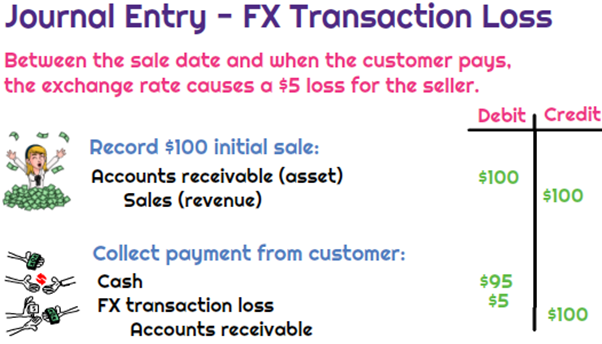

What is the journal entry to record a foreign exchange transaction

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Currency Translation Adjustments

Foreign Exchange Gains or Losses in the Financial Statements – dReport in English

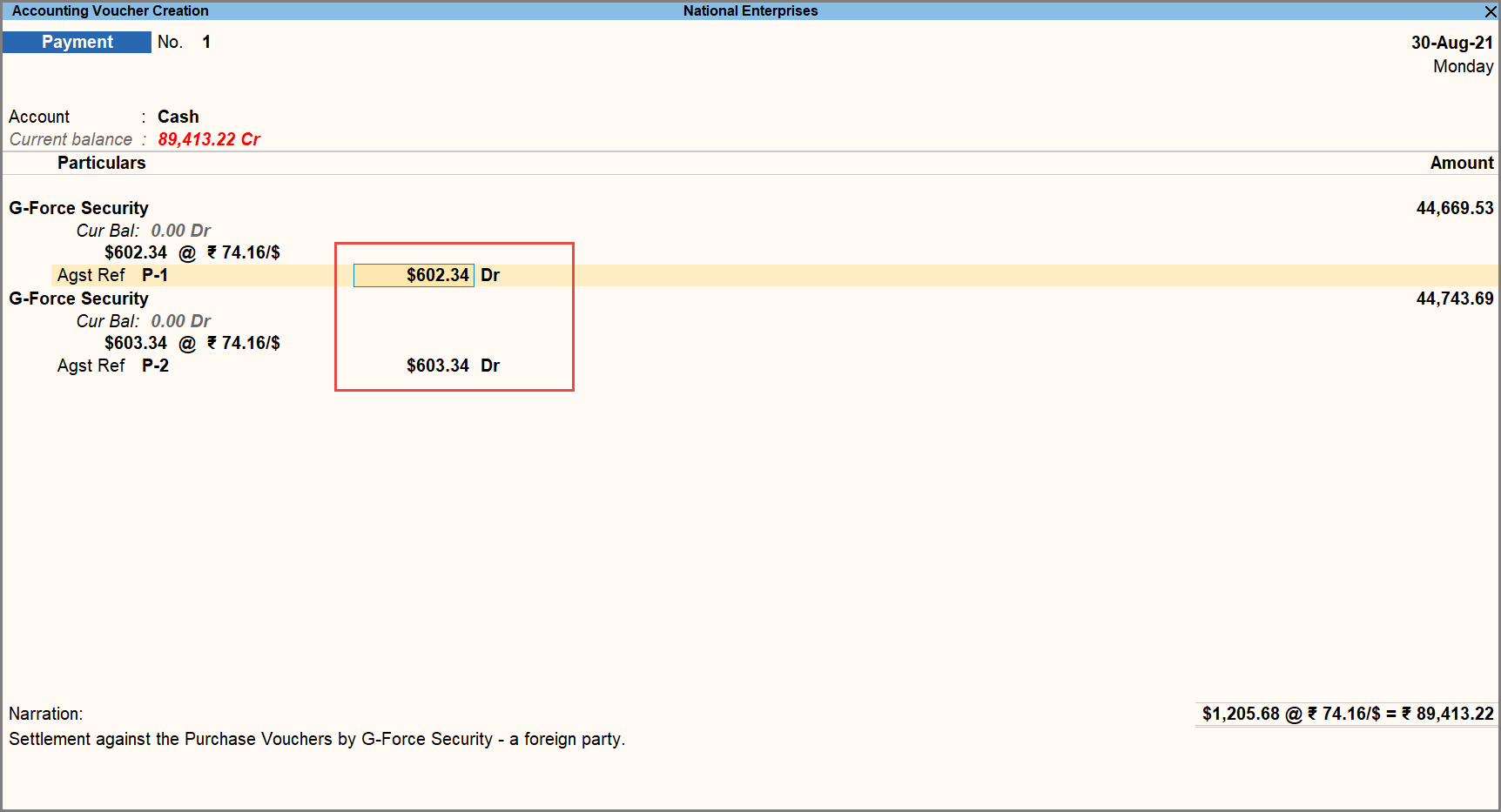

Currency in TallyPrime - FAQ

Accounting Journal Entries for Foreign Exchange Gains and Losses

