Building the Case: Low-Income Housing Tax Credits and Health

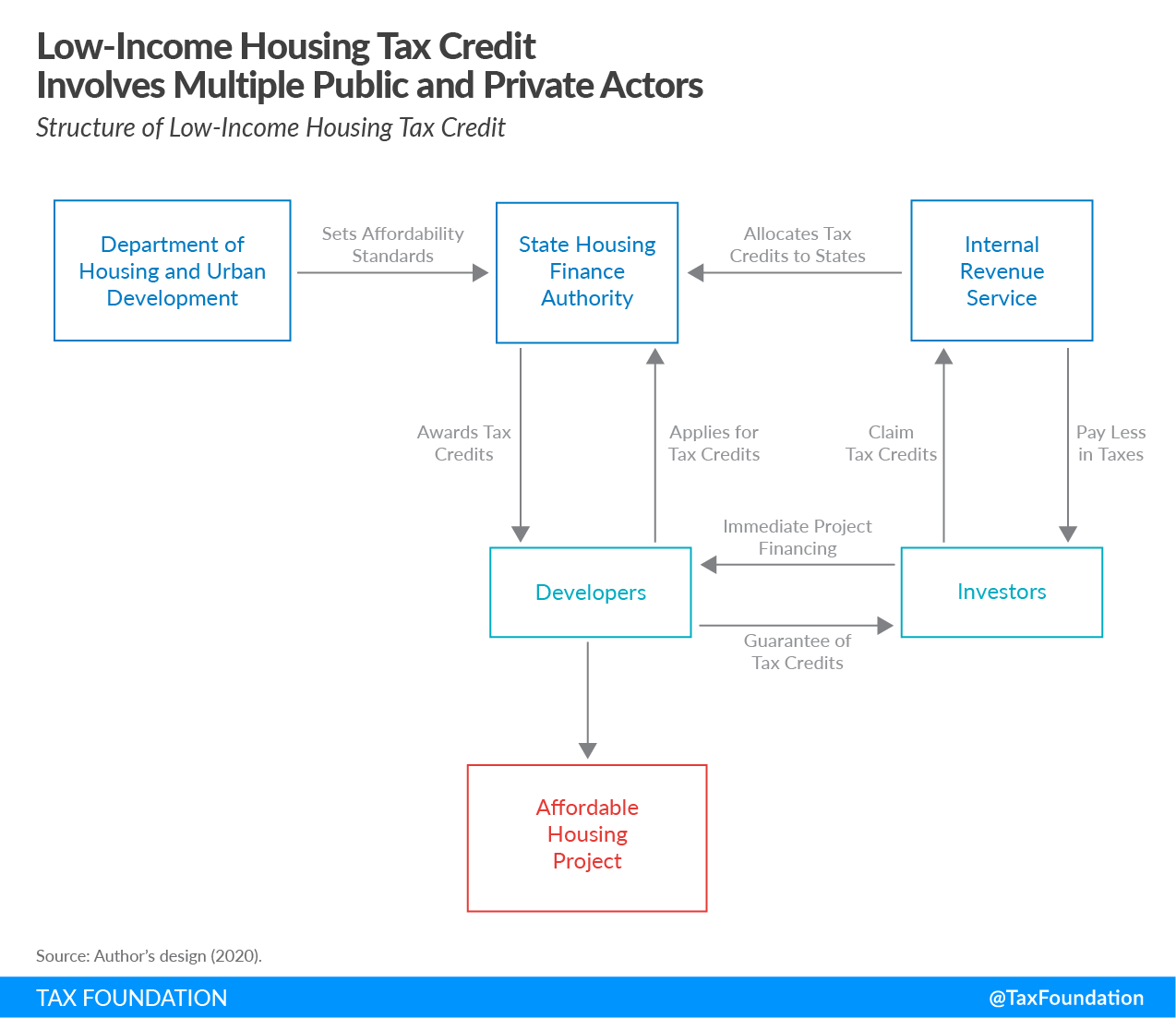

The Low-Income Housing Tax Credit (LIHTC) provides tax credits to private investors to support the development of affordable, multifamily housing. Since its inception, the…

