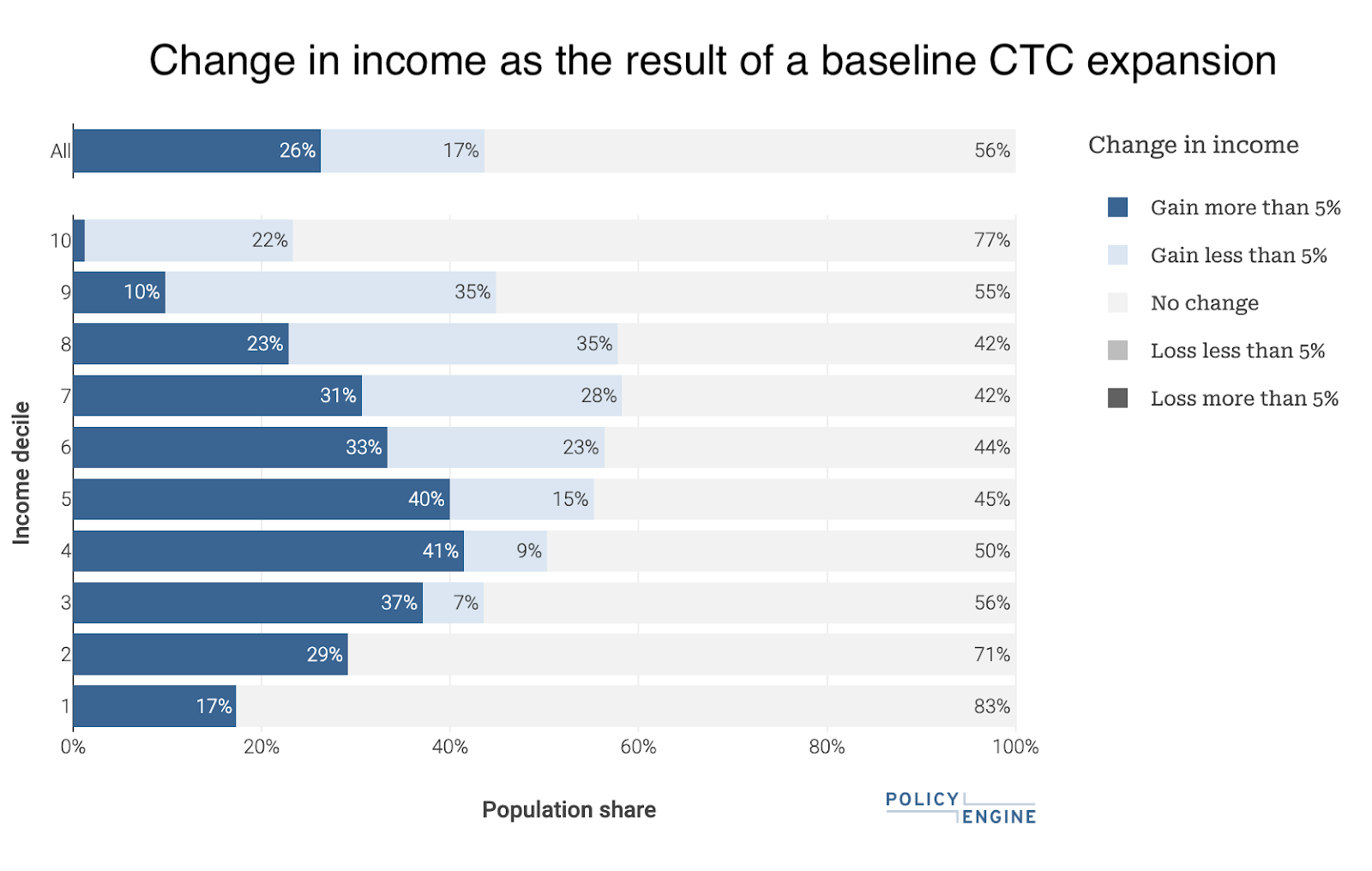

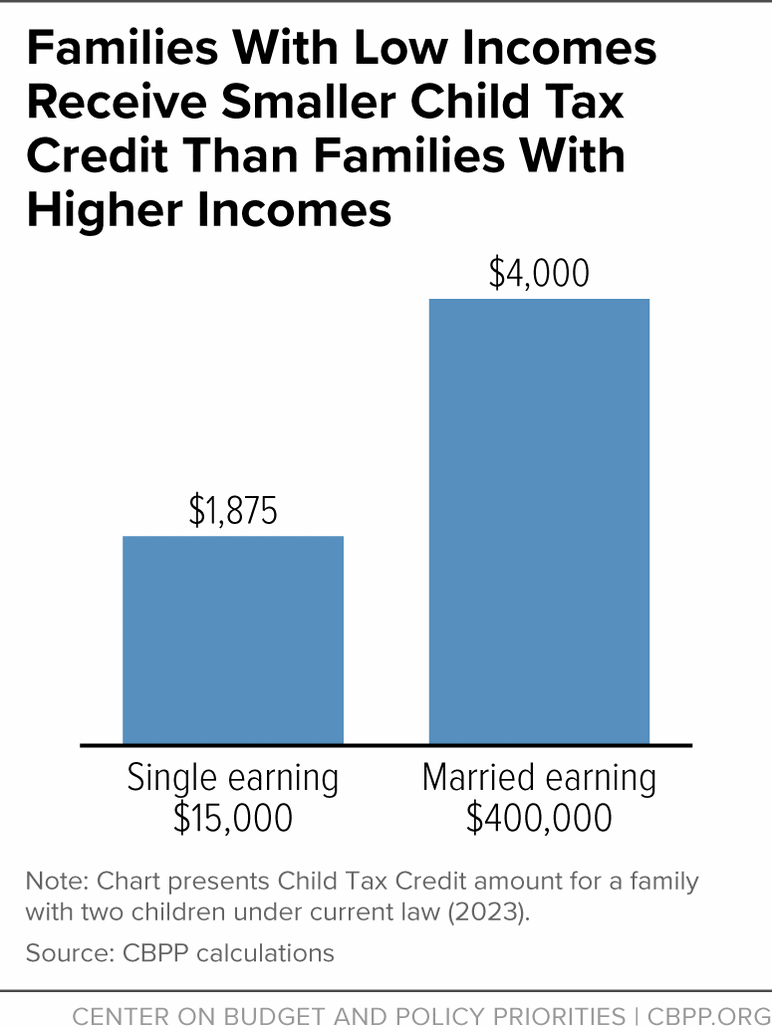

An expanded child tax credit would significantly increase the child tax credit for lower-income families with multiple children.