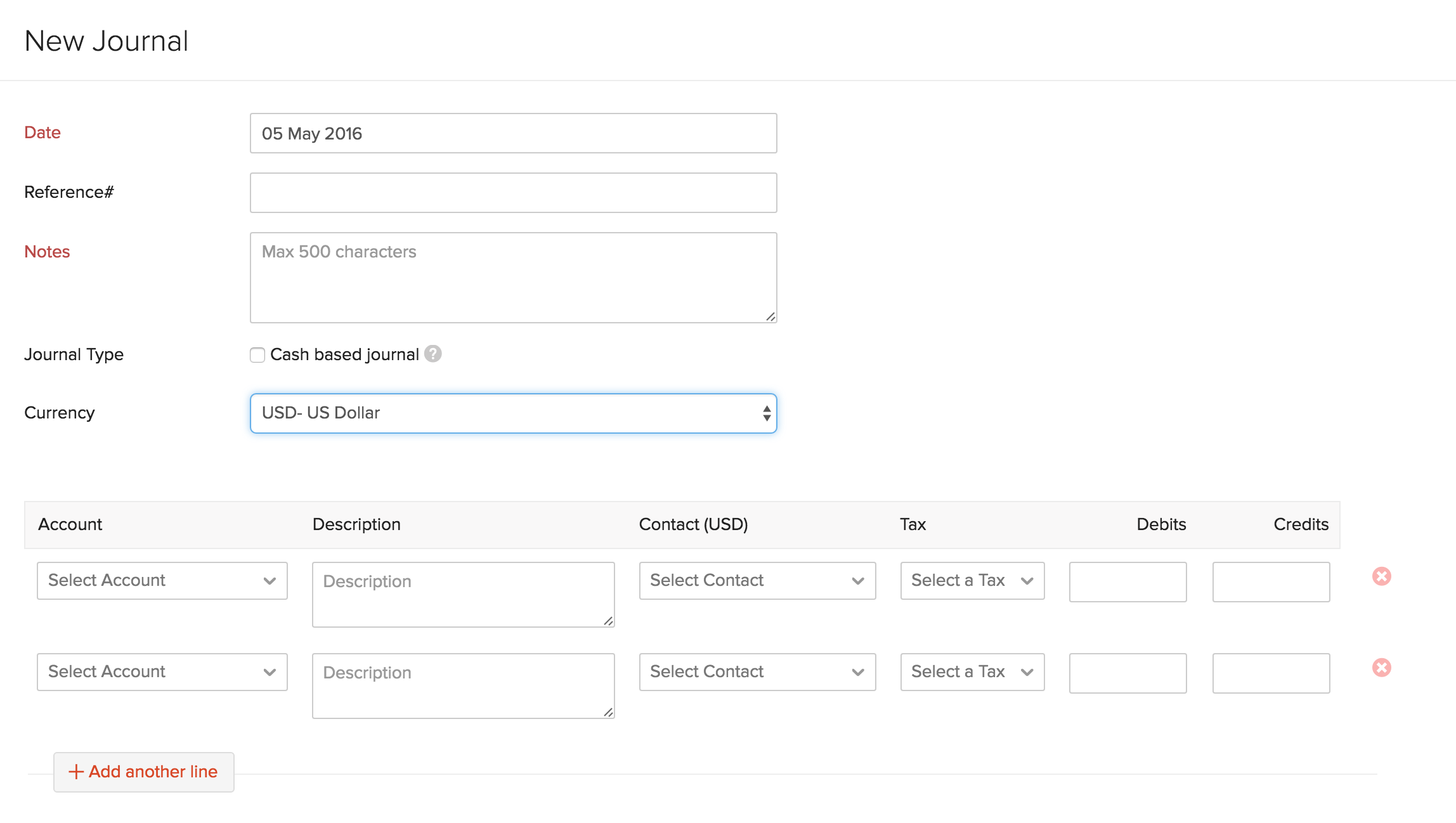

Manual Journals, Help

Foreign Exchange Gain/Loss - Overview, Recording, Example

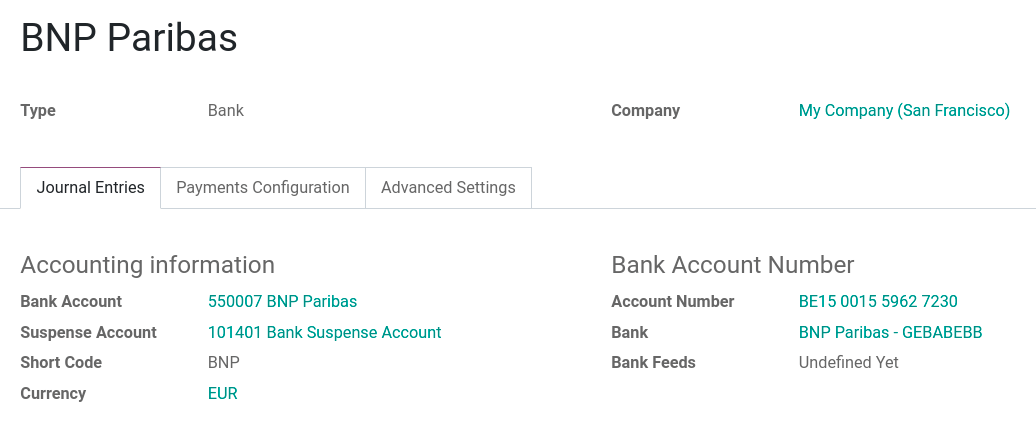

Manage a bank account in a foreign currency — Odoo 17.0 documentation

How do I record a US$ or other foreign currency transaction? — Young Associates

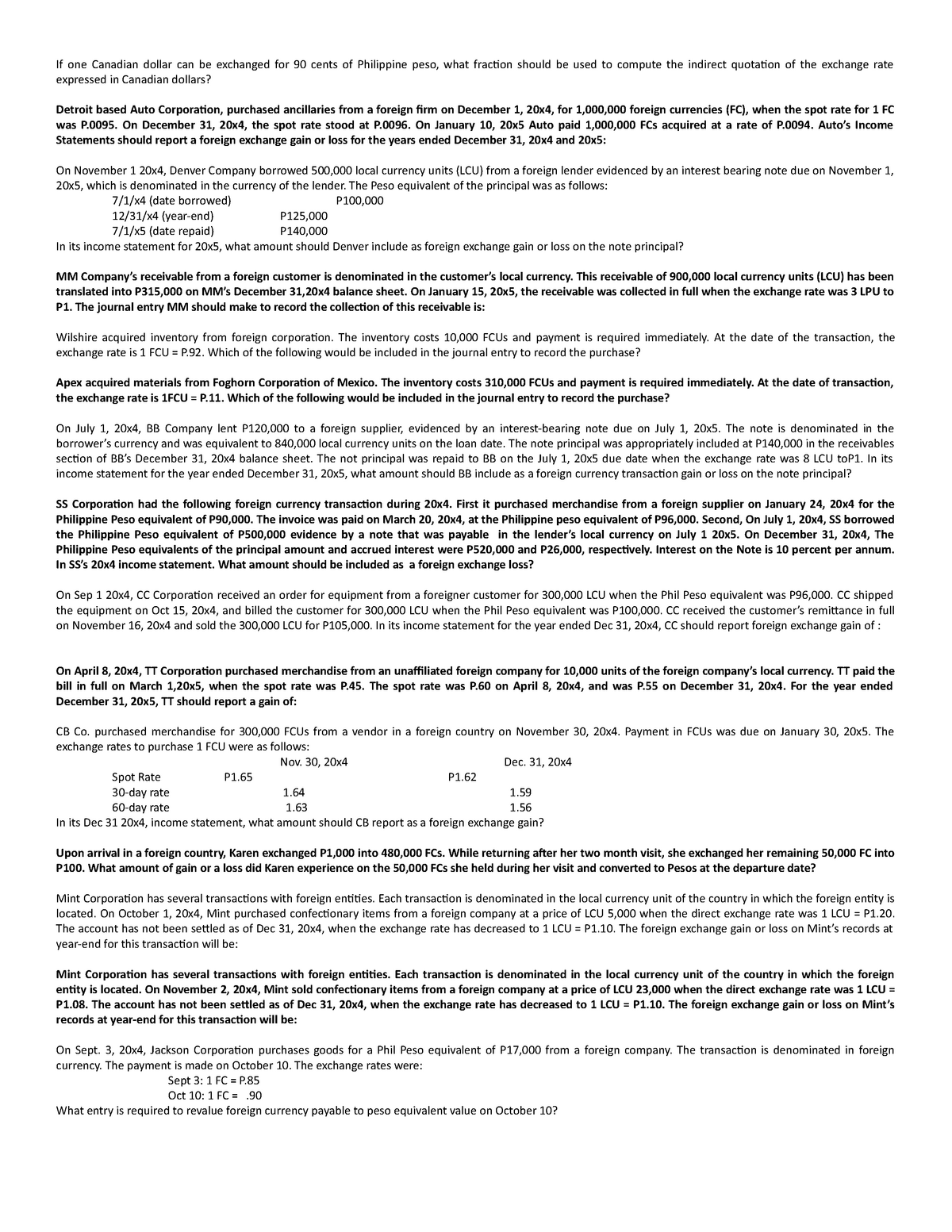

