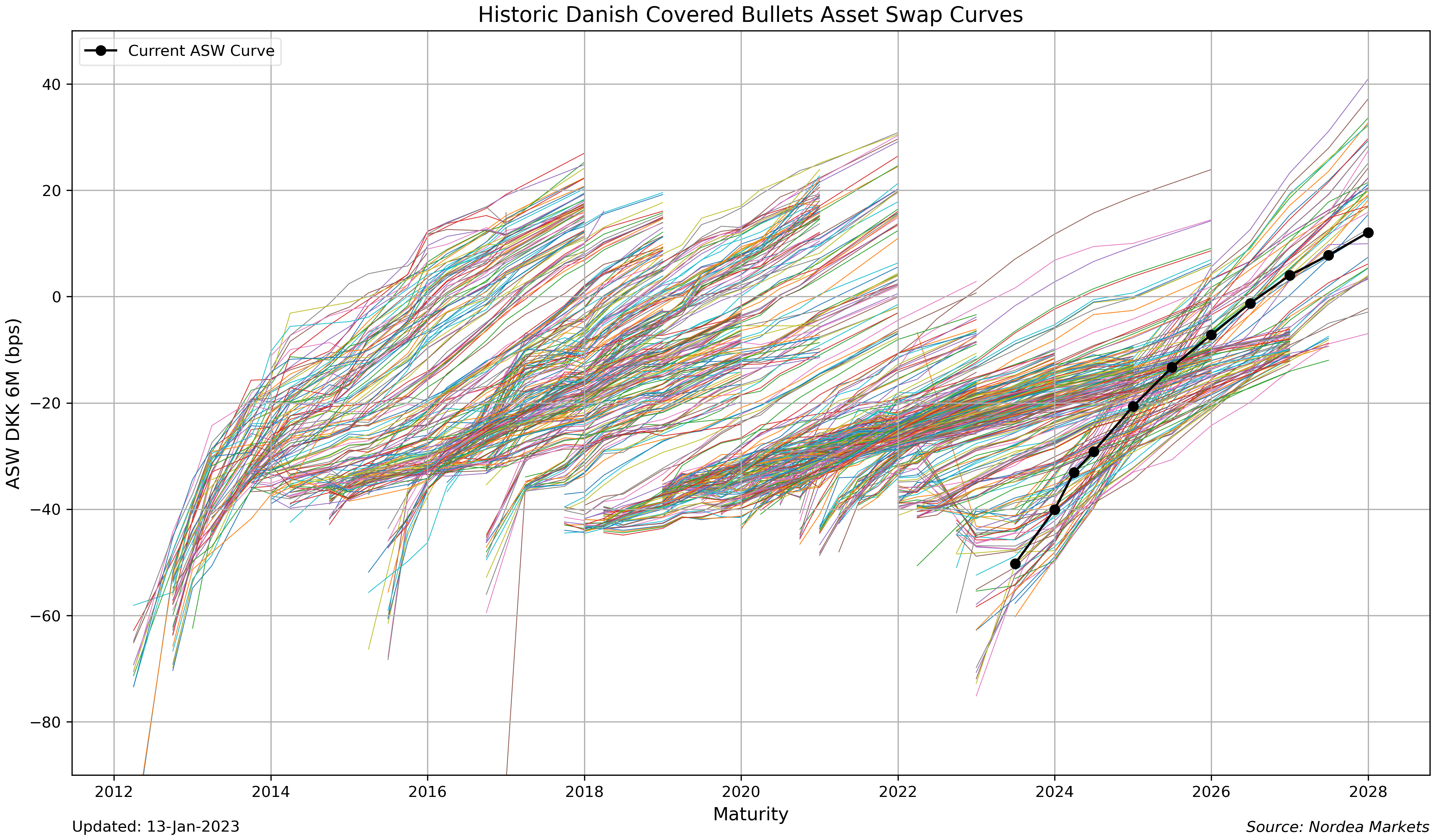

How to calculate carry and roll-down (for a bond future's asset swap) –

Bobl spread is 53.1bp, we are 3 months away from mar18 delivery, and a client blasts “what do you see as carry and roll for OE asw?”. Here are my notes on the mechanics of the calculati…

