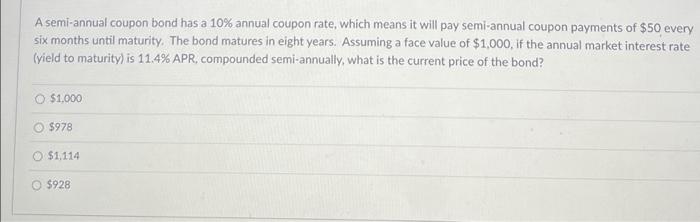

Solved A semi-annual coupon bond has a 10% annual coupon

Chapter 9: Bond Valuation » STUDY NOTES NEPAL

BKMPR Chapter 12 Posted Solutions, PDF, Bonds (Finance)

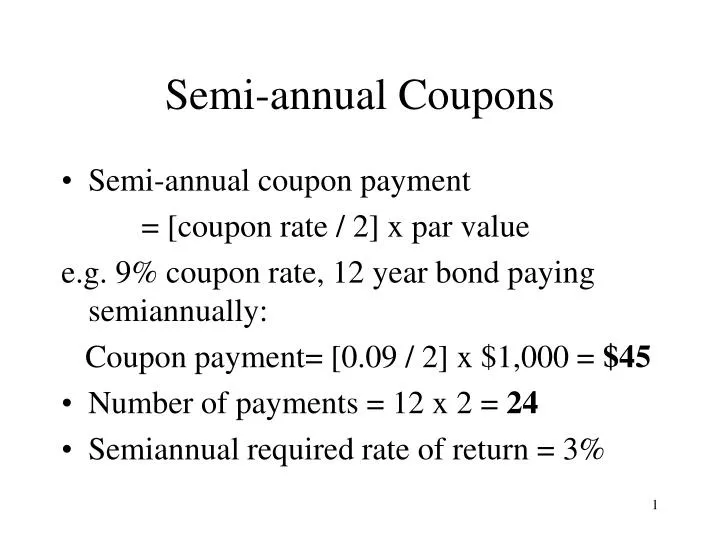

PPT - CHAPTER 7 Bonds Valuation PowerPoint Presentation, free download - ID:3817779

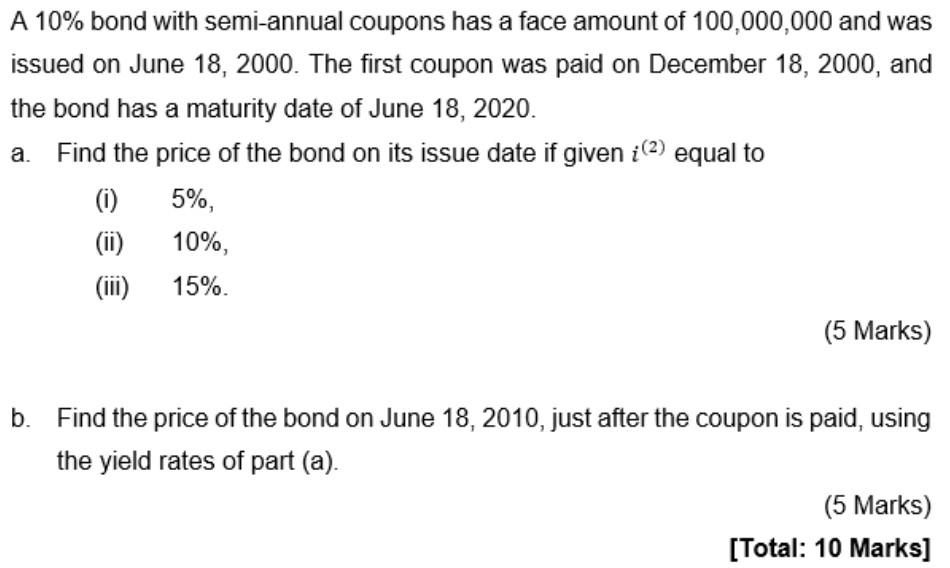

Solved A 10% bond with semi-annual coupons has a face amount

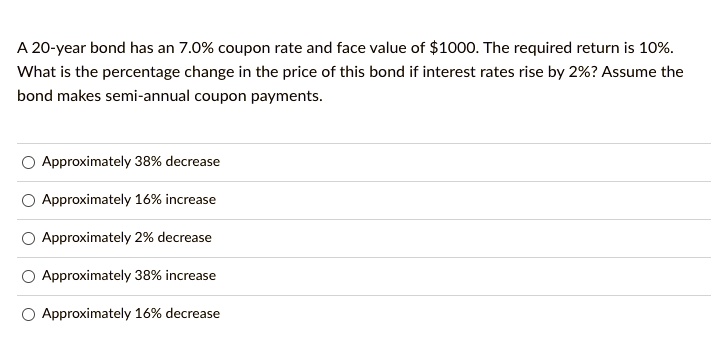

SOLVED: A 20-year bond has a 7.0% coupon rate and a face value of $1000. The required return is 10%. What is the percentage change in the price of this bond if