255789126 Advance Acctg Foreign Currency Problems - If one Canadian dollar can be exchanged for 90 - Studocu

Simple Example for understanding Realized Forex Ga - SAP Community

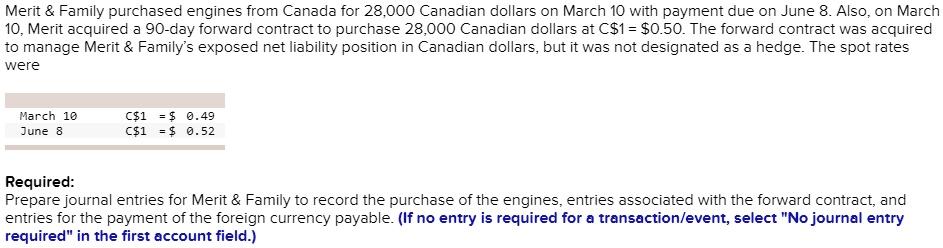

SOLVED: Record the foreign purchase of the engines. Record the entry for the 90-day forward exchange contract signed to receive Canadian dollars. Record the entry to revalue the foreign currency receivable to

Accounting Journal Entries for Foreign Exchange Gains and Losses Foreign exchange gain or loss accounting example Foreign exchange fluctuation is a difference between rate of currency at the time of sale (

Double Entry Bookkeeping

Foreign Currency Transaction w/ Journal Entries (FAR MCQ)

What is the journal entry to record a foreign exchange transaction loss? - Universal CPA Review