PDF) Building Affordable Rental Housing in Unaffordable Cities: A

Building Affordable Rental Housing in Unaffordable Cities: A

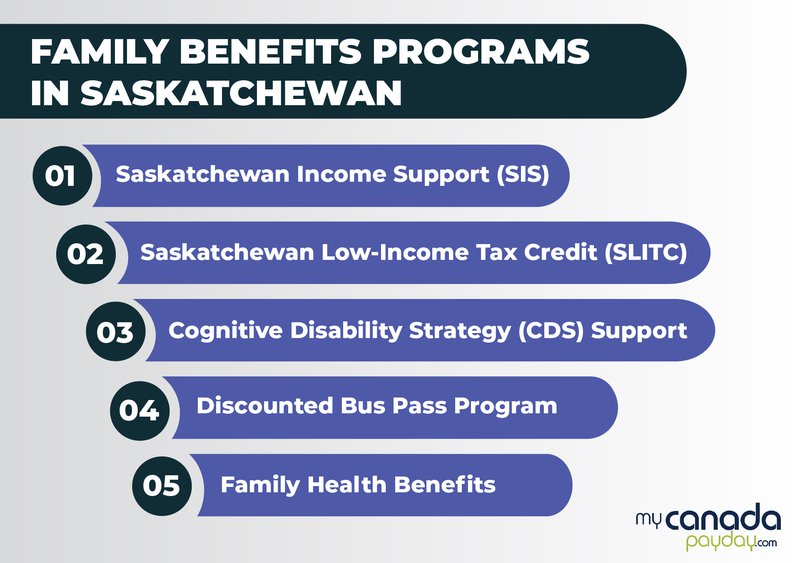

Family Benefits in Saskatchewan

Annual property tax - Province of British Columbia

A Blueprint to Decarbonize Affordable Housing - RMI

Understanding and Addressing Racial and Ethnic Disparities In Housing

Building the Case: Low-Income Housing Tax Credits and Health - TAAHP - Texas Affiliation of Affordable Housing Providers %

Low-Income Housing Tax Credit (LIHTC): Details & Analysis

The Link Between Affordable Housing and Economic Mobility

Exploring Tax Policy to Advance Population Health, Health Equity, and Economic Prosperity: Proceedings of a Workshop - in Brief

JSTOR Global Publichealth-Offer-complimentary 2022-01-24, PDF, World Health Organization

Low-Income Housing Tax Credit, Housing Program

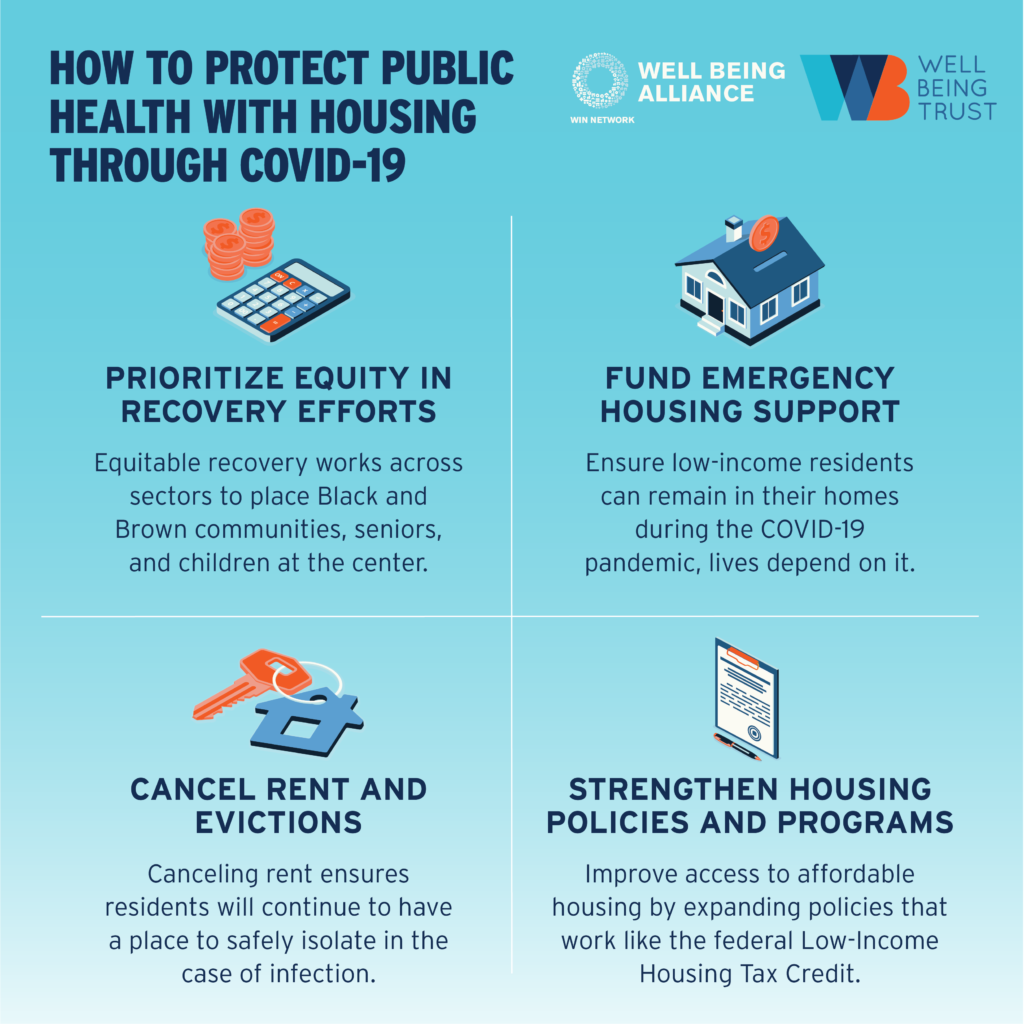

Solutions to Ensure Housing Access Amidst and After a Pandemic: We