Modified Duration - Zero Coupon Bond Modified Duration Formula

How to calculate the semi annual coupon of a bond with a maturity of five years that's priced to yield 8%, has a par value of $1,000, and has a face value

Which of the following $1000 face value bonds has a 10% yield, assuming semiannual coupon payment of 8% A. A 5-year maturity bond selling for 964.54 B. A 10-year maturity bond selling

What is the duration of a two-year bond that pays an annual coupon of 12 percent and has a current yield to maturity of 14 percent? Use $1,000 as the face value. (

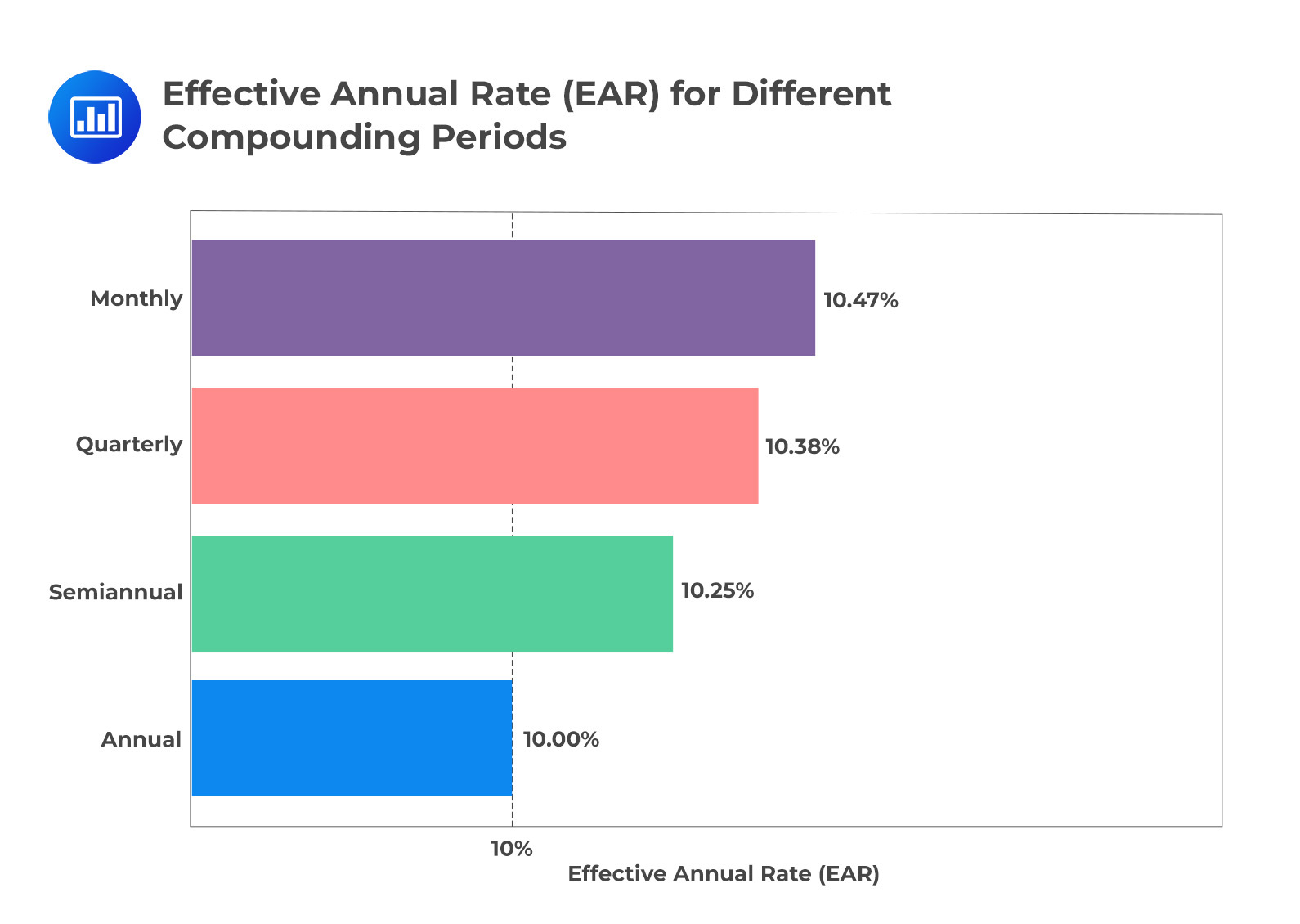

Annual Bond Yield: Different Compounding Periods - AnalystPrep

Coupon Rate Formula + Calculator

Finding the Coupon Rate of a Bond [FINANCIAL CALCULATOR]

FIN TEST 2 Review - Professor: Peter Trager - CH 7 – BONDS Find interest, find total interest : - - Studocu

Chapter 5 Model, PDF, Bonds (Finance)

Coupon Bond Formula Examples with Excel Template