Cross-asset carry: an introduction

Cross-asset carry: an introduction

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

Credit Derivatives core concepts and glossary

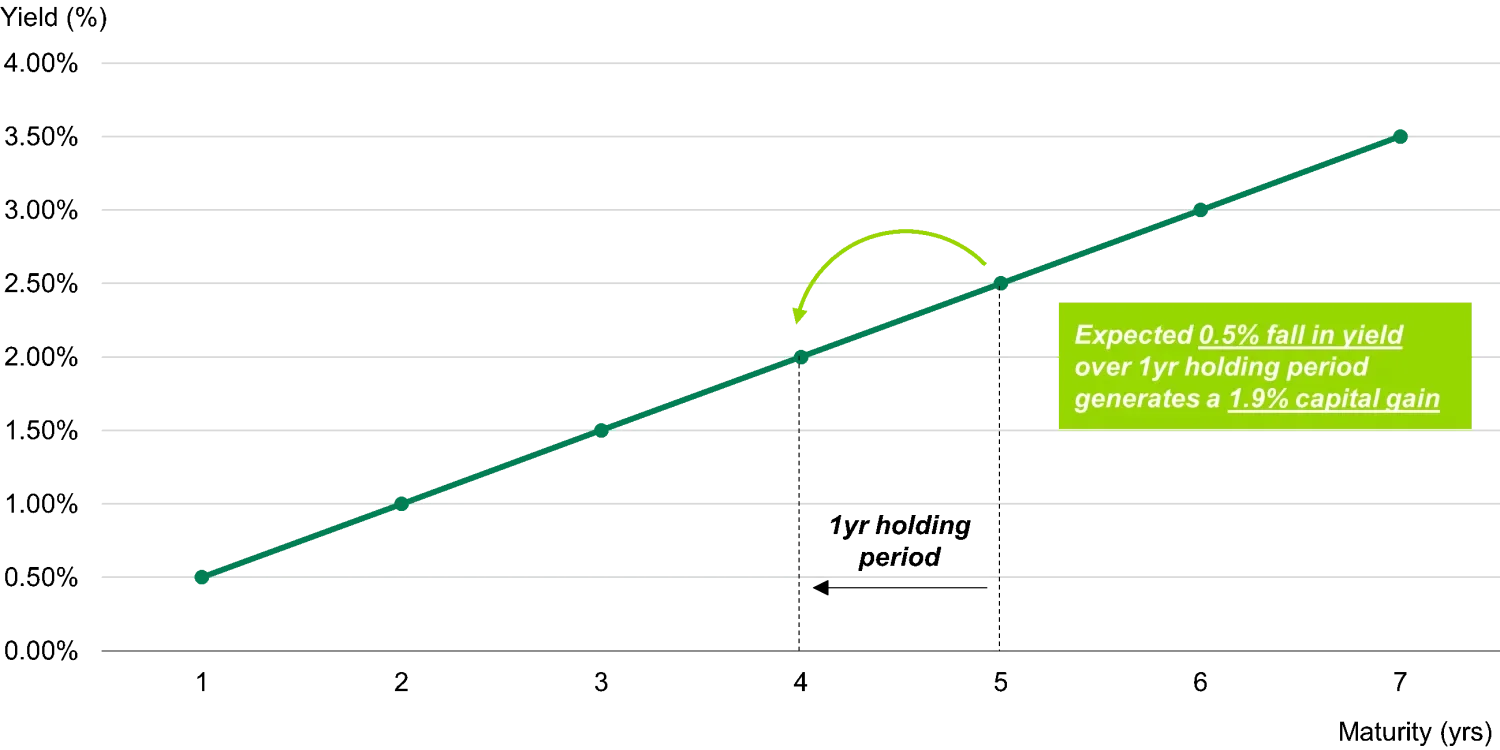

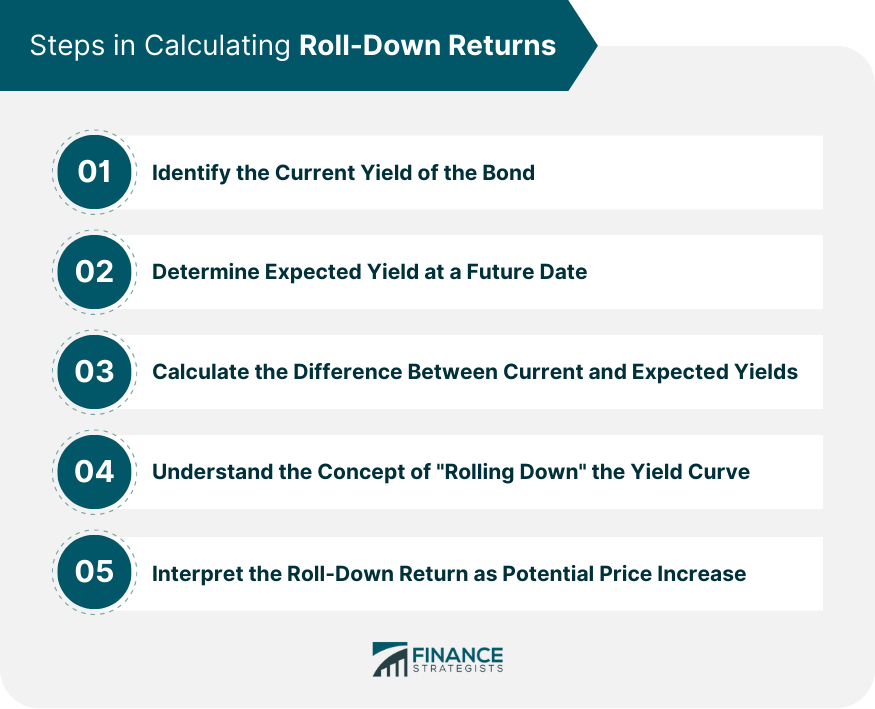

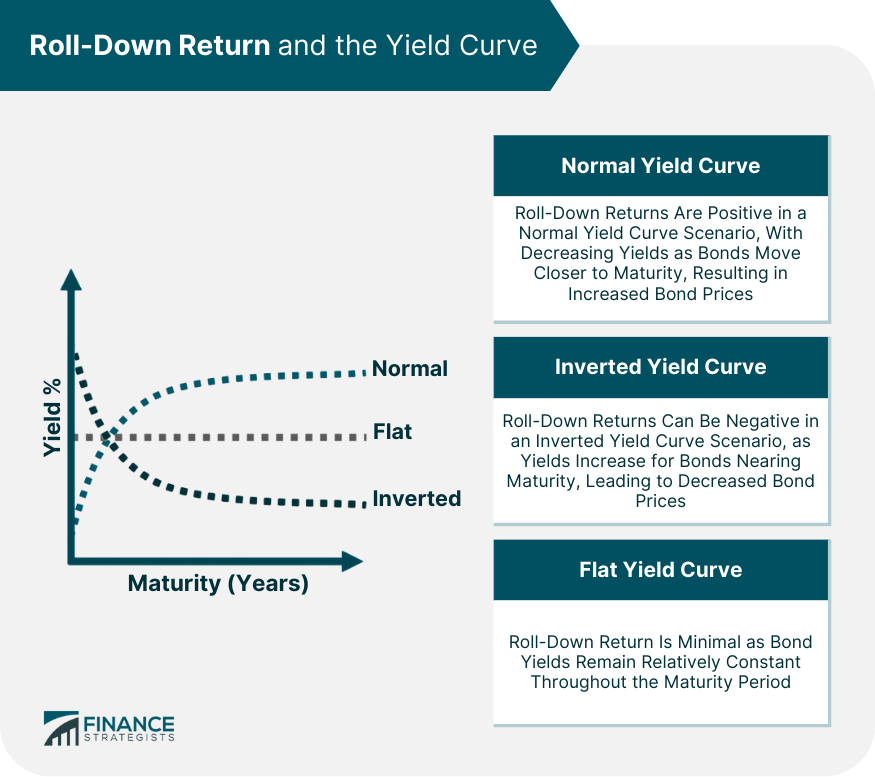

Roll-Down Return Definition, Elements, Calculation, Applications

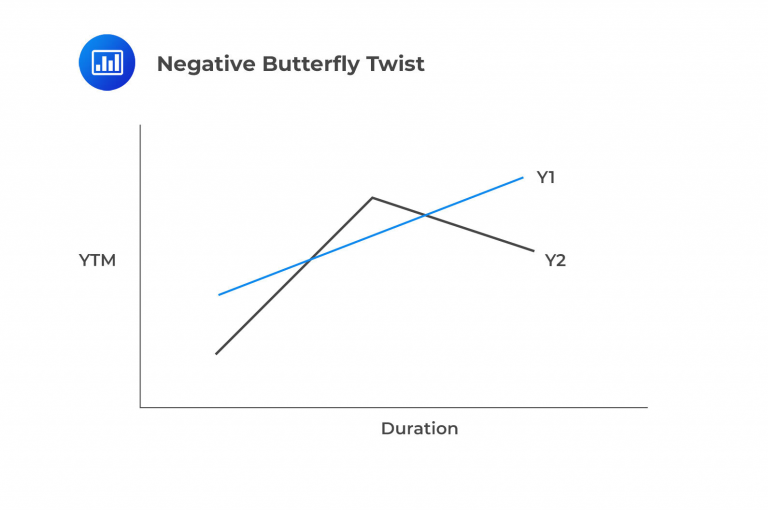

Yield Curve Strategies - CFA, FRM, and Actuarial Exams Study Notes

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

Carry and Roll-Down on a Yield Curve using R code

A Bond Convexity Primer CFA Institute Enterprising Investor

Roll-Down Return Definition, Elements, Calculation, Applications

fixed income - Determine the carry of a treasury bond futures contract? - Quantitative Finance Stack Exchange

Bonds & bold: When is roll a good predictor of future returns?