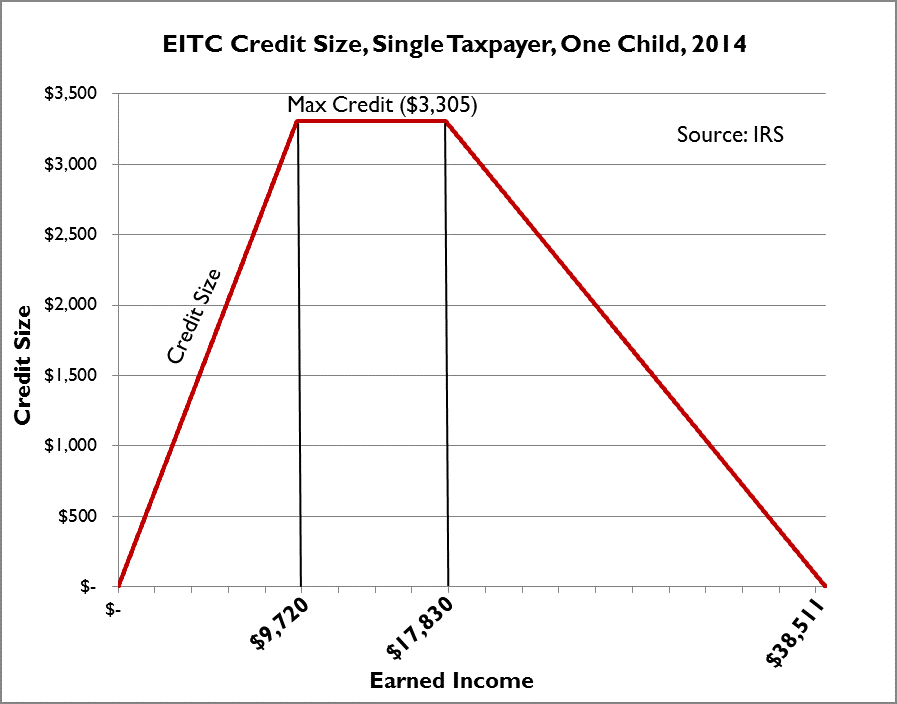

State Earned Income Tax Credits

The House has restored the child tax credit. Here's how it would work. - Route Fifty

House passes $79 billion bill to enhance child tax credit

Building a stronger foundation for American families: Options for Child Tax Credit reform - Niskanen Center

Child Tax Credit

Why Biden's Expanded Child Tax Credit Isn't More Popular - The New York Times

Benefits of Expanding Child Tax Credit Outweigh Small Employment Effects

Opinion A eulogy for Biden's expanded child tax credit. Maybe. - The Washington Post

Overview of the Earned Income Tax Credit on EITC Awareness Day

Child tax credit passes House: How much could you get this year?

Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut Child Poverty

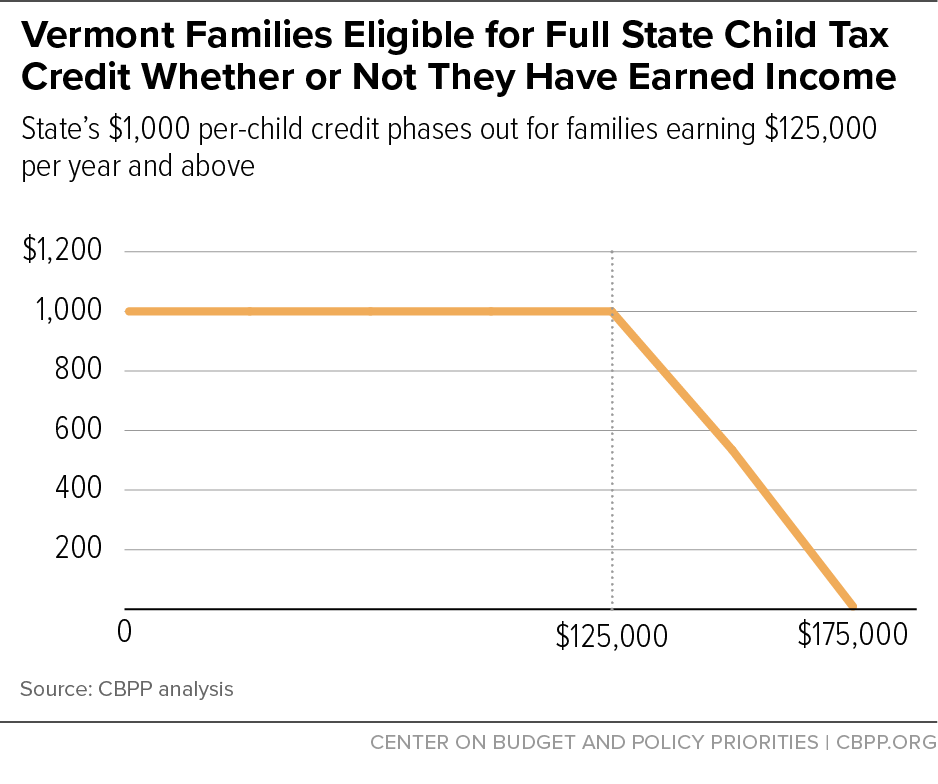

States Can Enact or Expand Child Tax Credits and Earned Income Tax Credits to Build Equitable, Inclusive Communities and Economies

Opinion The expanded child tax credit should be reinstated - The Washington Post

What is the child tax credit?

Child tax credit ending will push 10 million kids back into poverty